Thailand eyes foreign bonds to set private sector rates

Thailand’s Ministry of Finance is poised to issue foreign currency bonds for the first time in 20 years, a move that is not aimed at fundraising but at establishing a benchmark interest rate for the private sector. The announcement was made by Julapun Amornvivat, Deputy Minister of Finance, who stated that the Public Debt Management Office (PDMO) has been tasked with considering the issuance of bonds in various foreign currencies.

The potential issuance of foreign currency bonds, including Samurai bonds, yuan-denominated bonds, and dollar bonds, garnered interest from Hong Kong, a financial market known for its robustness. However, the details and benefits of such a move for Thailand need to be carefully evaluated for their value and how they would simplify processes, Julapun said.

“There is an opportunity to discuss the matter in Hong Kong. Hong Kong expressed interest in Thailand’s foreign currency bond issuance because they have a strong financial market and confirmed their readiness to support us in this matter. However, Thailand must consider the appropriateness and benefits to the country. This is a question we need to examine before discussing it further.”

Additionally, in March 2024, the Finance Ministry plans to release savings bonds worth approximately 40 billion baht as part of the fiscal year 2024’s budget. This initiative is partly to replace existing bonds and to support the financial management of the public sector, offering a variety of government fundraising tools to different investor groups and encouraging savings among the public. The ministry aims to raise approximately 100 billion baht through savings bonds during the fiscal year.

The deputy minister noted that the consideration of issuing foreign currency bonds revealed that not all foreign interest rates are higher than those in Thailand. For example, Japan’s rates are lower, and the dollar’s rates are higher, while the yuan’s are comparable.

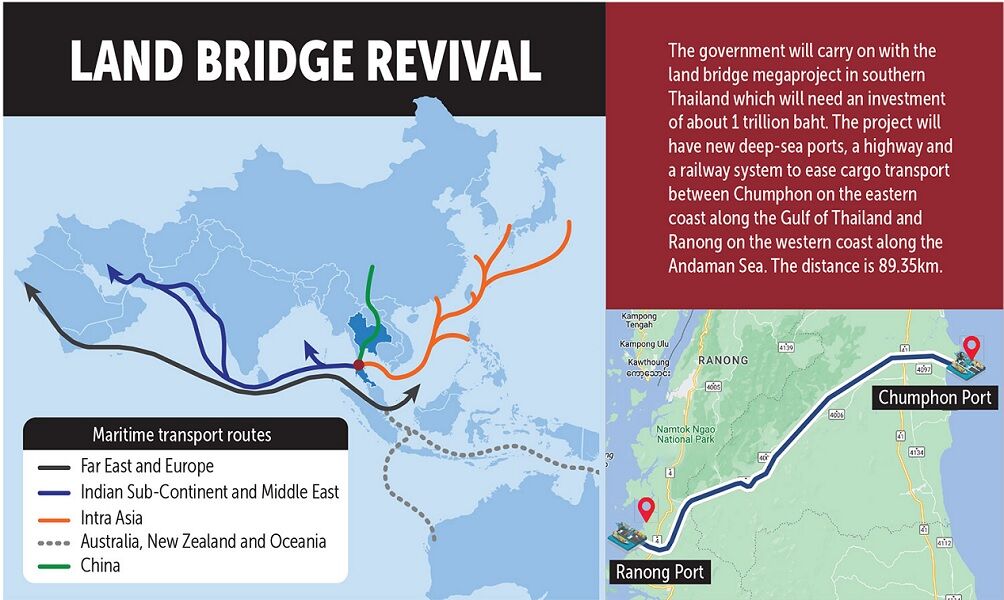

The objective of issuing foreign bonds is not about diversifying risks but rather finding lower costs and establishing a benchmark interest rate for the private sector. Projects that would support the fundraising must generate foreign revenue as required by law. The Landbridge project fits this criterion, but it is not expected to commence within the current year, reported KhaoSod.

Latest Thailand News

Follow The Thaiger on Google News: