WTF – “What The Future Holds” Event Summary

PHUKET: Professor Steve Keen is often quoted as saying that the only people who believe they can see the future are fortune tellers, economists and God, and that, while he’s sceptical about fortune tellers, he knows for a fact that economists are deluding themselves, often with appalling consequences.

Managing clients’ hard-earned assets shouldn’t be based on an individual assumption of what the future might hold because, unless God decides to set up an asset management company, no single view is able to predict the future with certainty.

Therefore investment management starts with risk management – how much volatility is an investor willing to stomach? To how great a loss, from the top of a market to the very bottom, are clients prepared to expose themselves? Once we know that, we can start the process of building bespoke portfolios tailored to each client to reflect the optimum blend of assets – the ones that in the very worst imaginable scenarios will perform within that client’s own tolerances but which in the reasonably expected outcomes will deliver the highest returns that the risk constraints allow.

There are no good stocks or bad stocks, or good asset classes or bad asset classes, merely an optimal blend of assets for each client that won’t exceed that investor’s worry threshold. The returns that are generated are an output that reflects that blend within the capital market conditions that then prevail – they can’t be controlled but risk can and should. This approach has driven our success over the years, helping our clients to achieve positive returns in difficult years like 2008 and outperform over the cycle.

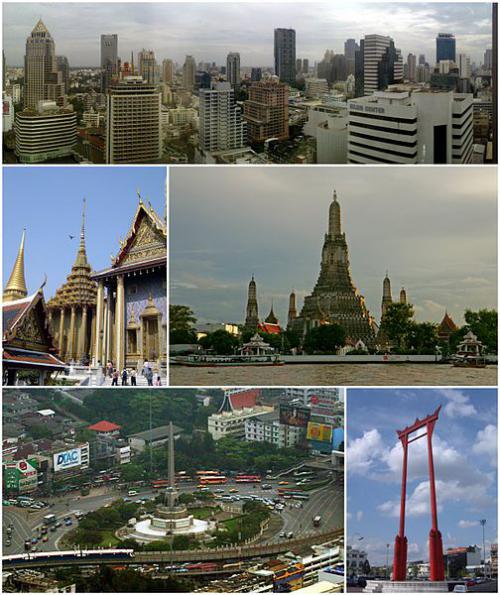

When asked at the “What The Future Holds” event in Bangkok this week about how to invest in the current economic climate, Steve Keen advised that academics don’t have huge pots of money to manage; best-selling author Richard Duncan favoured agricultural land (such as in his native Kentucky) along with US residential property. MBMG AM CIO, Paul Gambles recommended a highly diversified portfolio, constructed around individual risk appetite and at most risk levels holding a significant proportion of cash, managed to squeeze every ounce of yield out of it, poised and ready for what could be the greatest opportunities of a lifetime, along with cautious allocations to non-US listed global stocks and to judicious property exposure. Although valuations are high, he favoured Southeast Asia over developed markets but cautioned that a much stronger US Dollar is “almost inevitable” at some stage, although it’s hard to be certain as to when, making patience one of the key components to any portfolio right now.

The event focused significantly on the US economy and US capital markets simply because America is home to the world’s largest economy, main capital markets and greatest financial experiment in history – namely the stimulus policies aggressively pursued by the Federal Reserve and Treasury Department, which have driven US consumer debts to levels much higher than in the 1930s. However portfolio allocation and economic analysis require a global focus as what the future holds may well be different for each asset class and in different regions despite the close linkages between them. In fact such linkages are often responsible for the inverse relationship between assets that is so important to the diversification and risk management processes.

At the event, Gambles, Keen and Duncan all expressed concerns about levels of global debt and the high risks that such debt holds for the future. Gambles foresaw a range of possible outcomes, mainly comprising the following:

- QE will work; creating exit velocity growth and real inflation that will outstrip and devalue debt (this has never worked before).

- The global economy will ‘turn Japanese’ and we’ll suffer lost decades while the debt slowly and painfully endures – except that this isn’t an outcome, just a long transition to an outcome

- Some kind of re-set or event – a default, actual or effective, or the kind of event that ended the Great Depression, i.e., WWII

Each outcome will create huge risks and opportunities – it’s impossible to know which outcome will prevail or the timing but awareness of these possibilities allows each investor to position for the full range of outcomes, according to their individual risk profile. It’s not about investing into a particular asset in anticipation of a single outcome. It’s about constructing risk-adjusted portfolios using asset matrices that can withstand the most unfavourable outcomes.

Duncan’s central premise was that, since 1945, the world has been dominated by ‘creditism’ – “we see all economic and capital market activity ultimately driven by credit. This is a manipulation. It’s not capitalism.” His scenario mainly anticipated a binary outcome.

Either the economy continuing to grow with QE being invested in a way that is more efficient – new technologies, green energy etc – investing a further $5trn into productive sectors will generate adequate sustainable growth to fix the debt problem over time or a Japan-style lost decade or several lost decades will follow.

Keen focused on extreme levels of private debt seeing the economy right now as another accident waiting to happen – probably in the next 2-5 years. It could be just another recession in a long-term cycle of going nowhere for the next couple of decades, Japanese-style, but Keen also worries that social pressures, especially in Europe, could lead to the kind of austerity conditions that brought Hitler to power in the 1930s and led to WWII.

The range of outcomes and the risks inherent in each one only serve to reinforce our convictions about highly personalized risk management with diversification, a coherent outlook and patient pragmatism to the fore.

Keep checking the Phuket Gazette’s business pages for the latest local and national business news updates affecting Phuket and Thailand. Alternatively, join our Facebook fan page or follow us on Twitter.

MBMG Group is a multi-award-winning professional advisory practice that provides sound and impartial advice to assist private, corporate and institutional clients in protecting and building their hard-earned wealth. For further information, visit www.mbmg-group.com.

— MBMG Group

Latest Thailand News

Follow The Thaiger on Google News: