US House passes bill to suspend US$31.4tn debt ceiling, averts default

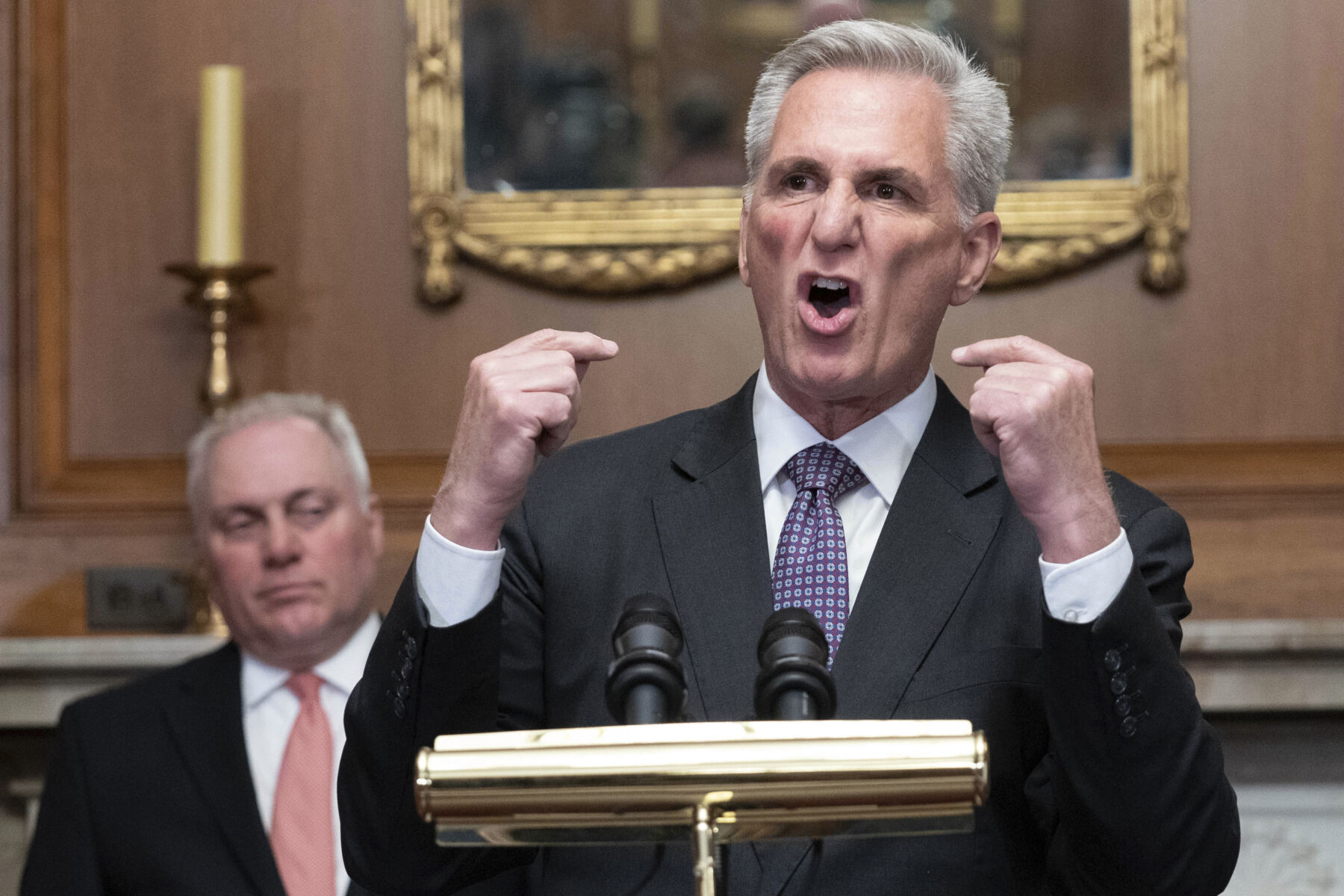

The US House of Representatives has passed a bill to suspend the US$31.4 trillion debt ceiling, with both Democrats and Republicans supporting the measure to avoid a catastrophic default. The legislation now moves to the Senate, which must enact it and get it to President Joe Biden‘s desk before the government runs out of funds to pay its bills. The bill is a compromise between Biden and House Speaker Kevin McCarthy and has faced opposition from 71 hardline Republicans. However, 165 Democrats supported the measure, ensuring its passage.

The legislation temporarily removes the federal government’s borrowing limit until January 1, 2025, allowing Biden and Congress to set aside the politically risky issue until after the November 2024 presidential election. It also caps some government spending over the next two years, speeds up the permitting process for some energy projects, claws back unused COVID-19 funds, and expands work requirements for food aid programs to additional recipients.

“At best, we have a two-year spending freeze that’s full of loopholes and gimmicks,” said Representative Chip Roy, a prominent member of the hardline House Freedom Caucus.

Progressive Democrats and Biden, who had resisted negotiating over the debt ceiling, also oppose the bill for various reasons, including new work requirements for some federal anti-poverty programs.

“Republicans are forcing us to decide which vulnerable Americans get to eat or they’ll throw us into default. It’s just plain wrong,” said Democratic Representative Jim McGovern yesterday.

The non-partisan Congressional Budget Office stated late on Tuesday that the legislation would result in US$1.5 trillion in savings over a decade. This is below the US$4.8 trillion in savings that Republicans aimed for in a bill they passed through the House in April and also below the US$3 trillion in a deficit that Biden’s proposed budget would have reduced over that time through new taxes.

In the Senate, leaders of both parties hope to enact the legislation before the weekend. However, a potential delay over amendment votes could complicate matters. Senate Majority Leader Chuck Schumer and Senate Minority Leader Mitch McConnell may need to allow votes on Republican amendments to ensure quick action.

“We cannot send anything back to the House, plain and simple. We must avoid default,” Schumer told reporters on Wednesday.

Senate debate and voting could stretch into the weekend, particularly if any one of the 100 senators tries to slow passage. Hardline Republican Senator Rand Paul has said he would not hold up passage if allowed to offer an amendment for a floor vote.

Senator Bernie Sanders, a progressive independent who caucuses with the Democrats, stated that he would vote against the bill due to the inclusion of an energy pipeline and extra work requirements. “I cannot, in good conscience, vote for the debt ceiling deal,” Sanders said on Twitter.

The bill would shift some funding away from the Internal Revenue Service, which is seen as a win for Republicans. However, the White House says that should not undercut tax enforcement. Biden can also point to gains, as the deal leaves his signature infrastructure and green-energy laws largely intact, and the spending cuts and work requirements are far less than Republicans had sought.

Republicans have argued that steep spending cuts are necessary to curb the growth of the national debt, which at US$31.4 trillion is roughly equal to the annual output of the economy. The deal would not do anything to rein in fast-growing programs such as health and retirement costs, which are projected to consume an increasing share of the budget, according to government forecasts.

The debt-ceiling standoff has prompted rating agencies to warn that they might downgrade US debt, which underpins the global financial system. Credit rating agency DBRS Morningstar put the US on review for a possible downgrade last week, echoing similar warnings by Fitch, Moody’s and Scope Ratings. Another agency, S&P Global, downgraded US debt following a similar debt-ceiling standoff in 2011.

Latest Thailand News

Follow The Thaiger on Google News: