Denied a visa extension in Thailand? Here’s how travel insurance can help

Turn a stressful and confusing around with the right coverage and support

Denied a visa extension in Thailand? It can be a stressful and confusing experience. Immigration rules are strict, and even a small mistake, like missing documents, overstaying a visa, or not showing enough funds, can lead to a denial. If this happens, you may need to leave the country quickly or face unexpected costs. This is where travel insurance becomes a big help. It can cover emergency expenses like last-minute flights, medical care, or travel delays, giving you support when plans suddenly change. With the right insurance, you’re not alone during this difficult time.

On this page

| Jump to Section | Description |

|---|---|

| Understanding visa extension denials | Explains the reasons for visa extension denials and the possible consequences, like fines and deportation. |

| How travel insurance can support you | Discusses how travel insurance can help cover unexpected costs like last-minute flights and emergency medical care due to visa issues. |

| Medical coverage while in transition | Details how travel insurance ensures medical coverage if you need to leave Thailand or get sick while transitioning after a visa denial. |

| Why nomads and expats trust SafetyWing | Highlights why SafetyWing is a trusted choice for digital nomads and expats, offering flexible insurance with global coverage. |

| What to do next after a denial | Steps to take after a visa extension denial, including contacting immigration and keeping your travel insurance active. |

| Planning ahead with reliable protection | Emphasises the importance of having reliable travel insurance to avoid unexpected costs and to stay protected during visa issues. |

Understanding visa extension denials

If your visa extension is denied in Thailand, it means immigration has refused your request to stay longer. This can lead to serious and quick consequences. You may have to leave the country right away or within a short grace period, if they give you one. If you don’t leave on time, you’ll be fined 500 baht per day, up to 20,000 baht. If you overstay for more than 90 days, you could face deportation and a ban from returning to Thailand for several years.

In many cases, you’ll need to leave the country and apply for a new visa from abroad. This can take time and cost money. If this happens more than once, or if you overstay too long, you might be blocklisted. This can make it hard to return to Thailand or even visit nearby countries. A visa denial is a serious reminder to follow immigration rules to avoid trouble, big fines, or future travel problems.

How travel insurance can support you

Travel insurance can help a lot if your trip is suddenly disrupted, including times when you need to leave a country quickly because of visa problems. While most insurance plans don’t cover visa denial directly, they do help with costs like last-minute flights, emergency travel, or changing your travel plans. Some policies also include trip interruption cover, which gives you money back if you have to cut your trip short. You may also get help with emergency medical transport or other urgent services while abroad.

Some travel insurance plans offer an upgrade called Cancel For Any Reason. This lets you cancel your trip before it starts and still get some of your money back, even if it’s due to visa issues. But you usually have to buy this option soon after booking your trip. Having travel insurance means you’re better prepared for the unexpected. It helps protect your money and gives you support when plans suddenly change.

Medical coverage while in transition

If your visa is denied and you need to leave Thailand quickly, medical coverage becomes very important. Travel insurance can help cover the cost of doctor visits, hospital stays, or treatment if you get sick or injured during this time. This means you can get the care you need without paying large bills out of pocket.

This is especially helpful if you don’t have access to Thailand’s public healthcare or can’t get local insurance right away. For some visas, like the Non-Immigrant O-A visa, health insurance is even required. It must cover things like Covid-19 treatment and emergency care, with coverage of at least US$100,000 (about 3 million baht).

Having proper medical coverage during this kind of travel stress gives you peace of mind. It protects your health and your wallet while you figure out your next steps.

Why nomads and expats trust SafetyWing

SafetyWing is a popular choice for digital nomads and expats because it offers flexible travel insurance that fits their lifestyle. Its monthly plans are easy to manage online and still work even if your visa changes or you move to a new country. You don’t need to buy a new policy every time you relocate. The insurance covers you in many places around the world, including Thailand.

The cost is also a big reason people choose it. Starting at about US$2 a day for the Essential plan, SafetyWing gives you solid coverage. It includes medical care, emergency evacuation, trip delays, and even pays for lost or stolen passports and visas. For people who live and work while travelling, SafetyWing is a simple and affordable way to stay protected.

Calculate your costs below!

What to do next after a denial

If your visa extension in Thailand is denied, the first thing to do is speak with immigration or a trusted visa agent. They can help you understand why it was denied and what you need to fix. Thailand doesn’t have an appeal process for visa denials, so you’ll usually need to reapply with correct and complete documents.

Make sure your travel insurance stays active during this time. It can help cover sudden costs like emergency medical care or last-minute flights if you need to leave the country quickly.

In most cases, it’s best to leave Thailand before your visa expires, then return on a new visa that suits your situation better. When you reapply, correct the problems from your last application to improve your chances. Acting quickly and staying prepared will help you avoid fines or other legal trouble.

Planning ahead with reliable protection

Having good travel insurance is one of the best ways to stay calm during visa problems. Long-term travel insurance helps cover medical emergencies, trip changes, and extra travel costs. This means you won’t be caught off guard if things suddenly don’t go as planned.

SafetyWing is a trusted option for many expats and digital nomads. It offers monthly plans you can manage online, with global coverage that includes Thailand. The plan keeps working even if your visa changes or you move to a new country.

With this kind of insurance, you get 24/7 help, medical support, and coverage for delays or changes. It gives you peace of mind, so you can focus on fixing your visa situation without worrying about extra costs or being left without help. Reliable insurance is a smart part of any long-term travel plan.

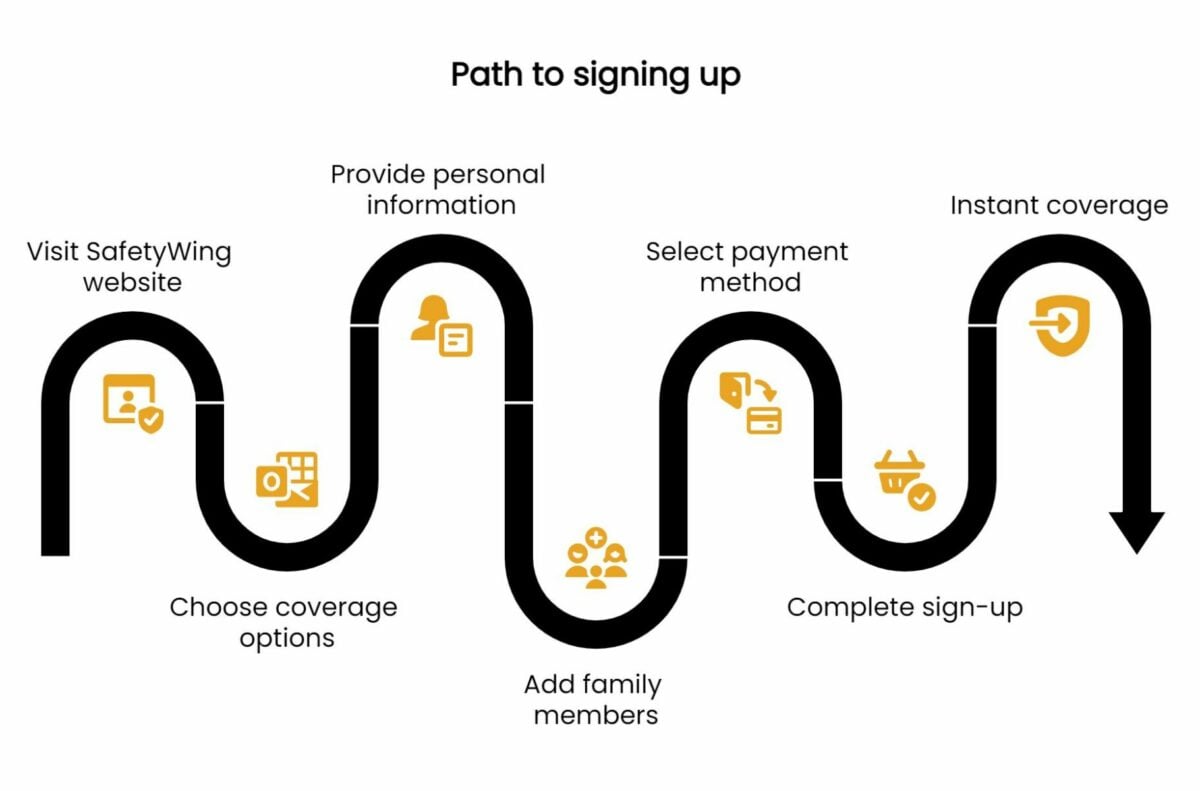

The path to signing up is easy and once you get through it, you will take away one concern that you might face.

Getting your visa extension denied in Thailand can be stressful, but travel insurance can really help. Many people face problems like missing papers, overstaying, or not showing enough money. If this happens, travel insurance can cover emergency costs like last-minute flights, medical bills, or trip changes. It also gives you medical support if you get sick or hurt during this time. SafetyWing is a popular choice because it offers flexible monthly plans, covers you in many countries, including Thailand, and is easy to manage online. Staying insured gives you peace of mind and helps you handle sudden changes without big costs. If you’re not sure which insurance is right for you, check out this guide on travel insurance vs digital nomad insurance.

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: