Banks get tough on loan criteria as economic effects of Covid-19 worsen

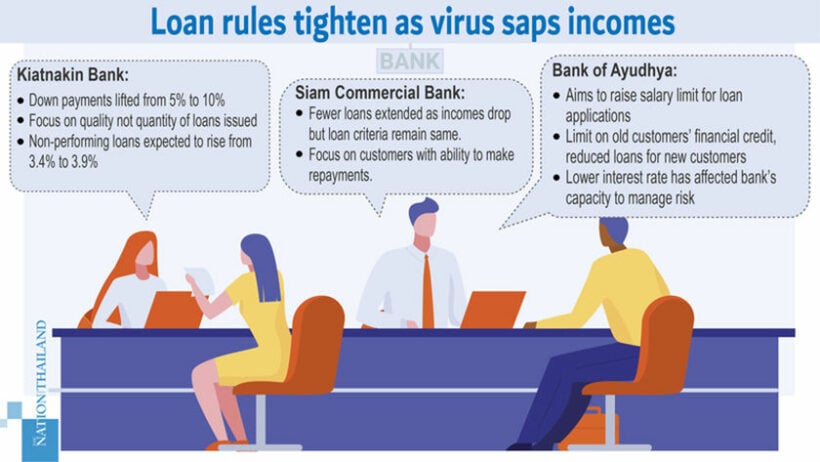

The Covid-19 crisis has had a devastating effect on the global economy and, while it may have been successful in suppressing the virus, Thailand is in no way immune to the economic fallout. A report in Nation Thailand today says the country’s banks are now clamping down on their lending, imposing stricter criteria on borrowing.

PHOTO: Nation Thailand

The Bank of Ayudhya is taking a tougher stance on lending to both old and new customers. New limits are being imposed on extending credit to old customers, while new ones will find it significantly harder to get a loan.

While customers of Krungsri Consumer can currently take out a loan if they earn at least 12,000 baht a month, or obtain a credit card if they make 15,000 baht a month, the bank says it’s considering raising that minimum to 20,000 baht.

Meanwhile, Kiatnakin Bank says its lending is based on customers’ ability to meet repayments, adding that conditions attached to loans are now stricter. As an example, the down payment required for a car loan is now 10%, up from 5%, with potential borrowers facing much tighter scrutiny. Freelance workers can no longer avail of loans from the bank, but the lending conditions for salaried employees remain unchanged.

Apiphan Charoenanusorn, president of Siam Commercial Bank, says the lender is now more wary of handing out loans to those who cannot offer any collateral as a guarantee. She says while the bank’s lending criteria remains unchanged, fewer applications are receiving a positive response as people’s incomes drop as a result of the Covid crisis.

SOURCE: Nation Thailand

Latest Thailand News

Follow The Thaiger on Google News: