Kasikornbank: Verify SIM card name by April 30

Kasikornbank has announced that mobile banking customers need to ensure their registered name matches their mobile SIM card name by April 30. The bank outlined two conditions for this requirement. Customers who have not been contacted need not take any action.

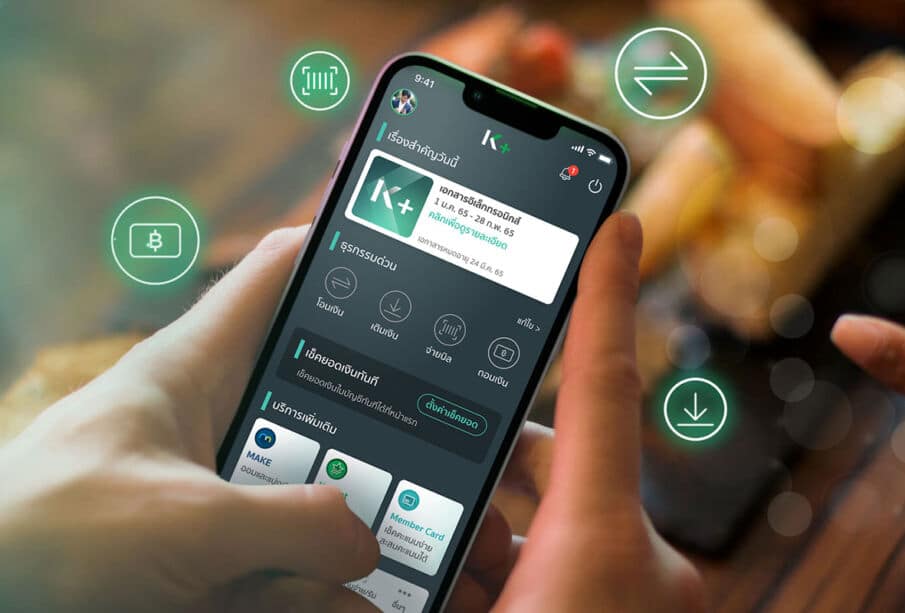

Kasikornbank communicated through its Facebook page, KBank Live, regarding a measure to enhance mobile banking security. This initiative requires the user name to match the mobile SIM card holder’s name. Customers utilising K PLUS, LINE BK, or MAKE by KBank and meeting the criteria will receive instructions through these platforms starting from February 17.

The customer group required to act by April 30 comprises those who began using mobile banking services from 2022 onward and fall into one of two categories. The first category includes users of K PLUS, LINE BK, or MAKE by KBank who have a mobile number without a verifiable SIM card holder’s name. The second involves foreign customers whose mobile phone number’s SIM card name does not match the user name on K PLUS, LINE BK, or MAKE by KBank.

Customers fitting these descriptions will receive guidance via K PLUS, LINE BK, or MAKE by KBank from February 17 onward. Those who do not receive any notification are not required to take any action. This directive aims to ensure greater security and compliance for all mobile banking users, reported KhaoSod.

In similar news, Thai telecom heavyweight True Corporation has firmly denied allegations of supplying SIM cards in bulk to call centre gangs, following a dramatic police raid in Bangkok.

The raid, carried out on December 20, targeted a condo on Rama IX Road in Huay Kwang, uncovering a staggering cache of criminal tech: 286 SIM boxes, over 300,000 SIM cards, 636 smartphones, and 100 computers. Six Chinese nationals were arrested in connection with the illicit operation.

SIM card fraud in Thailand involves criminals using fake identities or stolen data to register SIM cards for scams, financial fraud, and identity theft. Common schemes include phishing, OTP interception, and unauthorised transactions. Police have cracked down on illegal SIM card sales and strengthened registration regulations to curb fraud.

Latest Thailand News

Follow The Thaiger on Google News: