IDC predicts smartphone market in Thailand to remain stagnant

The Thai smartphone experienced a significant decline in 2022 and is expected to remain stagnant due to inflationary concerns, rising interest rates, and a lacklustre growth forecast for the Thai economy, according to the International Data Corporation (IDC).

The IDC reported that 16.6 million smartphone shipments were made in 2022, marking a 21% decline from the previous year and the lowest number of units sold since 2014. In the fourth quarter of 2022, shipments fell by 23% year over year, reaching 4.2 million units.

The decline in shipments was largely attributed to the absence of government stimulus campaigns in 2022 that boosted smartphone adoption in the previous year, as well as the economic and inflationary pressures. The entry-level smartphone segment (US$200) was particularly affected, with its market share shrinking from 64% in the previous year to 59%. Additionally, the average selling price (ASP) increased by 15% year on year (YoY) to US$329 in 2022.

Although the share of 5G smartphones increased from 24% in 2021 to 35% in 2022, the conversion from 4G to 5G was not as significant as the shift from 3G to 4G due to affordability concerns and a lack of compelling use cases for consumers.

Apirat Ratanavichit, Market Analyst at IDC Thailand, said he anticipates flat growth for the Thai smartphone market in 2023 due to ongoing inflationary concerns, rising interest rates and a lacklustre growth forecast for the Thai economy.

“Overall consumer spending power is unlikely to rebound in the short term, largely affecting the lower-end segment which comprises the bulk of the smartphone market. On the premium end, IDC expects sustained growth as consumers are attracted to vendor offerings with a superior user experience, better specifications and innovations.”

Top 5 Smartphone Vendor Highlights

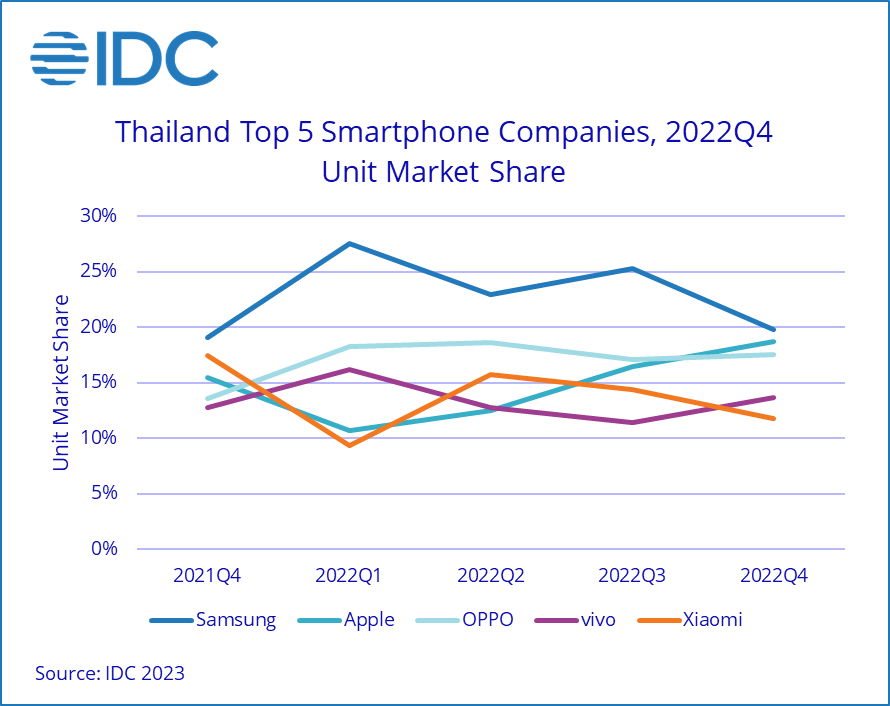

During the fourth quarter of 2022, Samsung continued to lead the smartphone market for the sixth consecutive quarter, despite a decline of 11% quarter over quarter (QoQ) and 20% YoY in its market share. Samsung’s premium Galaxy S/Foldable smartphones performed well during the holiday period.

Apple rose to the second spot with a 30% QoQ increase but saw a decline of 7% YoY. The launch of the new iPhone 14 range in September 2023, as opposed to the previous year’s fourth quarter, resulted in a stronger third quarter shipment. The iPhone 14 Pro range continued to outperform the iPhone 14 range, while the iPhone 11 and other n-1 and n-2 models received price cuts and continued to sell well.

OPPO dropped to the third spot but experienced an 18% QoQ increase in sales, with a slight 0.6% YoY decrease. Most of OPPO’s shipments were in the low-end segment, which grew 28% QoQ and 12% YoY. The A16k, A17, and A57 were the main volume drivers, and OPPO ran campaigns to promote sell-out, including retail-level offers and promotions for promoters.

Vivo rose to the fourth spot, with a 36% QoQ growth but an 18% YoY decline. Sales in the low-end segment rebounded by 47% QoQ after significant declines in previous quarters, while sales in the mid-range segment rebounded by 70% but decreased by 19% YoY. Vivo continued to run marketing campaigns and launched several models in the low-end Y series, as well as introduced the IQOO brand in Thailand.

Xiaomi dropped to the fifth spot, with a 3% QoQ decline and a 50% YoY decline. Telco sales increased significantly, as the Redmi 10 5G remained a key model in the affordable 5G segment. Xiaomi saw a decline in low-end segment sales but rebounded in the ultra-low-end (US$100) segment with the launch of Redmi A1.

Latest Thailand News

Follow The Thaiger on Google News: