Phuket Business: Income tax filing: Part II

PHUKET: For anyone who generated income in Phuket or elsewhere in Thailand last year, regardless of where or how they were paid, the personal income tax filing deadline is March 31.

However, since the last day of this month falls on a Saturday, the last opportunity to file on time will be Friday, March 30.

In the first of two-article series we introduced the formula Ti = Ai – (D+A), covering Ti (taxable income), income categories, and how to determine D (deductions) by referring to a tax income certificate (PND).

To read that first article, see page 10 of the March 10-16 issue, which can also be found online in the business section of the Phuket Gazette website, published March 15. Digital subscribers can download the full newspaper here.

To complete the formula, we’ll now go on to outline tax allowances (A) and explain how to apply progressive tax rates to determine how much tax was/is owed.

Everyone is entitled some allowances. You can claim these if you were single or supported dependents (child, spouse, parent, and/or handicapped persons) or if you’ve paid into social insurance, an approved provident fund, long term equity fund or life insurance premiums. You can also claim if you have paid interest on a house mortgage, and/or made charitable donations.

Like deductions, allowances are also capped. For example, a maximum 17,000 baht can be claimed for supporting a school-aged child (which is split among two parents at 8,500 baht each), or 30,000 baht for the support of a spouse or parent; 100,000 baht for a life insurance premium or interest paid on a house mortgage; and 500,000 baht or 15% of wages for contributions to a long term equity fund and/or provident fund.

Once you have determined all of your deductions and allowances, you are now ready to complete the formula and calculate how much of your income is actually taxable in the eyes of the government. This figure will determine what tax rate(s) to apply.

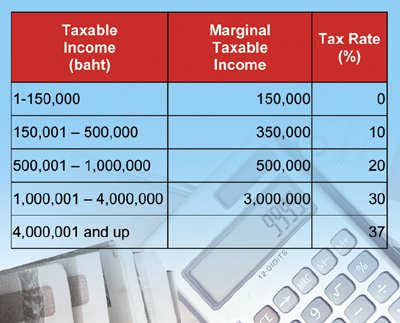

Refer to the following examples and progressive tax rate table.

Let’s say that after subtracting all deductions and allowances, your Ti is exactly 500,000 baht. In Thailand, the first 150,000 baht of your Ti is exempt. Therefore, only the remaining 350,000 baht would be subject to the bracket rate of 10%, or 35,000 baht.

The PND tax certificate(s) should show that this amount was withheld from your income and paid last year. If less was withheld, you will owe the difference. Likewise if more was withheld, the revenue department will be in line to write you a check equal to the amount of the surplus.

Moving up brackets, let’s say your Ti is 600,000 baht. Accordingly, the first 150,000 baht is exempt, and the next 350,000 baht would be taxed at 10%, while the remaining 100,000 baht would be subject to a 20% rate, or 20,000 baht. In this example, the total tax owed would be 55,000 baht (0+35,000+20,000).

When ready to file, no formal appointment is required at the Revenue Department. However, due to the rapidly approaching deadline, it is suggested that you get there early and allocate enough time for any potential delays.

Finally, be sure to bring with you all the originals and copies of all your PND tax certificates, as well as vital identification and verification documents.

Disclaimer: The information provided in this article is based on personal experience and direct inquiries with the Revenue Department. The author and the Phuket Gazette will not be held liable for any damages claimed from misuse, misinformation or misunderstanding. All specific tax issues should be directly addressed with the Revenue Department. For more information, see rd.go.th or call their hotline: 1161.

— Steven Layne

Latest Thailand News

Follow The Thaiger on Google News: