Why copy trading appeals to the next generation of investors

The investment landscape is changing fast, and Gen Z and millennial investors are leading the charge with a completely different approach to building wealth. While their parents might have stuck to traditional mutual funds and financial advisors, today’s young investors are embracing copy trading as their gateway to the markets – and it’s easy to see why.

Learning by Watching Real Pros in Action

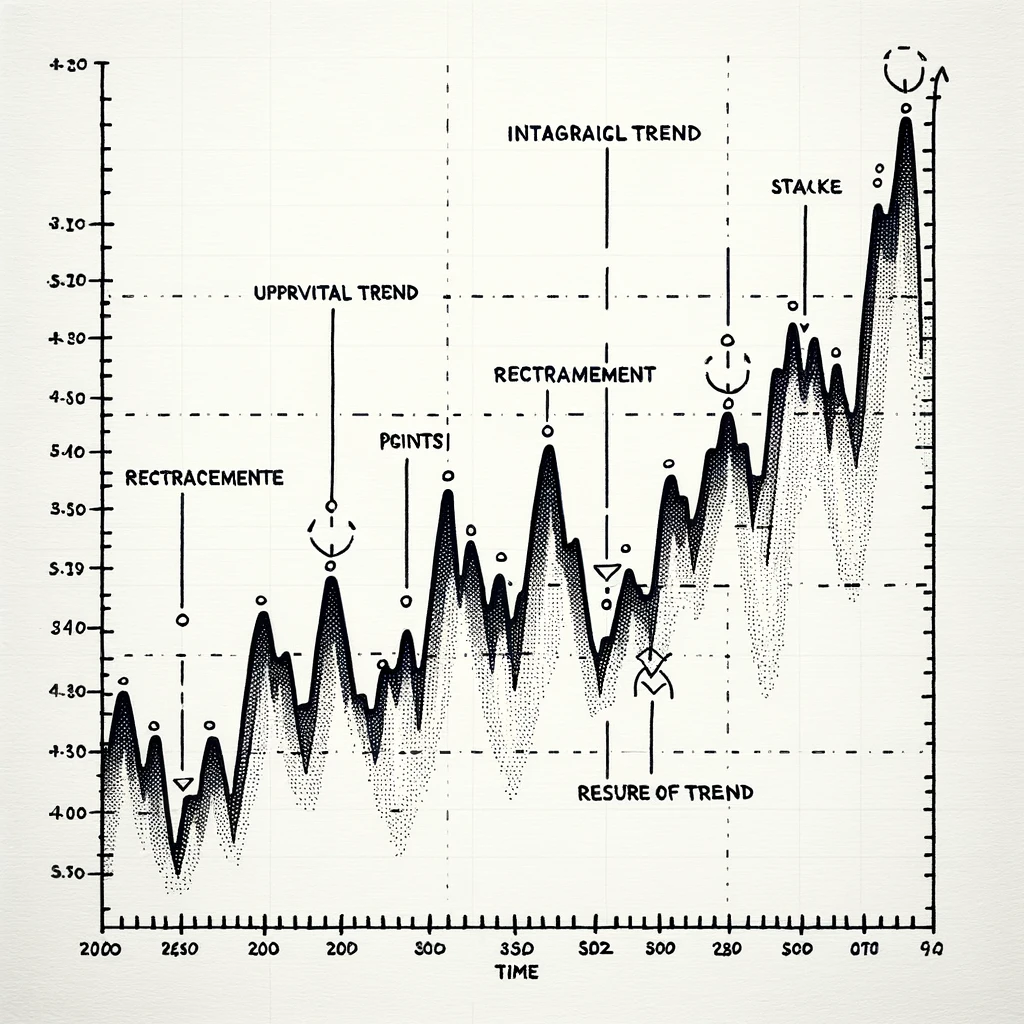

Traditional investing education can feel like drinking from a fire hose. Between complex financial jargon, endless research requirements, and the intimidating world of market analysis, many young people felt locked out of investing altogether. Copy trading flips this script by letting newcomers learn from experienced traders in real-time.

Instead of spending months studying charts and financial statements, new investors can watch successful traders make decisions and see the reasoning behind their moves. It’s like having a mentor who’s willing to share their entire playbook, making the learning curve much more manageable for those just starting.

Perfect for the Social Media Generation

Young investors grew up sharing everything online, from workout routines to cooking tips, so it makes perfect sense that they’d want to share – and copy – investment strategies too. Copy trading platforms tap into this social instinct by creating communities where successful traders can showcase their skills while newcomers can benefit from their expertise.

This social element transforms investing from a solitary, intimidating activity into something collaborative and engaging. Users can follow their favourite traders like they’d follow influencers on Instagram, creating a more familiar and comfortable entry point into the investment world.

Democratising Access to Advanced Strategies

Before copy trading, accessing sophisticated investment strategies typically required significant capital and connections to exclusive hedge funds or private wealth managers. Now, a college student with a few hundred dollars can potentially access the same calibre of trading strategies that were once reserved for millionaires.

This democratisation resonates strongly with a generation that values equality and accessibility. Young investors appreciate that success in copy trading depends more on research skills and risk management than on having wealthy parents or expensive financial advisors.

Technology That Makes Sense

Unlike clunky traditional brokerage platforms that feel like they were designed in the 1990s, copy trading apps are built with a modern user experience in mind. They feature intuitive interfaces, real-time notifications, and seamless mobile functionality that matches what young investors expect from their digital tools.

The automation aspect particularly appeals to busy young professionals who want to participate in markets without constantly monitoring their phones. They can set their risk parameters and let the system handle the day-to-day trading decisions.

Building Wealth on Their Terms

Perhaps most importantly, copy trading aligns with younger investors’ desire for financial independence and control. Rather than handing their money over to a financial advisor and hoping for the best, they can actively participate in investment decisions while still leveraging professional expertise.

This approach satisfies their need for transparency, control, and education all at once. They’re not just growing their wealth – they’re building valuable financial skills that will serve them throughout their lives.

The appeal of copy trading to young investors isn’t just about convenience or technology – it’s about creating a more inclusive, educational, and empowering way to build wealth that matches their values and lifestyle.

Latest Thailand News

Follow The Thaiger on Google News: