Koh Samui: The secret island gem of Southeast Asia’s hospitality scene

Over the past week, we have been compiling our latest hospitality, tourism, and hotel research on Thailand’s second-largest island, Koh Samui. The island remains a bit of a ‘little-big’ anomaly in Southeast Asia’s massive resort island arsenal. Despite hosting famed global hotel brands such as Four Seasons, Ritz-Carlton, W, InterContinental, and Banyan Tree, its smallish private airport capacity has somehow created a natural barrier to mass tourism in the development-crazed last 25 years.

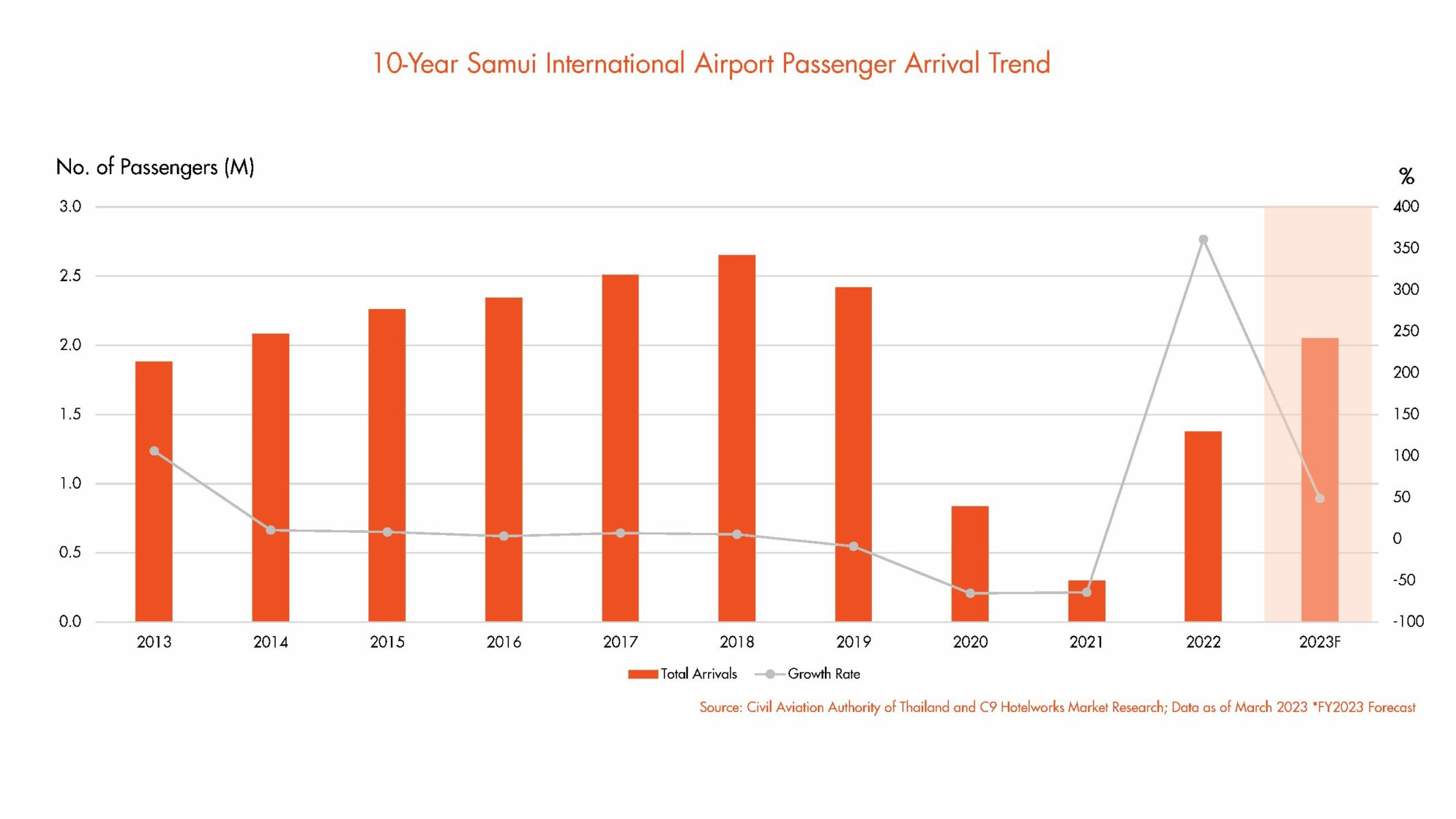

Looking at the tourism recovery trajectory in our newly released Samui Hotel Market Update 2023, the best word I could use for growth was the impish term ‘moderate.’ No, the island has not broken into a full sweat, but looking at the mounting hotel room night demand in Q4 of last year and into the first quarter of 2023, there are positive signs of momentum.

Looking at the tourism recovery trajectory in our newly released Samui Hotel Market Update 2023, the best word I could use for growth was the impish term ‘moderate.’ No, the island has not broken into a full sweat, but looking at the mounting hotel room night demand in Q4 of last year and into the first quarter of 2023, there are positive signs of momentum.

One of the most important pieces of recovery news is the re-starting of direct flights between Hong Kong and Koh Samui by Bangkok Airways starting the 1st of July. Three weekly flights are set, using an Airbus A319 aircraft. Mainland China flights are also on the books for May which is another strong positive. And for hotels, room night demand has been rising at a great pace this year.

But, this is the conundrum, the destination has limited low-cost airline access, with limited numbers coming from the mainland’s Surat Thani airport and then taking a ferry. While other Thai resort destinations such as Phuket and Pattaya hotels have been on a sharp incline upward, Koh Samui’s return to normal continues to be slower and at a more protracted pace

But my point here is, maybe that’s okay. As fast-growing resort islands across Asia grapple with high population growth, traffic woes, and broken infrastructure, perhaps Koh Samui’s airport-imposed limitation is not entirely a bad thing. Smaller can often be better and chasing the endless tail of growth is not the right recipe for every destination.

One of the niche tourism segments that the island has maintained over the years is wellness. The Kamalaya Wellness Sanctuary and Holistic Spa remain one of Asia’s best-in-class offerings. Rumoured to be expanding their current operation with additional land, we can’t wait to see what’s in store next for this icon.

Another health and wellness product, Vikasa attracts a global audience with its yoga training and in-house programs. They have been successful enough to tap into investment from the Alta Capital private equity group and are in the process of expanding to other regional markets.

The bottom line for health, wellness, and fitness travel is how sustainable the marketplace is given a high return guest profile, exceptional in-house spending at a time when hotels are losing traffic to outside restaurants, and most importantly a longer average length of stay. Why the latter is important for smaller destinations where typical regional tourists may spend 2-3 nights on a short break at the beach, while program-driven travellers may stay 5-7 nights, hence requiring less flight frequency.

Moving off of Koh Samui, Koh Pha-ngan which is famed for its epic Full Moon Party, has continued to attract more spiritual-oriented travellers, looking for meditation, spiritual connections, healthy eating, and a like-minded social scene. Again, this is a very specific demographic, but not every destination has to cover tourism in an A-Z travellers cookbook.

As for the idea of how to battle a surge in resort island urbanization that has plagued mass-market destinations such as Bali, Phuket, and Boracay, there is a lot to be said for sharing the business with other nearby locations. Take the Surat Thani mainland and Nakhon Si Thammarat with stunning white sand tropical beaches in Sichon and Khanom and other coastal areas. Plus, there are two large-scale airports in both of these provinces that have growth capacity and offer access to larger jet aircraft.

Real estate in Koh Samui at the higher pricing points is mainly villas and the island has seen two decades of growth with an impressive array of products. Villa rentals continue to attract the luxury market and create an attractive alternative to hotels. One trend in other Thai leisure destinations that the island has avoided is a build-up of midrise condominium hotels (often referred to as condotels), with the local government pushing back on these types of developments. Often relegated to low-rate mass travel and many times unlicensed, their absence is not altogether unwelcomed.

But many island businesses are of the opinion that the failure to expand the existing airport and the lack of a new site with a longer runway remains a blight on the economy. Late last year the Expressway Authority of Thailand (Expat) announced plans for a feasibility study to link Koh Samui and the mainland, via Khanom in Nakhon Si Thammarat. Whether the island needs a bridge or not, many think the money would be better spent in rehabilitating the existing ageing infrastructure.

At the end of the day, the old adage ‘Be careful what you wish for, as someday it may come true”, is a telling comment, and in Koh Samui’s case, staying small might be but the best wish of all.

Latest Thailand News

Follow The Thaiger on Google News: