Why retirees in Thailand are choosing long-term health insurance over quick fixes

And how it will benefit you better than choosing a shorter-term solution

The Thaiger key takeaways

- Short-term health plans leave retirees exposed to high costs and limited coverage.

- Long-term health insurance offers financial stability, full medical access, and peace of mind.

- Cigna’s flexible, expat-focused plans make retirement in Thailand safer and stress-free.

Retirees in Thailand are increasingly seeing the importance of health insurance in protecting their well-being during retirement. With insurance requirements for retirement visas and rising healthcare costs, many are moving away from short-term plans and choosing long-term coverage. Long-term health insurance gives retirees peace of mind by covering age-related health issues, providing access to quality care, protecting them from expensive emergencies, and ensuring a stable and stress-free retirement in Thailand.

On this page

| Jump to Section | Description |

|---|---|

| The drawbacks of quick-fix health insurance plans | Short-term health insurance plans have limited coverage, high out-of-pocket costs, and no support for ongoing healthcare needs. |

| Benefits of long-term health insurance | Long-term health insurance provides comprehensive coverage, access to top hospitals, and support for chronic conditions, offering financial stability. |

| Why Cigna health insurance is a smart choice for retirees in Thailand | Cigna’s flexible, expatriate-tailored health insurance plans offer access to quality care, 24/7 support, and meet the needs of retirees in Thailand. |

The drawbacks of quick-fix health insurance plans

Short-term health insurance plans are often chosen by retirees because they are cheaper and easier to get. However, these plans have several significant drawbacks.

- Limited coverage for medical services: Quick-fix health insurance plans usually offer limited coverage. This can make it difficult to access important medical services like specialist consultations, advanced tests, or hospital stays. Retirees may face high costs for treatments that are not covered, leading to unexpected bills.

- Higher out-of-pocket costs: Because short-term plans cover fewer services, retirees are often stuck with high out-of-pocket expenses for treatments that aren’t included in the plan. These costs can add up quickly, putting financial pressure on retirees living on a fixed income.

- Lack of long-term support for ongoing healthcare needs: Short-term plans also don’t support ongoing health conditions like diabetes, hypertension, or arthritis. Without the right coverage, managing these conditions becomes difficult, as treatments and medications may not be covered. This can lead to health issues becoming worse and harder to manage.

- Exposure to financial risks: Relying on quick-fix health insurance exposes retirees to serious financial risks. If a major illness or emergency occurs, the limited coverage can leave retirees with large medical bills. This uncertainty takes away the peace of mind that retirees need for a comfortable, stress-free retirement.

Benefits of long-term health insurance

Long-term health insurance plans offer retirees in Thailand the coverage they need to ensure a worry-free retirement. Here’s why these plans are a better choice:

- Comprehensive coverage for both outpatient and inpatient care: Long-term health insurance covers both outpatient and inpatient care. This means retirees can access a wide range of medical services, including doctor visits, hospital stays, specialist consultations, and tests, without worrying about gaps in their coverage or high out-of-pocket costs.

- Access to a wide range of medical services and hospitals: Retirees with long-term health insurance can choose from many top hospitals and clinics across Thailand. With access to high-quality care, they can get the treatment they need without the financial strain that comes from having to pay for services upfront.

- Ongoing support for chronic conditions, preventive care, and emergencies: Long-term health insurance plans provide support for ongoing health needs. Retirees with conditions like diabetes, hypertension, or arthritis can receive regular check-ups and continuous care. These plans also cover preventive care and emergency treatments, helping retirees stay healthy and manage sudden health issues.

- Financial stability and security: Long-term health insurance offers financial security by covering major medical expenses. Retirees won’t be surprised by high medical bills, and many plans meet the requirements for Thailand’s retirement visa. This gives peace of mind, knowing both health and legal needs are covered.

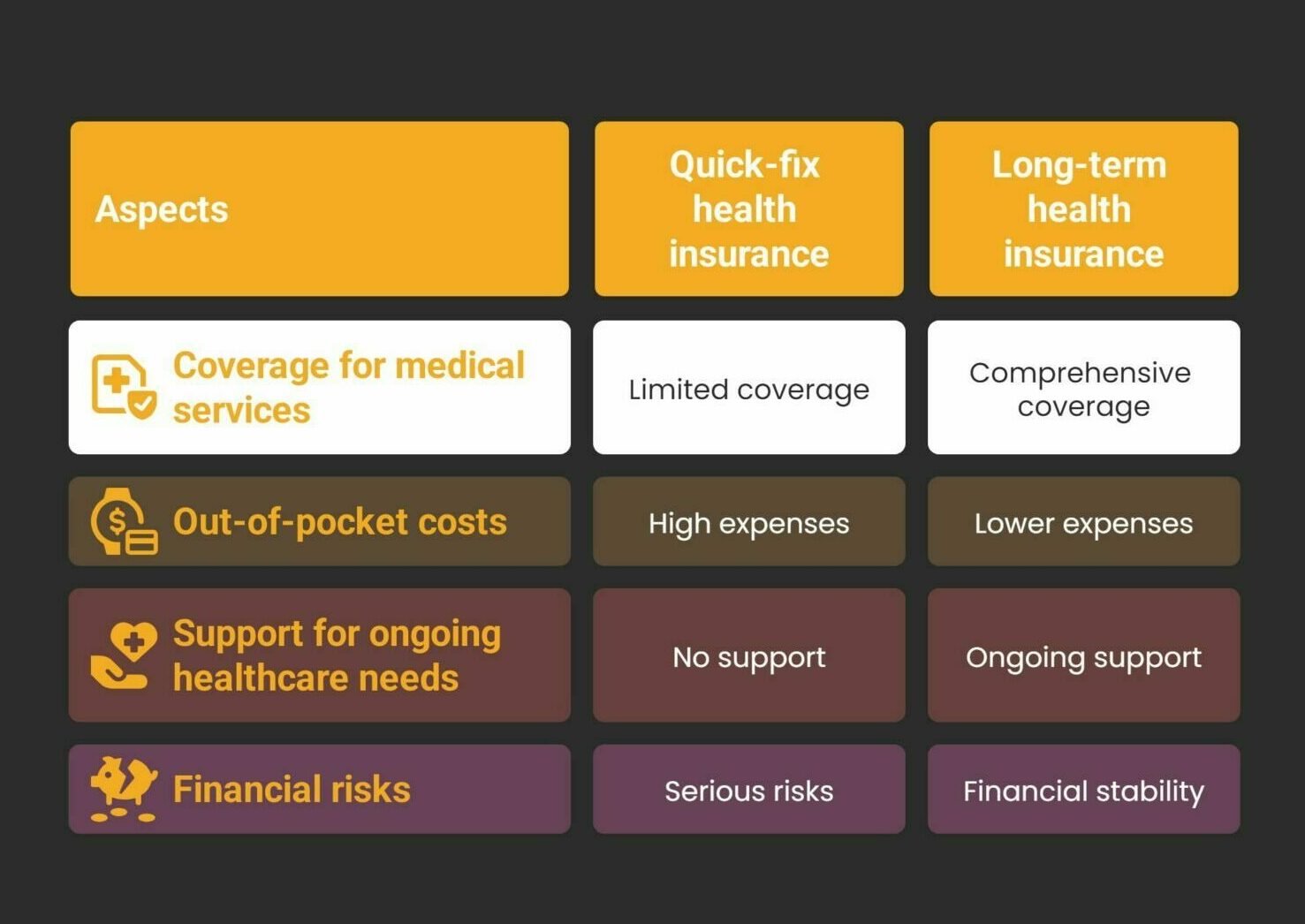

| Aspect | Quick-fix health insurance | Long-term health insurance |

| Coverage for Medical Services | Limited coverage, difficulty accessing specialist consultations, advanced tests, and hospital stays. | Comprehensive coverage for outpatient and inpatient care, including specialist consultations, hospital stays, and tests. |

| Out-of-Pocket Costs | High out-of-pocket expenses for treatments not covered by the plan. | Lower out-of-pocket costs, as long-term insurance covers a wide range of services. |

| Support for Ongoing Healthcare Needs | No support for chronic conditions like diabetes, hypertension, or arthritis. | Ongoing support for chronic conditions, preventive care, and emergencies. |

| Financial Risks | Exposes retirees to serious financial risks, especially in the event of a major illness or emergency. | Provides financial stability and security by covering major medical expenses and meeting retirement visa requirements. |

Why Cigna health insurance is a smart choice for retirees in Thailand

Cigna offers health insurance plans specifically designed for retirees in Thailand. These long-term plans are made to meet the needs of expatriates, providing reliable coverage for a secure retirement.

- Flexible coverage options designed for expatriates: Cigna’s plans are flexible and can be customised to suit the unique needs and budgets of retirees. This allows expatriates to choose the coverage that fits their lifestyle, giving them peace of mind throughout their retirement years.

- Access to top medical facilities and international healthcare standards: Cigna provides retirees with access to some of Thailand’s best hospitals, such as Bumrungrad and Bangkok Hospital, which meet international healthcare standards. With this level of care, retirees can be confident that they will receive quality treatment when needed.

- Round-the-clock support, ensuring retirees have coverage when needed: Cigna offers 24/7 customer support, including telemedicine services, ensuring that retirees can get assistance whenever they need it. Whether it’s a question or an emergency, Cigna’s support is always available to help retirees navigate their healthcare needs.

Retirees in Thailand are increasingly opting for long-term health insurance instead of short-term plans to ensure better coverage and financial security. Short-term plans offer limited coverage, high out-of-pocket costs, and no support for chronic conditions, which can lead to unexpected medical bills.

In contrast, long-term health insurance provides comprehensive coverage for both outpatient and inpatient care, access to top hospitals, and support for ongoing health needs, preventive care, and emergencies. Cigna offers flexible plans tailored for retirees, providing access to quality care and 24/7 support, making it a smart choice for retirees. For more details on Thai health insurance costs, read this article: How much is Thai health insurance?

Sponsored

Latest Thailand News

Follow The Thaiger on Google News: