Phuket Business: Now is the time to structure your financial investments

PHUKET: Now that 2012 is in full swing and no doubt many of the New Year’s resolutions have been thrown out of the window, it’s time to get a hold of the purse strings and have a set plan for the forthcoming year.

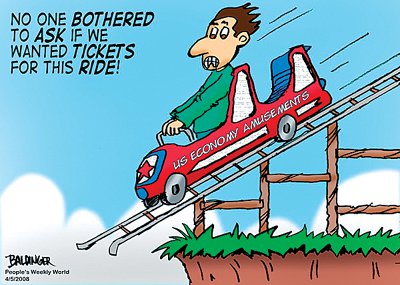

I have already given my views on what I believe we can expect from the year ahead. The financial rollercoaster ride is certain to continue for the next 12 months, so what would be the best way to survive the turbulence?

One thing that recently seems to have become a lot more popular is the rise of an investment called a structured note. So what is a structured note and what are the positives and also the negatives of this?

Firstly, let me explain what a structured note is.

The concept of a structured note is that in times of volatile markets it will enable you to benefit from good stock market performance while at the same time protecting you against bad market performance. In most cases a selection of stocks will be chosen. This tends to be in specific geographical areas or industries. Each structured note is likely to have an investment time frame from 12 months to 5 years and will have an initial valuation date and a final valuation date.

That’s the easy bit explained. Now the note will provide a pre-determined level of capital protection. In most cases this tends to be 50%. During the life of the note, the investor receives interest on a quarterly basis. What this means is that should none of the stocks selected fall by 50 per cent, the note will pay the interest. Again, this is valued on a quarterly basis.

Structured notes also have the ability to be autocalled. This normally means that should all the stocks selected be above their initial 100% level on the quarterly valuation date, the note will “autocall” and a full return of capital is given plus any interest that has been earned. Sound good?

Don’t get me wrong; as well as good points there are downsides to this and I advise anyone considering investing in one of these notes to do their research or seek professional advice.

So what are the disadvantages?

Well, a structured note is provided by an investment bank, so do your homework on the bank that is providing the note or the capital protection of the note, as we know banks have not had the easiest of rides over the last few years.

Due to structured notes having fixed terms they tend not to be very liquid, so if markets are falling dramatically, selling out of these can be quite hard.

The notes having a maximum return, in rapidly rising markets your growth can also be limited and stock markets may return more than the interest the note provides.

Also, be aware that should any of the underlying stocks within the note fall by more than 50%, on the final valuation day you will only receive the performance of the worst performing stock no matter how well any of the other stocks have performed.

So are they a good thing or a bad thing?

Well, this type of structured investment certainly has its good points and also its bad points. As with any investment, these should be held as part of a larger portfolio and I wouldn’t advise putting all your eggs in one basket.

As markets are volatile, the concept of the note is generally good. However you need to take into account the type of stocks the notes are based on, as well as the quality of investment bank issuing the notes.

For advice or information on structured notes, please contact: alyman@montpeliergroup.com.

— Athony Lymann

Latest Thailand News

Follow The Thaiger on Google News: