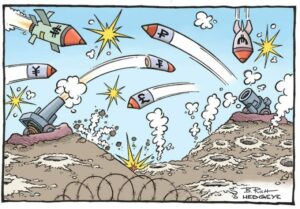

Currencies and stock exchanges flutter as the dust settles on the latest threats in the US-China trade spat

Central banks in India, Thailand and New Zealand cut interest rates this week in an attempt to fend off any harm from the spiralling US-China trade war.

The escalation of the trade war, sparked by fresh US tariff threats by US President Trump over the weekend, is seen as the reason for the policy shift.

On Monday, the People’s Bank of China claimed the slump in the yuan was driven by “unilateralism and trade protectionism measures and the imposition of tariff increases on China”. Aka. US-China trade war.

Worries that Australia may be the next to act led investors to send the Australian dollar to its lowest level against the US dollar in a decade. Australia’s central bank held its key policy rate at its current record low on Tuesday following two consecutive cuts, but suggests more easing measures might be needed amid the country’s slowing economy.

The unexpected moves by the three countries jolted global markets. On Wall Street, the S&P 500 closed flat after an early dive of 2%. Stock exchanges have been unsettled since Monday, when China let its currency weaken to the lowest point in more than a decade.

Yesterday, the Bank of Thailand’s Monetary Policy Committee made a surprise decision to cut the policy interest rate amid pressure to avert an economic slowdown and hedge the heightened trade war between the US and China. The MPC cut the interest rate by only 25 basis points to 1.5 %. Of the seven-member committee, five voted for the cut while two voted to maintain the rate at 1.75%.

The British pound was steady against the Thai baht yesterday following two weeks of dropping value against the strong Thai currency.

Latest Thailand News

Follow The Thaiger on Google News: