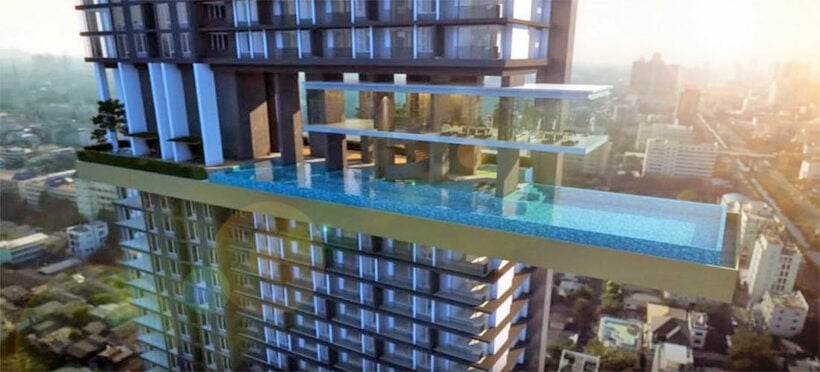

Bangkok has a surplus of 100,000 new condos as Chinese buyers stay home

Bangkok’s condominium market is facing its biggest challenge in decades with one of its key feeder markets sitting it out at home. The capital’s soaring condo market, once a favourite for Chinese investors, looks towards a bleak year with Chinese investors having other things to worry about, or simply unable to travel to Thailand, due to coronavirus fears.

Bloomberg economists predict that foreigners could account for as little as 10% of purchases this year. That’s down from 20% two years ago. The Agency for Real Estate Affairs estimates. Chinese buyers used to provide the largest proportion of overseas interest but are now limited in their travel options and the economic havoc inside their own country.

Sopon Pornchokchai, the president of Agency for Real Estate Affairs, says there is 100,000 vacant completed condominiums in and around Bangkok.

“The demand from foreigners may disappear in the first half following the outbreak. We’ll need to rely on local buyers, but that won’t be easy.”

“Thailand’s 55 member Property Development Index has tumbled about 19% in the past 12 months, worse than the 9% slide in the overall Thai stock market.”

Meanwhile, the Bank of Thailand is loosening the purse strings and mortgage-lending rules in a hope of encouraging domestic purchases. But local developers say that, even before the coronavirus outbreak, foreign interest was flagging as the “outlook for an economy reliant on trade and tourism deteriorated amid currency strength in 2019 and the US-China trade war”.

FazWaz.com CEO Brennan Campbell says that, with Chinese buyers staying home for now, there are some great opportunities for buyers to get creative with developers and come up with options, in the buyers favour.

“Many developers are wanting to move stock and it’s clearly a great time to push them into sharpening their pencils and throw in extras to get you into a new condominium. There’s never been a better selection of brand new condos and Bangkok continues to grow as a regional business capital.”

Many developers are also rolling out new strategies as some newly-built projects have sold less than 50% of available brand new units. In one case a developer is offering enticing direct rentals as a way for tenants to get into a shiny new condo apartment at a lower-than-usual price.

LPN condominiums that offer this strategy include Lumpini Township Rangsit-Klong 1 (2,700 units), Lumpini Place Rama 3 Riverine (100 units), and Lumpini Park Phahon 32 (100 units), or the total of 2,900 units worth 2 billion baht.

Another Bangkok developer, Supalai, has also unveiled Supalai Smart Solution, which offers a 30 year lease as an alternative to buying freehold, with the price 35-40% lower than purchasing the units. Buyers can pay 20-40 installments to Supalai with 0% interest within the period of 60 months.

But developers Land & Houses don’t plan to open any new condo projects this year. And another developer, Singha Estate, is “very cautious” about buying land for residential offerings because of concerns about an oversupply of property in certain locations.

The real estate sector slowdown is among the many challenges ahead for Thailand’s economy in 2020. GDP growth may slow to as little as 1.5% this year, a six-year low, according to a government agency last week.

Developers are expected to only bring an additional 6,000 newly completed condos to the Bangkok market between January and the end of March 2020. That’s down 40% from a year earlier, according to Phattarachai Taweewong, associate director of Colliers International Group’s Thai unit.

SOURCE: Bloomberg

Latest Thailand News

Follow The Thaiger on Google News: