Thailand’s retail and property markets adapt and move online

Tourism, property, retail – 3 sectors of the Thai economy that have taken a huge hit from the impact of lockdowns and border closures. Whilst most of the lockdown provisions are now lifted, the borders remain mostly closed and the economy ‘sluggish’ at best.

The first half of 2020 has been one of the most challenging periods that Thailand retail industry has faced, probably ever. CBRE, an international property consultant, reveals that the degree of uncertainty in the second half of 2020 remains high. Retailers and developers alike must be adaptive and boost their e-commerce penetration to survive.

Thailand’s Covid-19 measures were put in place to contain the virus, but retail, the property market, along with tourism, has taken a significant hit.

“What we have been seeing in the past three months are brand-new challenges that took everyone by surprise. For around two years, we have been saying that those who cannot adapt quickly enough to the shifting retail landscape will not survive, but this is on another level. Retailers have to change their business operations not only to match the drastic drop in footfall but to accommodate a new way of shopping” – Ms. Jariya Thumtrongkitkul, Head of Advisory & Transaction Services, Retail, CBRE Thailand.

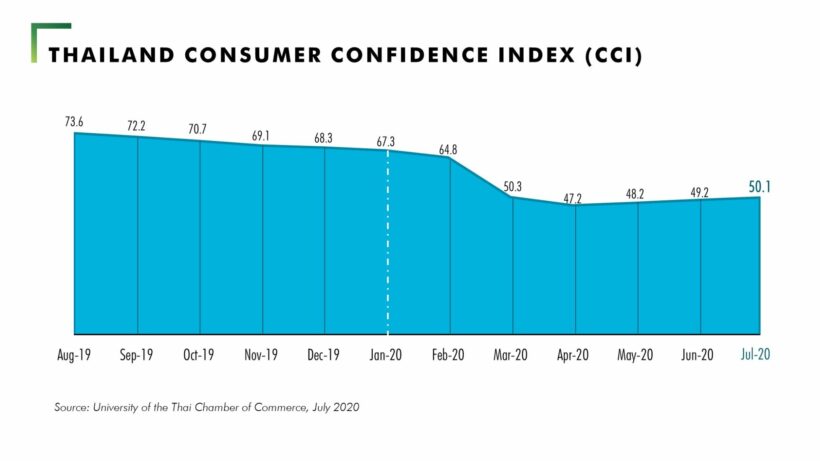

The retail sales index in May 2020 has dropped by 34% year-on-year, mostly from the decline in sales of cars and fuel. The Consumer Confidence Index dropped to the lowest point since 1998 at 47.2 in April but has managed to stumble back to just over 50 in July. While Thailand’s same-store-sales growth for Q2 has not been released, it is expected to indicate negative figures from both food and non-food retailers, as this period represents the time when most of Thailand was in some degree of lockdown and retail closure.

After the easing of business restrictions started in June 2020, CBRE notes that many landlords continued to restore their businesses by stimulating customers’ purchasing power via a variety of sales and marketing strategies, grand sales events and setting up frequent mall activities to help both permanent and temporary tenants. A few provided more flexible rental terms to retain existing tenants.

CBRE also witnessed that retailers who used to rent a bigger retail space turned to online platforms and are now refocusing their businesses online after the crisis, resulting in resizing or cancelling their current rental spaces in many retail centres. The move ‘online’ was simply accelerated by the impacts of the pandemic.

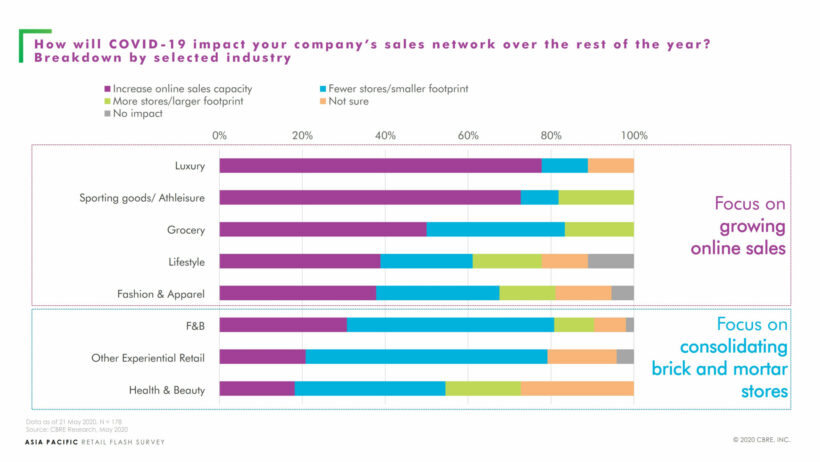

According to the Asia Pacific Retail Flash Survey conducted in May 2020, the majority of F&B and other experiential retailers will be focusing on opening fewer stores or focusing on smaller footprints for the second half of the year.

“Once the situation returns to normal, resizing existing rental space will become a more and more important approach that tenants take to be more cost-effective, especially for small and medium ones. Shopping mall operators thus need to revise their trade and tenant mix allocation more granularly and carefully.”

Thailand’s Covid-19 experience has accelerated the changes of traditional retail businesses and accelerated the growth of online retail business at the same time. CBRE notes that developers could reconsider the development concept of new malls to better suit the changes in shopping behaviour and better adapt to any unexpected events in the future. Convenience, hygiene, flexibility and online will be emphasised more for future retail developments.

CBRE believes e-commerce penetration will not be an option but a must for both brick and click businesses to survive. However, the Thai retail sector will be slow to fully recover unless tourist arrival figures reach a similar level to the pre-crisis period as many large-scale shopping malls, especially in downtown Bangkok, are fuelled by foreign tourists.

For property, sales have seen a sharp decline in demand from customers and agents report a risk-averse market. The price of new opening units from many developer companies has dropped significantly in line with the lack of customer demand at this time.

• Ananda Development, a leading company in the property market, is offering special prices on projects near BTS and MRT lines. The price reduction campaigns include a free transfer of ownership and five years of free common expenses.

• Lumpini Development is another leading company offering special prices. Their campaign includes a special discount of up to 50 per cent on existing projects.

• Supattra Kaewkwang, a property agent in the Bangkok area, says that she has been facing hardship since mid-February as both Thai and foreign customers are afraid of the travel restrictions throughout the country. The ongoing border ban and widespread economic recession, in Thailand and overseas, has caused a decline in her sales of up to 50%, compared to 2019.

But Brennan Campbell, CEO for FazWaz, notes that there is also considerable pent-up demand and searches on their website are still strong, along with reliable enquiries still coming through their office.

“In the early stages of the Covid disruption, we saw strong enquiries from, particularly, the Chinese and Hong Kong buyers. In recent months, despite the lack of tourist traffic, we’ve also started to see more European and SE Asian customers start to look at Thailand as a safe and reasonably priced market to invest in as the world starts to re-open.”

SOURCE: CBRE

Latest Thailand News

Follow The Thaiger on Google News: