The top 6 forex trading demo accounts for Thai traders

Finding a forex broker with ideal trading conditions to practice trading

Our evaluation of the top Forex demo accounts for Thai traders prioritised attributes such as the quality of the Forex trading platforms, trading conditions, and customer support provided. We also favoured brokers with good regulations for trust and security to ensure your funds are safe and trading conditions are fair.

The 7 top forex demo accounts favoured by Thai traders

Choosing the right Forex demo account is a crucial first step for traders in Thailand, offering a risk-free way to familiarize yourself with the Forex market dynamics and test trading strategies. To simplify the process of choosing a demo account, I’ve analyzed over 40 Forex brokers, focusing on critical aspects that impact your trading experience.

Our comprehensive review covers the trading platforms available, the variety of Forex and CFD products available to the competitiveness of spreads and execution speeds. By doing this, we hope you can easily find a broker that meets your trading needs. Below are the top 7 Forex brokers equipped with demo accounts tailored to cater to various trading styles and preferences. Let’s dive into what makes each of them stand out.

- Pepperstone – Best Forex Demo Accounts Overall

- IC Markets – Top Free Demo Accounts with Low Spreads

- eToro – Social Trading Demo Account Without Registration

- OANDA – Great Demo Accounts For Beginners

- AvaTrade – Top MetaTrader 4 Demo Account

- Plus500 – Best Demo App For Mobile Trading

- IG Group – Paper Trading With The Most CFD Products

To ensure the safety of your funds when trading, we only reviewed regulated brokers with regulations in major financial markets. We did not consider unregulated brokers.

1. Pepperstone – best forex demo accounts overall

Based on our extensive evaluation of 40 Forex brokers, Pepperstone should be the first choice for Thai traders. Four trading platforms—MT4, MT5, cTrader, and TradingView—are available to demo at no cost, and their fast execution speeds make them stand out from their competitors. Also note that they are regulated by top-tier Forex regulators, making them a top choice regarding trust and safety.

Top 3 key features of Pepperstone

- 4 Trading platforms

- 0 Pip spreads

- Fast execution speed

1. Trading platforms and instruments

Pepperstone allows you to choose from the four most popular mainstream (aka free) trading platforms in the market: MetaTrader 4, MetaTrader 5, cTrader, and TradingView. If you are into technical analysis.

TradingView is the best choice, but if you want to develop your trading robots and custom indicators, we recommend MetaTrader 4 or MetaTrader 5. If you want a platform designed for ECN or STP trading, cTrader with its Depth of Market (DoM) is a good choice.

Regardless of which platforms you choose, you can test them with a demo account. With Single Sign-On (SSO) via your Gmail, Apple, and Facebook accounts, you can open an account and get started in less than one minute.

Two account types are available – a Standard account with $0 commission and a Razor (or RAW) account with spreads as low as 0.0 pips and a round-turn commission of $7 for each lot.

Justin Grossbard from CompareForexBrokers says Pepperstone offers four excellent trading platforms and two types of trading accounts, meaning it is a good choice for all traders, from beginners to experienced traders, day traders, scalpers, swing traders, and manual traders.

2. 0 Pip spreads (Yep, Zero, Zilch, Zip)

Low spreads mean fewer costs and zero pip spreads mean you only pay commission costs when you trade. We can all agree that is a good thing, and I found that Pepperstone has 0.0 pip spreads more often than any other broker.

Our colleague tested 20 brokers to see which broker has 0.0 pips spreads most of the time, and Pepperstone came out on top. Outside of the rollover period, Pepperstone had zero spreads 100% of the time for the following currency pairs: AUDUSD, EUR/USD, GBPUSD, USDCAD, USDCHF, and USDJPY. The only other broker to achieve this result was the City Index.

| 0 Pip Spread Brokers | AUD/USD | EUR/USD | GBP/USD | USD/CAD | USD/CHF | USD/JPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| City Index | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% | 98.55% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| Eightcap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| TMGM | 100.00% | 100.00% | 100.00% | 96.65% | 0.5% | 0.63% | 0.43% |

| Blueberry Markets | 100.00% | 100.00% | 91.30% | 100.00% | 78.26% | 95.65% | 94.20% |

| Go Markets | 82.61% | 91.30% | 86.96% | 91.30% | 82.61% | 91.30% | 87.68% |

| Blackbull Markets | 100.00% | 100.00% | 95.65% | 95.65% | 65.22% | 65.22% | 86.96% |

| Tickmill | 100.00% | 100.00% | 26.09% | 100.00% | 95.65% | 95.65% | 86.23% |

| Axi | 100.00% | 100.00% | 65.22% | 91.30% | 60.87% | 78.26% | 82.61% |

| CMC Markets | 100.00% | 95.65% | 65.22% | 86% |

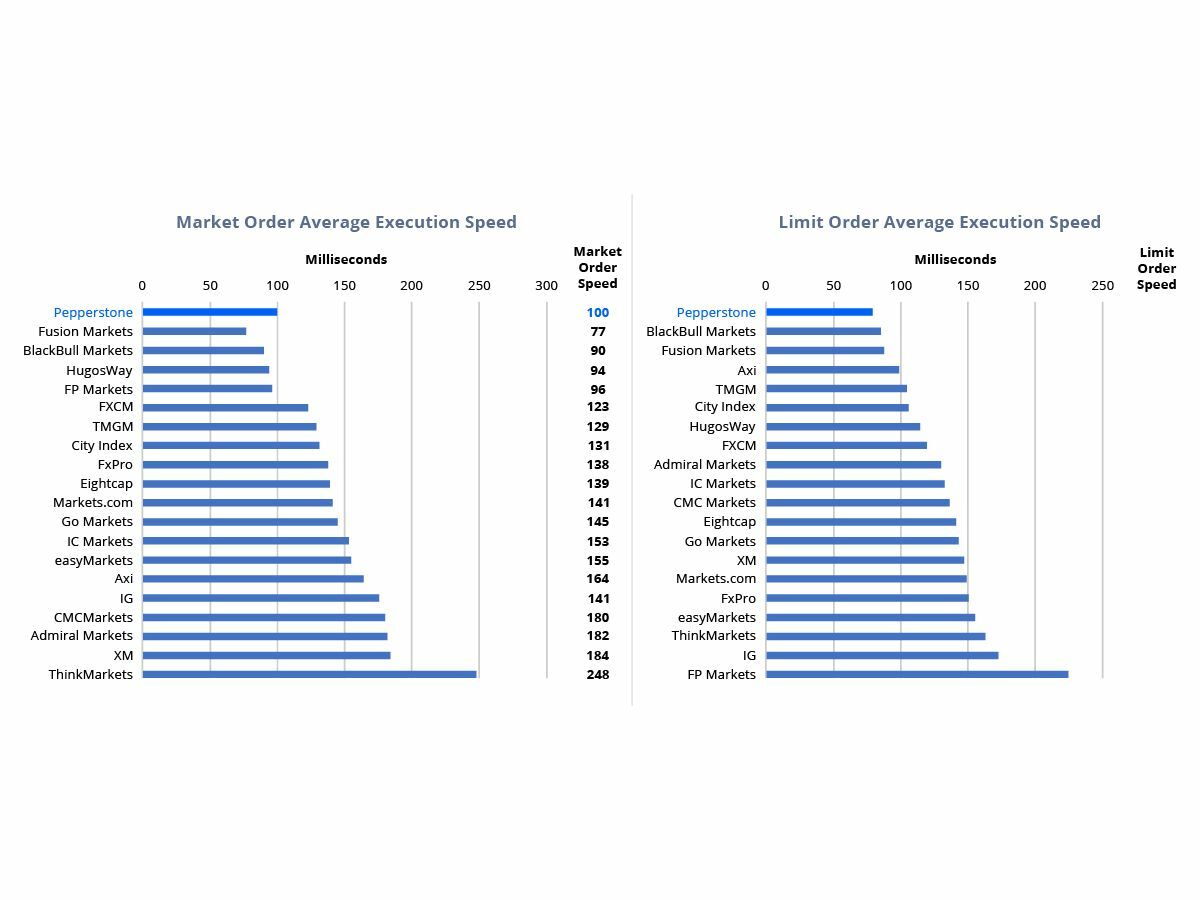

3. The best for blazing-fast execution speedsWhen trading, we always look for a broker with fast execution speeds as we want to know we will get the price we ordered and not have to worry about slippage and gapping. Our tests found that Pepperstone has some of the fastest execution speeds in the market.

Limit orders with Pepperstone are just 77 ms, while market orders are 100 ms. These speeds are well below the industry standard of 128.25 ms for limit orders and 133.95 ms for market orders. We generally expect no dealing desk brokers using straight-through processing (STP) or electronic data execution (ECN) to be fast, but even then, Pepperstone is exceptionally fast.

Pepperstone achieves these speeds by placing its servers in the same data centres in New York (NY4) and London (LD4) as top liquidity providers. These liquidity providers include notable banks like JP Morgan, Citibank, and Barclays Bank. The broker also uses top-quality infrastructure, such as fibre-optic cables.

Lots of reasons to trust Pepperstone

These are just some of the main selling points for why we like Pepperstone, but we should mention their customer support and level of trust.

We tested the live chat customer support on the Pepperstone website. While you can choose a chatbot for assistance, speaking to a human agent was super easy. In our experience, some brokers make it hard to talk with a human support agent and/or can be slow to respond; Pepperstone was both immediate and responsive. This support is available 24/7 and acknowledged as award-winning by several sources.

Other support tools include a Forex trading education centre, webinars, FAQ and glossary sections, and an in-house research team.

Lastly, Pepperstone is regulated in seven countries or regions. The bodies overseeing Pepperstone include some of the most stringent financial regulators, such as ASIC in Australia, the FCA in the UK, CySEC and BaFin in the EU, and DFSA in the UAE.

Pepperstone uses the SCB in the Bahamas for Thai traders. This means your funds will be kept secure in a segregated trading account, and you will get negative balance protection should your funds go into negative balance. The broker has no minimum deposit requirement to start trading.

2. IC markets – Top free demo accounts with low spreads

Our testing of IC Markets found the broker to be the best choice for low spreads. Whether you are using a demo account, live trading account, standard account, or RAW spread account, IC Markets has some of the tightest Forex spreads on the market.

The broker is regulated by ASIC, CySEC, and the FSA in Seychelles and has four trading platforms, making it a good choice for all types of traders.

Top 3 key features of IC markets

- Low spreads with Standard Accounts

- Low spreads with RAW Accounts

- 4 Trading Platforms to demo with

Demo accounts with IC markets

You can test all 4 IC Markets trading platforms using a demo account: MetaTrader 4, MetaTrader 5, cTrader, and TradingView. The signup process for a proactive account has two steps: the first step requires basic personal details, including your phone number (a step Pepperstone does not require), and the second step requires you to choose the account type you wish to practice with and then fund the account.

Despite the extra steps, signup is straightforward, with demo accounts that are good for 90 days.

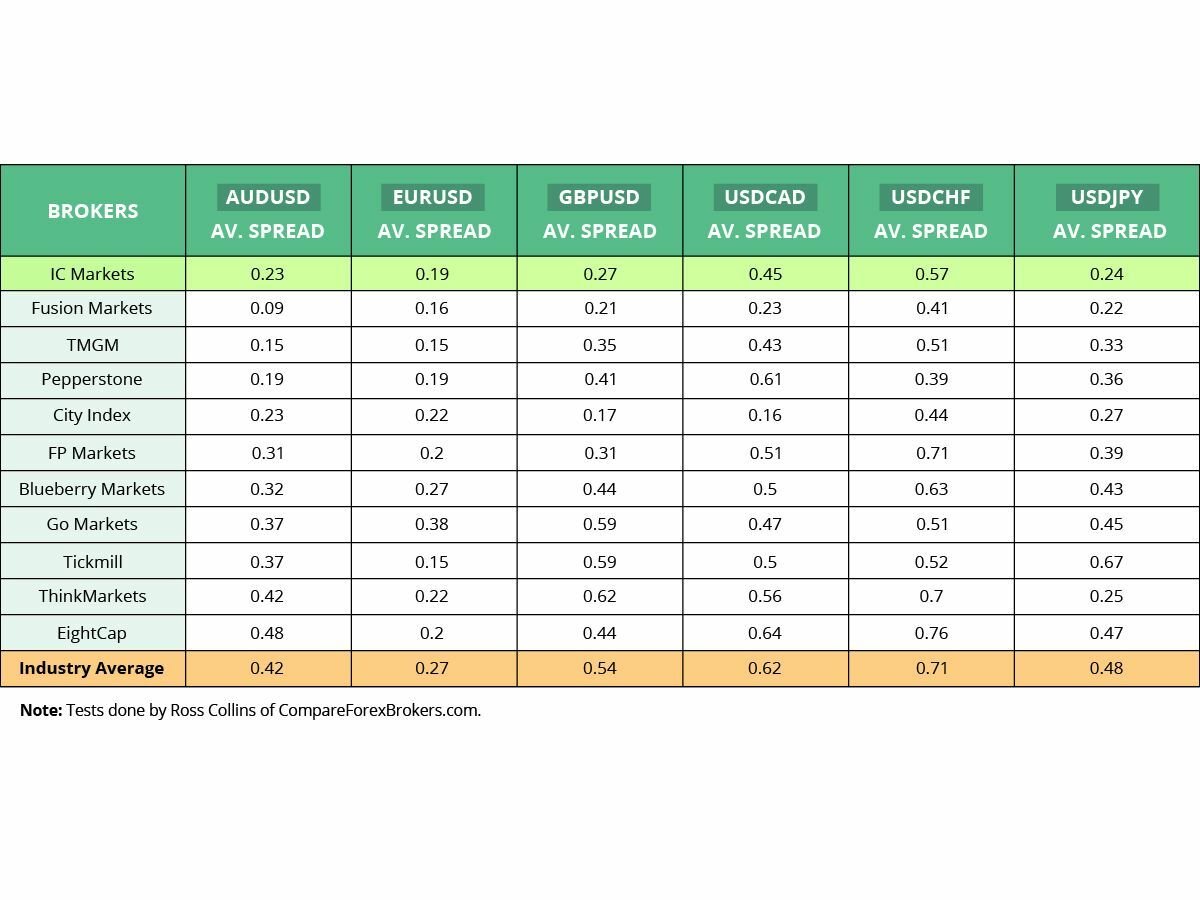

IC markets has the lowest spreads with standard account

Most if not all brokers have a commission-free trading account, usually called a standard account. So, it is fair to say this type of trading is competitive, so it makes sense to look for a broker with the lowest spreads to save on trading costs.

To help you, our colleague tested the spreads of 20 MT4 brokers to find which broker has the best spreads. According to our tests, IC Markets’ spreads are very competitive, with minimum spreads of 0.6 pips and an average spread of 0.73 pips for the EUR/USD currency pair. It’s not just with the EUR/USD pair; the broker finished in the top 3 for all six currency pairs we tested.

IC markets has the lowest ECN or RAW spreads

The other trading account IC Markets offers is a RAW spread account. RAW spread accounts use ECN execution and have no dealing desk, which is why they can have spreads as low as 0 pips. The commission cost with IC Markets is $7.00 round turn per trading lot but your overall cost will be cheaper than with a Standard account.

Our colleague tested the spreads of IC Markets’ RAW spread account and compared them to similar accounts with other brokers. We were impressed to see that IC Markets is also one of the best choices for this type of trading in addition to their Standard account.

Our tests found IC Markets’ spreads for EUR/USD average 0.19 pips, placing them fourth overall. That’s not bad, given that we tested 20 brokers. In fact, IC Markets finished in the top 4 for a number of currency pairs, which is a testament to their consistency.

3. eToro – Social trading demo account without registration

eToro, much like Plus500, only offers a proprietary trading platform, but unlike Plus500, the eToro trading platform is unique. This platform is designed for social trading and copy trading. Interaction with other traders in the community is encouraged, and AI technology is used to offer some unique products. If you don’t wish to put in the hard work of learning to trade, you may appreciate the ability to follow and copy other more experienced traders.

Top 3 key features with eToro

- SSO Sign up for demo account

- Best platform for social trading

- CopyTrader and Smart Portfolios

Demo account with no registration

To sign up for a demo account with eToro, you simply provide your email or log in via Single Sign-On (SSO) using Gmail, X (formerly Twitter), Apple, or Facebook. There’s no need for you to provide your funding details such as credit cards, debit cards, or ID to practice trading. eToro gives you $100,000 in virtual funds, and the account never expires.

eToro has a wealth of trading products

eToro has the following CFD products for trading:

| CFD Trading Product | Number Of Products | Leverage |

| Forex Pairs | 40 | Major (1:400), Minor/Exotics (1:50) |

| Stocks (Equities) | 4596 | 1:10 |

| ETFs | 533 | 1:10 |

| Commodities | 32 | 1:100 |

| Indices | 21 | Major(1:100), Minor (1:10) |

| Cryptocurrencies | 77 | 1:5 |

All products with eToro are spread only, so there are no commission costs to worry about. There are also no fees to sign up with eToro, but all accounts are in USD, so there may be conversion charges if you deposit or withdraw in a currency other than USD.

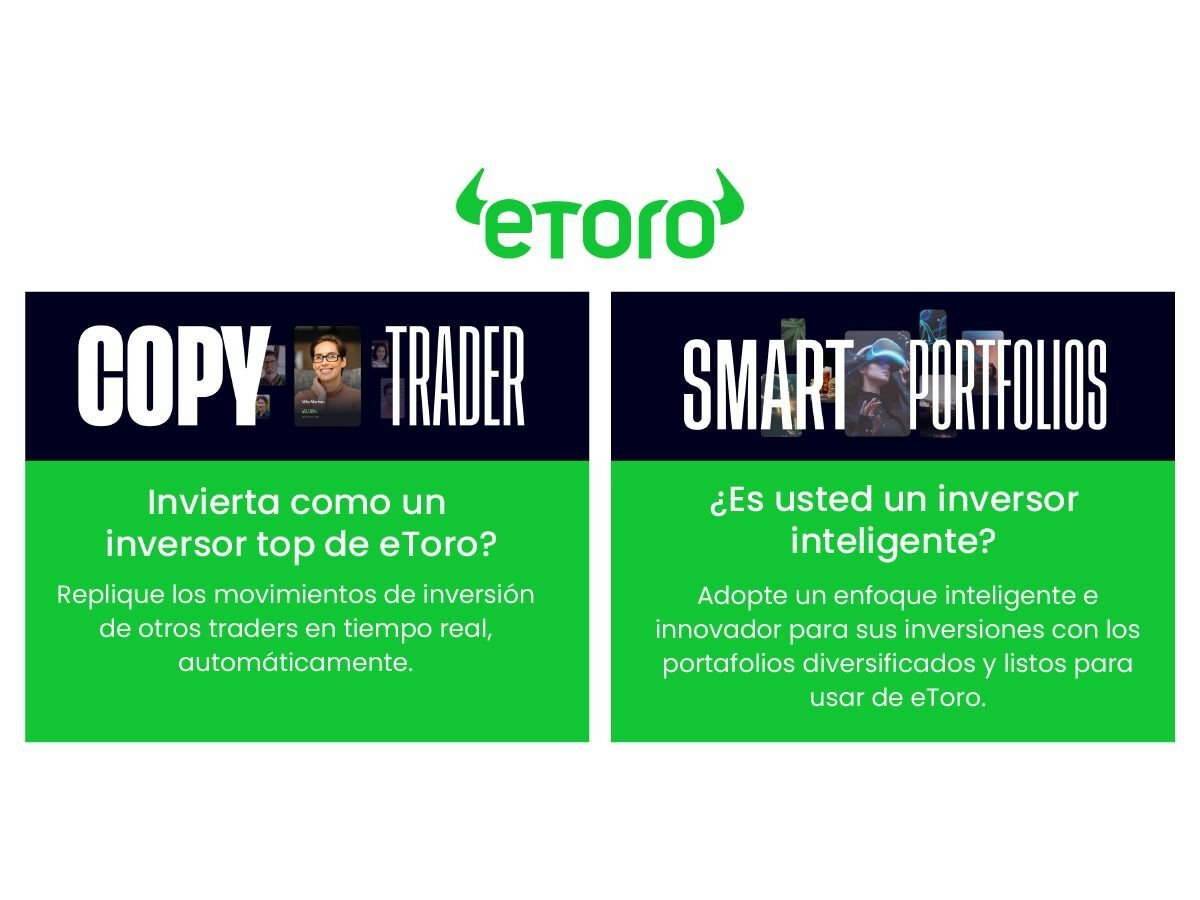

Copy trading capabilities

A standout feature of eToro is their copy trading called CopyTrader™. This feature allows you to replicate or mirror the trades of others in the eToro community. To help you with this, eToro provides filters to help you find a provider that matches your trading mindset or requirements. We like that the provider needs to provide a profile introducing themselves so you know who they are.

Filters to find the right investors include location, risk score, and performance metrics. We think reviewing their trading history, risk score, and consistency of returns is worthwhile. We also like that there are risk management tools to protect you from any dirty trades providers may execute (as unlikely as that is).

Smart portfolios

eToro uses AI technology to create a very unique product called Smart Portfolios. Indices or stock baskets based on every theme you can think of are created using AI or by eToro analysts, community experts, or partners. These indices are frequently updated with the top-performing stocks to ensure the chances that the index is always improving.

Top traders are curated by the best-performing traders in the eToro community. Thematics are created using AI and include themes such as Big Tech, Gaming, Politics, Crypto, and Real Estate, while Partners are collaborations with experts in industries such as AI and crypto.

Social trading with the eToro network

Noam Korbl of CompareForexBrokers explains that the social aspect is what makes eToro different from other brokers:

“eToro built their platform from the ground up with social trading in mind. eToro helps you interact, share insights, and learn from other traders in the eToro network. I use the social news feed for trading ideas and to see what others are doing. I’ve connected with other traders, something I have never done with other trading platforms.”

Community engagement in the form of social trading can be done via news feeds, direct chats, and forums and is a good way to exchange ideas and learn from other traders.

4. OANDA – Great demo accounts for beginners

In our opinion, OANDA is the best choice for a new traders. Our reasons are that OANDA Trade has no expiry, has a guaranteed stop-loss order, and has no commissions. OANDA is one of the world’s most trusted brokers, being regulated in 8 countries and regions including Japan, Singapore, Canada, and the United States, Australia, The UK, and Europe.

Top 3 key features with OANDA

- OANDA Trade platform has risk management tools

- Low spreads with Standard account

- Our most trusted broker

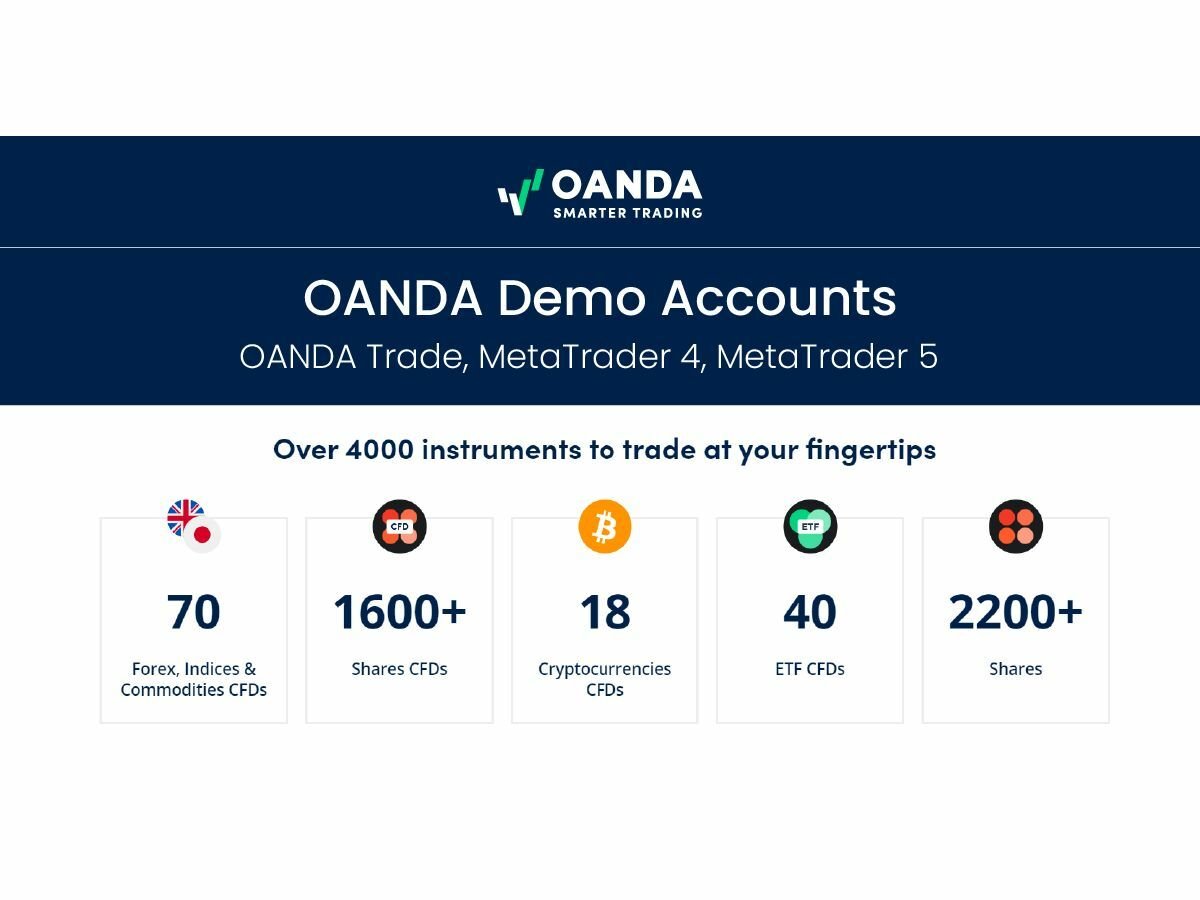

OANDA trade demo account platforms

You can test OANDA with OANDA Trade, MetaTrader 4 and MetaTrader 5. As we have previously mentioned, TradingView is great for chart trading, while MetaTrader 4 is the world’s most popular platform and does everything well, including automation with Expert Advisors (EAs).

MetaTrader 5 is a step up from MT4 since it has more trading tools, indicators, charts, and time frames. You can even trade shares, which MT4 does not do very well. All these platforms are free and are good for 90 days.

The last trading platform we tested and wish to discuss is OANDA Trade, which is available for web and mobile apps. We liked that this platform has an unlimited demo period which allowed us to fully test the 100+ technical indicators, 50 drawing tools, nine timeframes, and 11 chart types thoroughly before we commenced trading. we especially appreciated the guaranteed stop-loss order type, which allowed us to protect my trading position while I learned to trade.

OANDA has great education resources

We thought OANDA had a very impressive educational offering. This learning suite includes online articles, live webinars, YouTube videos, and FAQs. Education features are nicely divided into four sections: ‘Getting Started’, ‘Tools and Strategies’, ‘Capital Management’, and ‘Live and Pre-Recorded Webinars,’ where you can discuss risk management and Fibonacci lines with experts.

OANDA has the best research

MarketPulse.com is OANDA’s news and research portal. Here, you will find insights covering fundamental and technical analysis for OANDA’s products. These products include 69 Forex pairs, 15 stock indices, 1,600 stocks, 41 ETFs, 31 commodities, six bonds, and 18 cryptocurrencies. I appreciated their week-ahead articles, which made me aware of upcoming economic events and what to expect.

In addition to MarketPulse, we could stay informed via Dow Jones FX Select news feeds. Here, we could get real-time news and insights from reporters across the globe.

5. AvaTrade – Top MetaTrader 4 demo account

Admittedly, we could easily nominate most of the brokers on this list as the best MetaTrader 4 brokers. AvaTrade was unique to me because we could automate my trading with MetaTrader 4 (and 5) and use their Guardian Angel Suite for better risk management.

Top 3 key features with avatrade

- MetaTrader 4 and 5 Trading Platforms

- AvaTradeGO has risk management

- 3rd party social trading tools

Demo trading platform and accounts with avatrade

AvaTrade offers MetaTrader 4 and MetaTrader 5 and its in-house developed apps for mobile trading, AvaTradeGo and AvaOptions. All platforms come with $100,000 in virtual money and are valid for 60 days. You can even practice social trading with DupliTrade, AvaSocial, and ZuluTrade.

MetaTrader 4 with avatrade

Unusually for a market maker, AvaTrade gives you full access to MetaTrader 4 and 5 trading tools. This means you can not only use the 6 order types, 23 analytical tools, 30 technical indicators, 9 timeframes but also Expert Advisors (EAs) to automate your trading or create custom indicators. You can even trade micro-lots, which is good if you are new to trading or wish to control your risk.

One feature I like that is exclusive to MT4 and MT5 with AvaTrade is the Guardian Angel. This tool provides you with objective feedback on your trades so you can learn from your mistakes and hopefully trade better in the future. Feedback provided includes if you are taking on excessively high risk, using stop-loss orders correctly, and if your overall trading performance is strong or weak.

Lastly, you can integrate DupliTrade and ZuluTrade with MT4 for copy trading or social trading. I discuss social trading tools below.

| Trading Platforms | Trading Apps | Social Trading |

| MetaTrader 4 | MetaTrader 4 | AvaSocial |

| MetaTrader 5 | MetaTrader 5 | ZuluTrade |

| AvaTradeGo | AvaTradeGo | DupliTrade |

| AvaOptions (Options Trading) |

Social trading with avatrade

Like with granting full use of MT4, it is interesting to see a market maker offer social trading. They don’t just offer one 3rd party social trading app but two plus their own in-house developed app.

DupliTrade is a copy trading app with strict criteria signal providers must meet before they are accepted into the DupliTrade trading community. This means traders you follow and copy are likely to be successful since they have proven their ability.

ZuluTrade is similar to DupliTrade in that it only accepts signal providers that have proven to be successful. The main difference is ZuluGuard, which is a risk management tool of sorts that protects your account should a signal provider start performing poorly.

The last app is AvaSocial. This app encourages social interaction with other members of the AvaTrade community through news feeds and chat.

6. Plus500 – Best demo app for mobile trading

With its simplified and intuitive design, Plus500’s in-house developed trading platform and mobile app is a good choice for beginners to Forex trading. Key strengths of this CFD broker include the lack of commission costs, the new +insights analytics tool, a guaranteed stop loss, and 2,800 tradable financial instruments.

3 key features of plus500

- Good range of CFD products

- Plus500 platform has risk management tools

- Plus500 platform is good for mobile trading

Opening a demo account with plus500 is simple.

Plus500 makes it very easy to get started with a demo account. All you need is an email and password or a social account for single sign-on and you are done. One feature we like is that the account does not expire, giving you as long as you need to practice trading. A balance of 200 virtual USD will be provided to start trading.

Trade anywhere via mobile or web browser

So confident in their trading platforms available via the Web Trader and iOS and Android apps, Plus500 (along with Interactive Brokers) is one of the few brokers not to offer MetaTrader 4 (even CMC Markets and IG Group now have MetaTrader 4). While we are not sure this makes Plus500 better than its competitors, the Plus500 trading platform does have some nice functionality.

There are five order types: Market Orders, Limit Orders, Stop-Loss Orders, Trailing Stop-Loss Orders, and Guaranteed Stop-Loss Orders (GSLO). As someone new to trading, we think you will appreciate the GSLO, as this ensures you cannot lose more than you are prepared to lose even in the event of slippage.

Forex industry expert Justin Grossbard says, “The Plus500 trading platform comes with a useful range of order types, alerts, and sentiment tools that ensure you will never miss a trade. They also include 24/7 customer support which is good since most brokers only have 24/5.”

The app comes with 13 chart types, 11 time frames, 21 drawing tools, and a whopping 119 indicators, while the web version allows you to run 9 charts simultaneously. So we are confident there are enough technical analysis tools needed. However, you cannot sync the web and mobile app or automate your trading.

While no social trading is available, you will find +insights useful. This tool shows the general market sentiment of Plus500 clients. For example, if traders’ sentiment shows over 90% going long and very few going short, then there may be a reversal due to the price trend.

Plus500 Has 2,800 products with no commission

Plus500 is a market maker. Like most market makers, It does not charge commissions when trading Forex. In our testing, Plus500’s spreads are in line with the industry average, which is about 0.8 pips for the EUR/USD.

Overall, 71 currency pairs are available, so you can be confident that except for some niche exotic pairs, the pair you want to trade is available. Other CFD trading products include 1100+ shares, 30 indices, 7 energies (oil, gas), 5 metals (gold, silver), 98 options, and 15 cryptocurrencies.

| CFD Trading Products | Number Of Products | Leverage |

| Forex Pairs | 71 | 1:300 |

| Stocks (Equities) | 1100 | 1:20 |

| Options | 98 | 1:5 |

| Metals | 5 | 1:150 |

| Energies | 7 | 1:150 |

| Cryptocurrencies | 15 | 1:5 |

| Indices | 30 | 1:300 |

7. IG group – Paper trading with the most CFD products

IG Group is one of the oldest and largest retail forex brokers. Few brokers can match their range of trading products, trading platforms, and reputation. In my book, this makes IG Group a solid choice for Thai traders.

3 key features of IG group

- Highly trusted broker

- Largest range of trading products

- Good trading platforms

CFD products with IG

With 17,000 financial instruments for trading, IG Group definitely stands out. By our count, you can trade 98 forex pairs, 15 cryptocurrencies, 80 indices, 19 bonds, and 40 commodities. You can even trade futures, options, bet with binaries, and trade sectors and weekends. We don’t think we’ve encountered a broker with such an extensive range.

| Spreads With IG Group | |||

| Currency Pair | Minimum Spread (pips) | Average Spread (pips) | Leverage/Margin |

| AUDUSD | 0.6 | 1.33 | 1:200 |

| EUR/GBP | 0.9 | 2.51 | 1:200 |

| EUR/USD | 0.6 | 1.13 | 1:200 |

| GBP/EUR | 2.0 | 1.13 | 1:200 |

| GBP/USD | 0.9 | 2.38 | 1:200 |

| Gold | 0.20 | 0.30 | Tier 1 – 0.5%

Tier 4 – 15% |

| Silver | 0.50 | 2.0 | Tier 1 – 2%

Tier 4 – 20% |

Trading platforms with IG

IG Group has its own trading platform, IG Web, and IG App. The web platform comes with 33 indicators, 22 time frames, 20 drawing tools, 5 chart types, and even a guaranteed stop loss (GSLO). The app version has 33 indicators, 19 drawing tools, and 17 time frames but does not come with a GSLO. Use these apps to access the full range of CFD products with IG and for its GSLO.

Other trading platforms include L2 Dealer for DMA trading with shares and Forex, MetaTrader 4 for automation, and ProRealTime for superior chart trading.

Education with IG

IG Group is one of the leaders in Forex education and research. Its education comes in the form of weekly webinars, glossaries, trading guides, and online content. All this is free and suitable for beginners through advanced trading levels.

We enjoyed testing the IG Academy. This education suite includes online trading courses and live sessions. Topics include how trading works and how to use orders and leverage. You are required to sign up for a demo account to practice with as you learn.

Are forex demo accounts accurate?

Forex demo trading accounts are accurate enough to give you a realistic trading experience. They are designed to simulate real trading conditions and achieve this by using the same spreads quoted on the live market as with a live account.

However, there are some differences you may wish to take note of:

- Market conditions: While spreads should match live trading conditions, there may be some variances in times of high volatility or low liquidity.

- Order execution: In a demo account, spreads are always filled at the requested order price. You will not experience slippage, partial fills, or requotes.

- Execution speed: The speed of your trades may differ with a demo account since the most powerful infrastructure prioritises live trades.

These limitations aside, a demo account still provides a near-real trading experience and is a good way to practice trading without risking your own funds, as would happen on a real account. The forex brokers reviewed on BrokersThai.com, including the ones featured on this page, offer a quality trading experience with good trading conditions, speed, and execution.

How long should I demo trade?

The length of time you should demo trade in forex depends on your trading experience, strategy complexity, and consistency of profits. As a general guideline:

- Beginners: 3-6 months

- Experienced traders: 1-3 months

- Complex Forex trading strategies: Several months to a year

Don’t start trading until you are confident in your capability as a forex trader and only trade funds you can afford to lose. Beyond practising with a demo account, other good practices include trading with low leverage, using risk management tools, and educating yourself.

What is the best demo account for trading?

A good demo account should aim to give you a realistic trading environment. Look for a demo account that simulates real market conditions, has the trading platform you wish to practice on, has access to a wide range of markets, offers real-time pricing, and has advanced features.

Pepperstone stands out as the best Forex demo account for trading due to several key factors:

- Multiple trading platforms, including MetaTrader 4, MetaTrader 5, cTrader and TradingView

- Access to a wide range of markets, such as forex, commodities, and indices

- Real-time Forex market data and pricing for a realistic trading experience

- Customizable account settings, including leverage and virtual balance

- Free educational resources and tutorials to support skill development

With its comprehensive features and commitment to providing a realistic trading environment, Pepperstone’s demo account is an excellent choice for both beginners and experienced traders looking to refine their trading strategies in a risk-free environment.

Can you use a demo account in Thailand?

Yes, you can use a demo account in Thailand. All the best Forex brokers in Thailand, including Pepperstone, offer demo accounts to traders worldwide.

Using a Forex demo account in Thailand is legal and does not violate any regulations. Demo accounts are designed for educational and practice purposes, allowing traders to familiarise themselves with the trading platform and test new strategies without risking real money.

However, when it comes to live trading, it’s necessary to choose a regulated broker that is properly regulated and complies with Thai laws. While forex trading is legal in Thailand and regulated by the Bank Of Thailand, it’s crucial to trade with a reputable broker to ensure the safety of your funds and avoid any potential legal issues.

Pepperstone, for example, is regulated by top-tier authorities such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the United Kingdom, ensuring high security and compliance for their clients, including those from Thailand.

| Broker | Regulators | Regulation For Thailand |

| Pepperstone | ASIC, FCA, BaFin, CySEC, DFSA | SCB |

| IC Markets | ASIC, CySEC | FSA-Seychelles

SCB |

| eToro | ASIC, CySEC, FCA, MFSA, ADGM, GFSC | FSA-S |

| OANDA | NFA/CFTC, MAS, CIRO, FCA, ASIC, JFSA, KNF, MFSA | FSC-BVI |

| AvaTrade | ASIC, CIRO, CySEC, ADGM, ISA, JFSA, CBI, KNF, FSCA | FSC- BVI |

| IG Group | ASIC, FCA, BaFin, FINMA, NFA/CFTC, CySEC, MAS, FMA, JFSA, DFSA, FSCA | BMA |

| Plus500 | ASIC, FCA, CySEC, FMA, MAS, DFSA, EFSRA, FSA-S, FSCA | FSA-S |

Disclaimer: The information provided here is for educational and informational purposes only and should not be considered as financial advice or a recommendation to trade. Trading involves a significant risk of loss and may not be suitable for everyone. Always do your own research and seek independent advice before making any trading decisions.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: