10 trading strategies you must explore for a stable flow of finance

An investment strategy represents a set of principles that guide investment decisions. There are different trading plans that you can follow depending on your choice, risk tolerance, access to capital, and ability to reach your long-term financial goal.

When you are trading in financial markets, you will come across popular trading options. You can find your success using one strategy to experience a stable flow of finance.

Some important factors that should be considered are your personality, the availability of resources, and your personality type. You can also use forex to recognise current patterns and identify market trends.

Identifying a successful trading strategy is one of the most important aspects of finding a trading strategy.

In this article, we will cover some of the trading options you can explore for a stable flow of finance.

How To Choose The Right Trading Strategy?

Intending to generate a return on your investment (ROI) or profit, you need to focus on reducing and slowly eliminating the losing trades and increasing the winning ones – sounds simple, doesn’t it?

Therefore, any trading strategy that will direct you toward your goal can prove to be a winning one.

Before proceeding with the trading strategies, knowing how to choose the best forex trading strategy is important.

A simple guideline can help you select the right trading strategy.

- Choose the right time frame that will suit the trading style. There is a huge difference between trading from a mini chart and a weekly chart.

- While initiating a strategy, you should know how frequently you would like to open your next position. Focus on a scalping trading strategy if you are aiming to open a higher number of positions.

- Try to choose the preferred trading strategy based on higher frames.

- Finding proper trade size requires adequate trading strategies. It is better not to risk higher time frames and larger positions.

- It is suggested that a limit is set for each trade. At times, you can set a 1% limit on their trade.

Trading Strategies Every Trader Should Explore

Here are some trading strategies that every trader should explore to maintain a stable flow of finance.

1. End-Of-Day Trading Strategy

This strategy comprises trading near the end of the market. Similarly, the end-of-the-day traders are active when it becomes clear that the cost is about to settle or close.

However, if you wish to adopt this strategy, you must study price action compared to the previous day’s price movements.

Furthermore, this style of trading would need less commitment than other trading approaches. This is because it would be less time-consuming, and you would get the chance to analyze the charts.

This would further make you speculate on how the cost could move based on price action and decide on any indicator that they are using within the system.

You can also create a set of risk management orders, which include a limit order, a take-profit order, or a stop-loss order so that it can reduce any overnight risk.

2. News Trading Approach

A new trading strategy includes trading based on the market and new expectations, both after and before news releases.

You can trade on news announcements that would require a skilled mindset, as news can travel quickly on digital platforms.

This trading option will be beneficial for you to enter and exit a trade according to how the market interprets the news and one that commonly outlines the trader’s plan.

With daily news on economic and social events, it can offer you trading opportunities. All you need to do is follow crucial information by examining and monitoring the economic calendar.

3. Day Trading Strategy

The most popular strategy amongst at-home traders is also commonly known as intraday trading, which is suitable for traders who want to trade actively in the daytime.

If you opt to be a day trader, you can take advantage of price fluctuations between the market opening and closing hours. But in this situation, you are not required to leave the position open overnight to minimise the problem of overnight market situations. If you adopt the strategy of a day trader, then follow an organised trading strategy that can instantly adapt to fast market movement.

The trading option brings no additional risk and requires no trade left open overnight.

4. Swing Trading Strategy

This term refers to conduct trading on both sides of the financial market. The strategy aims to buy a security when they suspect a rise in the market. If not, the trader can sell an asset when they suspect a price fall.

As a swing trader, you can take advantage of the market oscillation as the price swings back and forth from an oversold to an overbought state.

Thus, the swing trader is a technical approach to analyzing a market. It includes analyzing the individual movement and studying charts that comprise a bigger-picture trend.

Remember to anticipate the recent trends in the market and encounter the increasing level of supply and demand.

5. Position Trading Strategy

Position trading is a popular trading approach where the trader holds a long-term period, months, and years, ignoring the price fluctuations in favour of profits.

If you adopt the strategy of a position trader, you can use the fundamental analysis to evaluate the potential rise in price trends within the market. Similarly, consider other factors such as market trends and historical patterns.

Therefore, positioning trading allows high leverage as the possibility of a mistake is smaller than conventional trading.

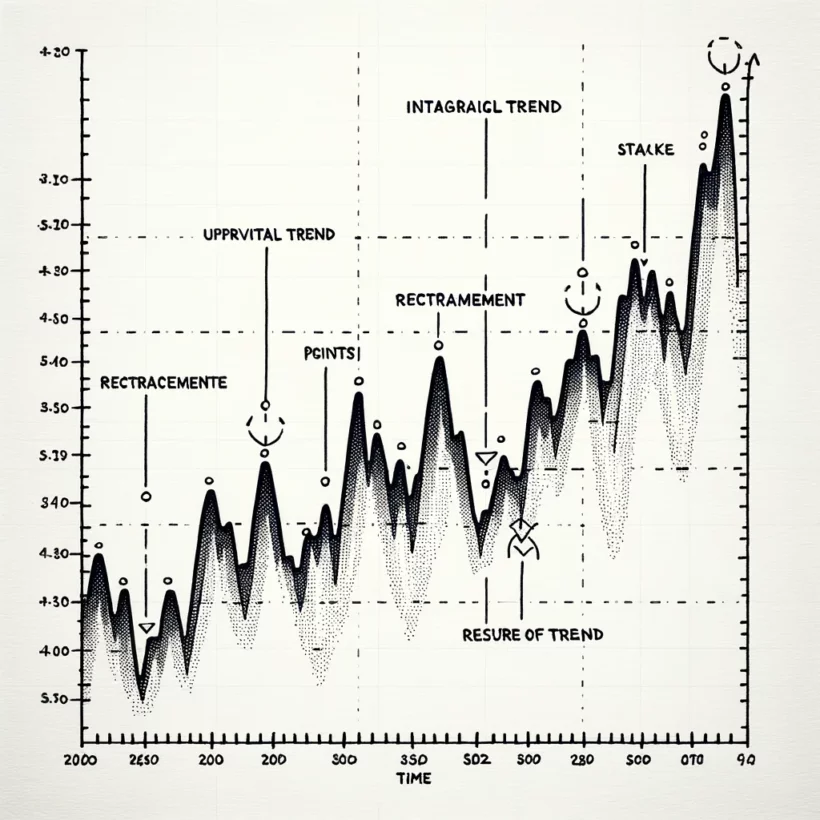

6. Trend Trading Strategy

This strategy is specified when a trader uses technical analysis to describe a trend and only trades in teh direction of the pre-determined trend.

As a trend trader, you have a fixed view of where the market should go.

Thus, remain alert and adapt as the trend can quickly change. As a trend trader, you need to be aware of the risks in the market reversal, those which can be mitigated with trailing stop-loss orders.

You would also have to exercise their patience while maintaining the recent trends. Sometimes, it might be difficult for you, but you can overcome them with discipline and confidence.

7. Scalping Trading Strategy

The traders who use the scalping strategy place short-term trade with small price alterations.

If you adopt the strategy of a scalper, you must have a disciplined exit strategy as a larger loss and can eliminate many other profits than the accumulated slow.

This trading approach technique applies to people who want to trade flexibility. On the other hand, the traders initiate several small positions with less defined criteria compared to different trading strategies.

With a clear downside to scalping, you may be unable to stay in the trade for too long. In addition, it would require a lot of attention and time, as you must analyze constantly to find new trading.

8. Algorithmic Trading Strategies

Algorithm trading is the method in which the trader uses computer programs to exit and enter trade.

The trade will set a code of conditions and rules for the computer program to act upon it. However, the strategy is also known as algo, automated, or robot trading.

Most algorithm trading tries to take advantage of small price movements in higher frequency. Many new traders are enticed to have algorithms to enter and exit trades when they are not present.

On the other hand, you can also use a stock market algorithm or investment algorithms to assist in the search for certain fundamental conductions that are a part of the trading strategies.

9. Long-Term Trading Strategies

Investment strategies and trading strategies can be similar, but one can have a major difference.

With investing strategies, you can design the investors to hold long-term positions, while trading approaches are designed to execute short-term positions.

The strategy is designed for traders so that they can invest in profitable companies and have unlimited potential. One major drawback is that the trader loses all the money if the company faces a loss.

10. Retracement Trading Strategies

Retracement trading searches for instances when the market price reserves for a short-term continuation to prevail trend.

This trading strategy can be distinguished from reversal, when the price reverses and continues in all directions, forming a new trend.

These temporary price movements can be a great entry point for traders who want to join the trend. But at the same time, they can also provide indications that they are losing momentum and will soon reverse.

Select The Right Trading Strategy

When it comes to trading strategies, all can perform well under specified market segments.

Selecting the best trading strategy is not complex; you do not have to stick with just one type. If you wish to explore the second or third type of strategy, you can easily adapt to the change.

Remember, the best traders are adaptable, and one can change their trading approaches based on opportunity.

Learning about your choice is a good idea; when you combine more than one approach, you are adaptive to each situation.

Furthermore, you should not be disheartened if you come across the initial losses on your fund. Patience will make you strive to be a successful trader and ignore the losses to grow and develop your trading skills.

Hence, when you are a successful trader, you will often track your losses and gains, which will help you remain disciplined and consistent across all trades.

Latest Thailand News

Follow The Thaiger on Google News: