What to do when interest rates rise

PHUKET: IT IS widely believed that history does indeed repeat itself. What was true in the past is most likely to be true today and in the future. Sure, the events and names of companies change, but general economic principles will apply.

When it comes to investing, one of the most important things for investors to understand is long-term interest rates. One must remember that you can lose money by investing in bonds if you do not hold the bond until maturity. As interest rates rise, prices come down. As prices of bonds rise, interest rates come down. Bond prices and yields have what’s called an inverse relationship.

For traders that understand this correlation, it can also be applied to stocks and bonds. When investors are confident, they buy stocks and sell bonds. If there is fear in the marketplace, however, investors dump their stocks and go into bonds for safety.

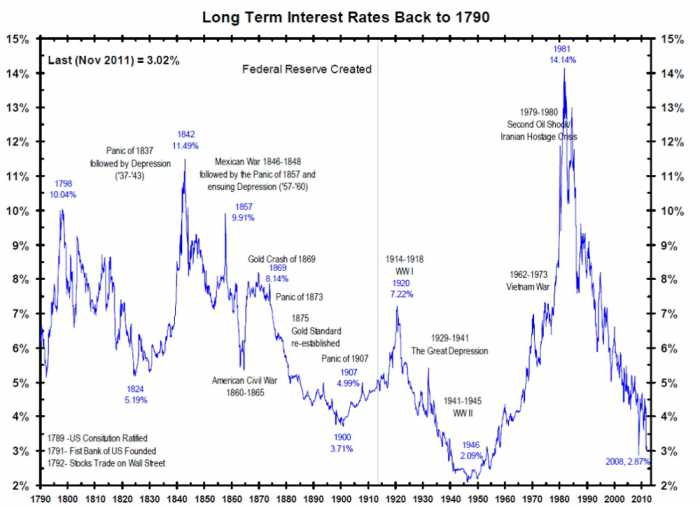

Long-term interest rates are currently near their historical lows. The only time interest rates were lower was just after World War II. This came as the United States emerged as the world’s greatest superpower and did not suffer the large-scale damage that Europe, Japan and Russia had. Money needed to go somewhere, and investors bought US bonds, because at the time, the US was the only place in the world where investors thought they would get their money back.

Interest rates have come down as the US Federal Reserve cut them as far as it could and instituted quantitative easing (QE) to bring long-term interest rates down even further. However, the Fed has started scaling back QE and has indicated that it will likely raise interest rates next year.

As indicated in the chart showing the trend of interest rates over the past two centuries (see above), when the Fed starts cutting rates, the rates keep falling. Conversely, when the Fed starts raising rates, the rates keep rising.

So it’s not a question of if rates are going to rise, but when. What that means is that bond prices will come down as rates rise. This has bond fund managers like PIMCO’s Bill Gross nervous. The great 25-year bull market in US Treasury bonds will finally come to an end, and it will be harder for bond fund managers to make money.

The good news for stock market investors is that there’s a lot of pent-up money sitting in bonds which will be looking for a new home. What will be seen is the great migration of money out of bonds and into stocks. This is what a lot of people aren’t considering and the reason why the stock market will continue going up.

There are literally trillions of dollars sitting in US bond funds. As investors reallocate their portfolios, they will reduce their bond fund holdings and boost their stock market holdings. This fact, along with the technological revolution, has me really excited about the stock market for the next 20 years.

This just leaves one critical question remaining: what are income investors to do? Besides bond funds, one strong sector that has performed quite well over the past few years for income investors has been real estate investment trusts (REITs).

For example, the Vanguard REIT ETF has averaged 9.29% annually over the past 10 years and pays a 3.78% dividend yield according to Vanguard representative Joseph Pendergast.

The problem for REITs is that as interest rates rise, it makes it more expensive for them to borrow money and buy real estate. Since rental prices can’t go up as fast, that means there’s less money for REITs to distribute to their investors. This will likely reduce the returns investors get from US REITs.

The solution is for investors to look at overseas REITs, particularly in Europe and Asia. Today, markets, including Japan, Australia and Europe, are unlikely to raise their rates any time soon. That’s why investors should consider the Vanguard REIT ETF and into the Vanguard Global ex-US REIT ETF. It offers all the protection and security of the Vanguard name, but gives investors exposure to property markets outside the US.

It’s important for investors to realize that rising rates are a near-term event. In other words, investors need to start preparing for it and adjust their portfolios accordingly.

Don Freeman is president of Freeman Capital Management, an independent US-registered investment adviser. He has over 20 years’ experience and provides personal financial planning and wealth management to expatriates. Specializing in UK and US pension transfers. Call 089-970 5795 or email freemancapital@gmail.com.

— Don Freeman

Latest Thailand News

Follow The Thaiger on Google News: