Phuket Business: Learning from the master investor

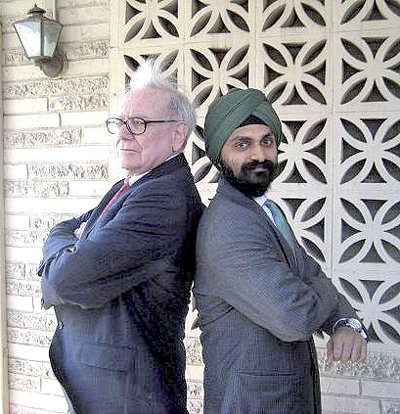

PHUKET: Warren Buffet, CEO of Berkshire Hathaway, is arguably the greatest investor of our time. Most of us can never hope to achieve the kind of success he has had, but we would all probably do well to follow some of his very common-sense advice.

I have gathered a few quotes attributed to him for this week’s article. They’re pretty much simple advice – and obvious if you really think about them – but then, most deep wisdom usually is.

- “Warren Buffet’s Two Rules of Investing: Rule One: Never Lose Money. Rule Two: Never Forget Rule One.”

- “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

- “You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.”

- “After all, you only find out who’s swimming naked when the tide goes out.”

- “Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.”

- “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

- “The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table.”

- “I have pledged – to you, the rating agencies and myself – to always run Berkshire with more than ample cash. We never want to count on the kindness of strangers in order to meet tomorrow’s obligations. When forced to choose, I will not trade even a night’s sleep for the chance of extra profits.”

Basically these quotes sum up a very simple yet effective approach to investing in stocks or businesses in general. Buy good companies, when times are bad and prices are depressed, and hold them forever.

Warren Buffet has amassed the bulk of his fortune from doing just that. He invests only in companies he understands, and chose to sit on the sidelines during the dot com madness. Thus he avoided the big crash that hurt so many investors at the start of the century.

He also is very anti-debt, which is what he is referring to in the final quote. If he has been able to achieve becoming the wealthiest man on the planet without being leveraged to the hilt (for many years it bounced back and forth between him and Bill Gates), there is no reason for anyone else to employ leverage either.

It should be noted that Warren Buffet doesn’t make money every single calendar year, and even he lost money last year. The big difference between his “losses” and most people’s losses are that his will be recouped easily when markets climb as he is invested in companies that will likely still be around in 100 years.

If you are seriously interested in stocks, wait patiently for the next crash, and invest in companies like McDonald’s and Coca-Cola when they have reasonable valuations.

David Mayes MBA lives in Phuket and provides wealth management services to expats around the globe, specializing in UK pension transfers. He can be reached at david.m@faramond.com or 085-335-8573.

— David Mayes

Latest Thailand News

Follow The Thaiger on Google News: