Phuket Gazette Business: US tax regime to scrutinize taxpayer bank accounts

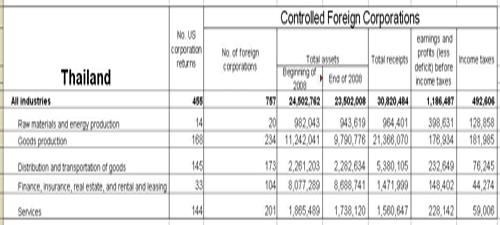

PHUKET: In light of the ‘federal fiscal fiasco’ in Washington DC – to the tune of nearly 17 trillion dollars – the American government is looking to expand its worldwide tax base.

As such, US citizens and green card holders conducting, contracting or controlling business operations in or from countries outside the US, including Thailand, need to ensure consistency and transparency when complying with the latest reporting requirements.

“They’re [the US Internal Revenue Service (IRS)] going after undisclosed, offshore bank and securities accounts,” says John Andes, a US CPA and Thai-American partner with the Bangkok-based accounting firm KMPG Phoomchai Tax Ltd.

Speaking at a US tax update seminar sponsored by Phuket Chapter of the American Chamber of Commerce (AMCHAM) at the Holiday Inn, Patong on March 8, Mr Andes reiterated that all American citizens, regardless of their domicile or residency status, are required to file US income tax returns, report worldwide income and disclose certain information about foreign investments annually.

In addition to increased scrutiny by the IRS for individual income reporting, the Department of Treasury is also putting the onus on foreign banks to disclose certain information about non-US financial accounts held by Americans.

“More stringent reporting requirements and enforcement by the IRS came about after the IRS discovered large sums of unreported money by US account holders in Swiss bank accounts,” explains John.

In last week’s “You can run, but you can’t hide” article, Mr Andes identified two primary options for Americans residing overseas to consider when trying to reduce their US tax obligations – electing a Foreign Earned Income (FEI) exclusion, and claiming a foreign tax credit.

In addition to filing taxes with the IRS, US citizens and resident aliens with financial assets outside of the US and its territories, may also need to file the Foreign Bank Account Reporting (FBAR), using form TD F 90-22.1.

This form must be received by the US Department of Treasury no later than June 30, and there are no extensions possible.

“The FBAR is required for US citizens or resident aliens who had a financing interest over one or more foreign bank and financial accounts, in aggregate, amounting to or more than US$10,000 at any time during the year.”

Mr Andes explained that “having a financing interest in an account” means that the US citizen (or resident alien) was the owner, individual or jointly, or simply had signatory authority over the account, even if he did not control or own the respective funds.

Reportable accounts include bank accounts, insurance policies with a cash surrender value, securities, securities derivatives, or other financial instrument and mutual fund accounts.

Meanwhile, bonds, notes and stock certificates held directly by the person are not FBAR reportable.

The IRS is increasing enforcement of this reporting requirement.

“There are significant civil penalties imposed if it is determined that there was willful failure to file. These can be up to $100,000 or 50% of the aggregate balance in accounts.”

“There are also potential criminal penalties, which can amount to $500,000 and/or five years of jail time.”

US taxpayers who are living abroad on the general tax filing deadline of April 15 get an automatic extension of two months to file.

The taxpayer can file for an additional four month extension (total six months, or by October), using form 4868.

If, however, the taxpayer has an amount owing to the IRS, he must pay that amount by April 15. The extension is only an extension to file, not to pay.

Next week, we’ll conclude with advice and updates about foreign assets and investments.

— Steven Layne

Latest Thailand News

Follow The Thaiger on Google News: