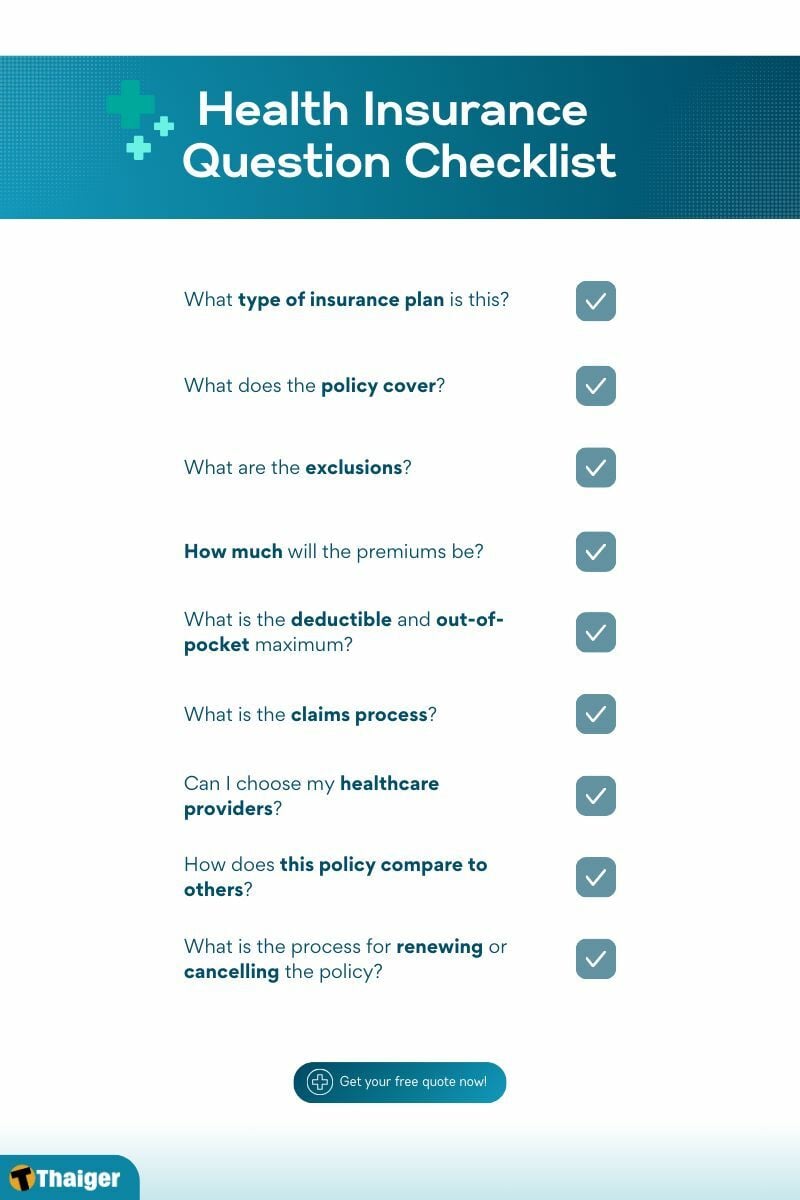

10 questions to ask an insurance provider when purchasing an insurance policy

When you’re buying insurance coverage, it’s important to ask questions that can give you a better understanding of what the policy offers you regarding protection and benefits. Here are ten specific questions to think about so you can make a well-informed choice that fits your requirements:

1. What type of insurance plan is this?

Knowing the kind of insurance is really important, whether it’s health insurance, life insurance, motor insurance, or property insurance. Each type comes with its advantages and restrictions, which must be considered carefully before making a decision. For instance, in the case of health insurance, it’s key to figure out whether it’s an HMO plan, a PPO plan, or an EPO plan, as this can give you insight into how many choices you have when it comes to picking your healthcare provider.

- HMO

Health Maintenance Organisation Plans that typically have lower monthly premiums than PPO or EPO plans, but higher deductibles. HMOs usually have a local network of doctors and hospitals, and you must choose a primary care provider (PCP).

- PPO

Preferred Provider Organisation Plans that offer a larger network of doctors and hospitals to choose from, and generally have higher monthly premiums than HMOs. PPOs don’t require you to choose a PCP, but it’s recommended.

- EPOExclusive Provider Organisation Plans that combine features of HMOs and PPOs. EPOs offer a local network of doctors and hospitals, but networks are generally larger than HMO networks. EPOs are usually more pocket-friendly than a PPO plan.

2. What kind of life insurance policy should I get?

When selecting a life insurance policy, consider term life insurance, which provides coverage for a specific period and is often more affordable, whole life insurance, which offers lifelong coverage and includes a cash value component, or universal life insurance, which provides flexibility in premium payments and death benefits. Evaluate your long-term financial goals and family needs to choose the best policy type.

When selecting a life insurance policy, consider the following options:

- Term life insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years) and is often more affordable. It pays a death benefit only if the insured passes away during the term.

- Whole life insurance: Offers lifelong coverage and includes a cash value component that grows over time. Premiums are generally higher, but the policy guarantees a death benefit and builds cash value.

- Universal life insurance: Provides flexibility in premium payments and death benefits. It also accumulates cash value based on current interest rates.

Evaluating your long-term financial goals, family needs, and budget will help you choose the best policy type.

3. What does the policy cover?

Consider delving deeper into the policy’s scope with specific terms. For instance, if you are considering Cigna Health Insurance, enquire about whether essential services like hospitalisation, preventive care, prescription drugs, mental health services, and visits to specialists are covered. This will help you determine whether the policy you are being offered is suitable for your healthcare needs.

4. What are the exclusions?

It is a businessman’s practice to theorise that no policy is complete without exclusions. These are conditions under which a provision will not apply. It is necessary to understand these exclusions so that you don’t incur additional unnecessary expenses when looking for that care. Request an extensive list of exclusion clauses and seek clarifications on vague ones. That way, you will know in detail what out-of-pocket costs you may expect.

5. How much will the premiums be?

Clarify the monthly or annual premium costs and whether they are fixed or subject to change. Additionally, ask about any potential discounts for bundling policies or maintaining a healthy lifestyle. Understanding the financial commitment helps you budget effectively and avoid surprises.

It’s also important to ask how premiums may change over time, especially as you age or if your health status changes.

6. What is the deductible and out-of-pocket maximum?

Ask how much the deductible is and the amount you must reach for out-of-pocket costs before the insurance company pays for most of the expenses. This is the ceiling of the amount you are to spend on your policy in one year in most cases. These figures are helpful in knowing your likely financial exposure and making preparations for any unplanned medical costs.

7. What is the claims process?

Knowing how to submit a claim is important for an experience when you have to utilise your insurance coverage. Questions about the procedures required for filing a claim and the necessary paperwork can make the process smoother. Make sure to ask about any waiting periods tied to the policy to prevent any delays in getting the care you need. Having a defined claims procedure can greatly decrease tension during times of hardship.

8. Can I choose my healthcare providers?

When selecting a health plan and you have doctors or hospitals you prefer to use for your medical needs, it’s important to check if they are part of the network covered by your chosen insurance provider. Enquire about the provider network. Whether there are any referrals needed for specialists. Try a free quote and get a special 10% off now!

- Valid until the end of September

- A 10% discount offer will be sent to your email by an agent after filling out the form

9. How does this policy compare to others?

Don’t hesitate to ask how this policy stacks up against similar offerings from other insurers. Inquire about coverage limits, premium costs, and additional benefits. This information will provide you with a broader perspective on whether you are getting a competitive deal. Comparing policies can help you find the best option for your unique needs.

10. What is the process for renewing or cancelling the policy?

Understanding the terms for renewal and cancellation is vital for long-term planning. Ask about the renewal process, any potential changes in premiums, and what happens if you decide to cancel the policy. Knowing your options will empower you to make informed choices in the future and avoid potential pitfalls.

With these questions, you can take advantage of the difficulties presented by the insurance policies. This technique gives you the capacity to not only make wise choices but also provides an opportunity to pick a plan that prevents any adverse effects on your health and finances.

Advantages of Cigna provider compared to others

Choosing the right insurance provider is crucial for your healthcare experience and financial well-being. Here are five important reasons why selecting Cigna as your insurance policy provider is a wise choice:

1. Comprehensive coverage options

Cigna offers a wide range of insurance plans, including health, dental, and life insurance, tailored to meet diverse needs. With various types of health insurance plans such as HMO, PPO, and EPO, you can choose the best fit for your lifestyle and healthcare preferences, ensuring that you find a plan that aligns with your specific requirements.

2. Affordability and cost-saving features

Cigna provides affordable healthcare options, including plans featuring $0 deductibles and $0 copays for preventive care. Many generic prescription drugs are available at no cost, allowing you to access essential services like annual check-ups and routine screenings without worrying about out-of-pocket expenses. This makes healthcare more accessible and manageable financially.

3. 24/7 customer support

Cigna offers round-the-clock customer service, ensuring that you can get assistance whenever you need it. Whether you have questions about your plan, need help with claims, or require support in a different language, Cigna’s customer service team is available 24/7 to assist you. This commitment to customer support enhances your overall experience and provides peace of mind.

4. Robust preventive care services

Cigna emphasises preventive care by offering services such as annual check-ups, routine health screenings, and vaccinations at no cost. This proactive approach helps you maintain your health and catch potential issues early, leading to better health outcomes and lower overall healthcare costs.

5. Global network of providers

With access to a vast network of over 1.65 million healthcare providers, Cigna ensures that you can find quality care wherever you are. This extensive network includes hospitals, doctors, and specialists, making it easier for you to receive care without worrying about out-of-network costs. This flexibility is particularly beneficial for those who travel frequently or live in different locations.

In summary, choosing Cigna as your insurance policy provider offers comprehensive coverage options, affordability, 24/7 customer support, robust preventive care services, and access to a global network of providers, making it a wise choice for your insurance needs.

- Valid until the end of September

- A 10% discount offer will be sent to your email by an agent after filling out the form

Latest Thailand News

Follow The Thaiger on Google News: