Muang Thai Life partners with Line BK for low-income targeted insurance

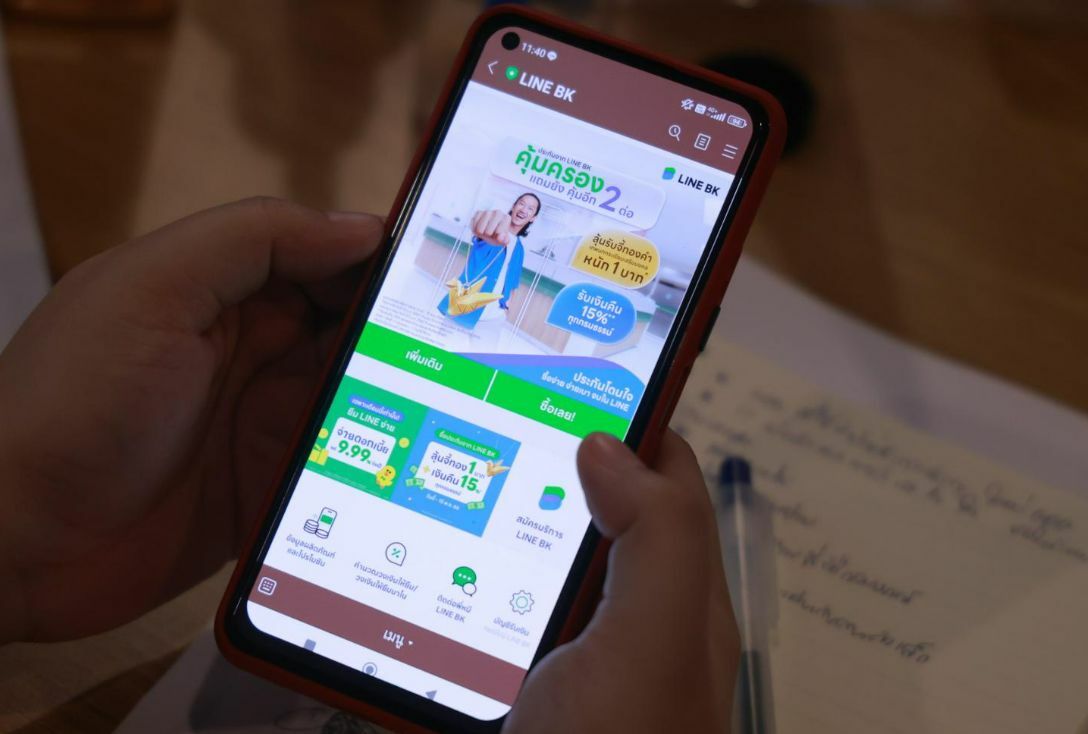

Muang Thai Life Assurance (MTL) is partnering with Line BK, a provider of social banking services, to introduce an insurance brokerage service that primarily caters to those with lower incomes and freelancers.

Sara Lamsam, the CEO and president of MTL, stated that partnering with Line BK will provide the public with easier access to health and life insurance policies that are personalised to each person’s lifestyle.

This collaboration aims to simplify the public’s access to the services of Muang Thai Life, aligning with the company’s mission to bring joy into each individual’s life.

The brokerage service is primarily designed for Line BK’s customers, particularly those with lower incomes, with the products being created from an outside-in perspective to meet genuine customer needs.

Line BK currently has approximately six million users, with 10% or 600,000 users expressing interest in life insurance products.

Initially, Line BK will offer five of MTL’s life and health insurance products via its platform. The first product will assist consumers in offsetting outpatient medical treatment expenses with a maximum coverage of 2,000 baht per visit, valid up to 30 times each year.

The second product offers policyholders a lump-sum payment of up to 500,000 baht upon diagnosis of a serious illness at any stage.

This product is accessible to individuals aged between 20 and 58. The third product, known as the IPD Top Up, covers excess medical costs from existing insurance or provides benefits of up to 500,000 baht per hospital admission with a 20,000 baht deductible per event. This product is available for individuals between the ages of 20 and 69.

The fourth product offers coverage for the actual cost of a room and treatment of up to 500,000 baht per event, with no limitations on admission numbers. This is available to individuals aged 21 to 59.

The final offering provides daily compensation of up to 1,000 baht per day for a maximum of 365 days if a policyholder is hospitalised due to an injury or illness.

The compensation amount is doubled if the individual is admitted to the ICU. This product is available for individuals between the ages of 21 and 59. All insurance plans are available for application without the requirement for a health check, reported Bangkok Post.

Tana Pothikamjorn, the CEO of Kasikorn Line, considers insurance to be one of the most fundamental financial products that can aid Line BK’s customers in effectively managing their finances in unpredictable health and accident situations.

Follow Thaiger’s latest stories on our new Facebook page HERE.

Latest Thailand News

Follow The Thaiger on Google News: