Upcoming trends for trading in 2024

2024 is poised to be a game-changing year for the FX and CFD markets. With the integration of AI technologies and a growing emphasis on mobile trading, industries are adapting to keep pace with global shifts. Here are the top 5 upcoming trends for trading in 2024.

1. Artificial Intelligence will remain at the forefront

With the continuous advancement of artificial intelligence (AI), there’s a possibility that it might play a significant role in trading this year. AI, particularly generative AI, may help you do market research as it can sift through masses of data using simple language commands. This means you no longer need complex search tools with too many filters to get market data and make informed decisions. Additionally, AI may minimise human errors and increase the accuracy of trades.

Building on the capabilities of AI, machine learning (ML) may further improve the trading process, especially in algorithmic trading. While AI simplifies market research for traders, ML offers the ability to analyse large datasets and identify intricate patterns at incredible speeds. Consider a scenario where a stock trader needs to examine years of historical price data in search of trends and patterns. Machine Learning can rapidly process this information, revealing recurring behaviours and offering insights into potential future price movements. Thus, helping algorithm traders make well-informed decisions in real time.

2. Copy trading is gaining popularity

Copy trading is becoming more and more popular because it’s accessible and easy to use. Plus, it offers the potential for improved investment performance. It has evolved from the early days of social trading, where people would browse online forums for ideas and tips to improve their trading strategies. Today, it has transformed into a more sophisticated and automated process.

So, what is copy trading? Copy trading is an investment strategy where you replicate the trades of experienced traders in real time to potentially make money. It allows you to benefit from the expertise of others without requiring advanced financial knowledge. By finding a successful trader and mimicking their trades, you can profit without having to make decisions independently for each trade. Despite following someone else’s moves, you still have control over your investment portfolio and can manage it as needed.

Although copy trading may seem easy, you need to remember that it’s not an instant road to riches. Relying on another person’s trading decision is risky as we can never guarantee the performance of a trader. Markets are very unpredictable, so even the most experienced traders can face losses. Therefore, copying trades doesn’t provide foolproof protection against financial market volatility and uncertainties.

Moreover, everyone’s risk appetite, financial condition, and trading goals are different. For example, top performers on copy trading platforms often achieve impressive returns by taking greater risks. However, as a copier, you may not have complete visibility into their risk profiles. This can lead to substantial profits but also increase the risk of significant losses for copiers, especially those unfamiliar with leverage.

3. More people are adopting algo trading

Besides copy trading, another trading strategy that is gaining popularity this year is algo trading. Also known as algorithmic trading, algo trading involves using computer codes and software to automatically execute trades based on specific rules, such as price movements in a particular market. When the program detects that market conditions align with these rules, it will execute trades without requiring any manual intervention. This automation can save you time by eliminating the need to constantly monitor market activity.

Algo trading is popular among both individual investors and institutional traders due to its efficiency and ability to remove emotional biases from trading decisions. While it may sound very sophisticated, many online trading platforms are simplifying the process. For instance, IG offers algorithms trading through user-friendly platforms like ProRealTime and MetaTrader 4 (MT4). They also provide native APIs for seamless integration into algorithmic strategies. Plus, their advanced technical analysis and charting tools simplify the process. This allows you to create custom algorithms or use pre-built solutions effortlessly.

4. Mobile trading as the norm

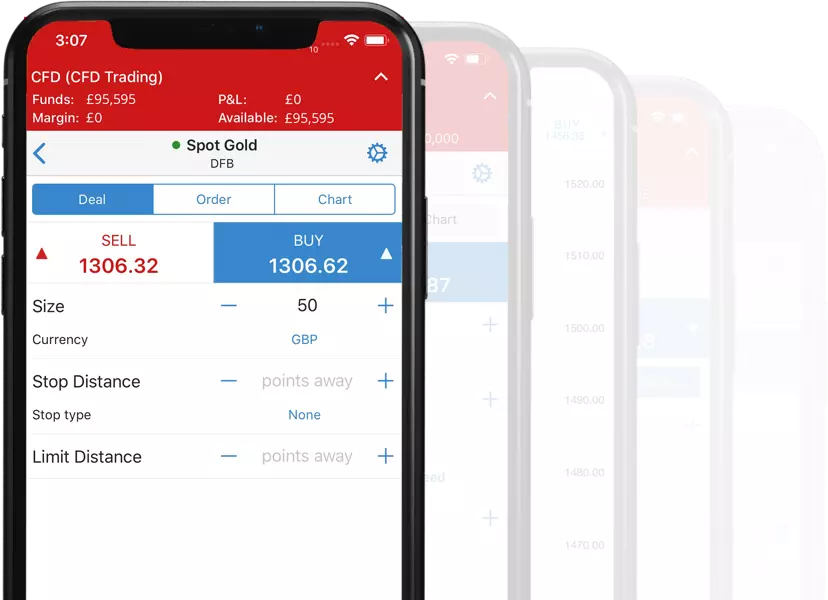

In today’s rapidly evolving digital world, the mobile trading app has become an indispensable tool for investors worldwide. Online brokers are witnessing a noticeable trend towards mobile-based trading. And more investors are opting to conduct their trades on the go using their smartphones and tablets. The IG Trading Platform Mobile App is a great example of how mobile solutions are transforming the way traders access financial markets. The convenience offered by these apps is unparalleled, allowing you to manage your investments on the go.

One of the key advantages of mobile trading apps is their ability to deliver real-time notifications and alerts. Thus, keeping you informed about market movements no matter where you are. Security is also top-notch, with features such as encryption and two-factor authentication ensuring that your assets are protected from unauthorised access. Furthermore, these apps enable users to tap into global markets around the clock. Therefore, you have the flexibility to trade at any hour of the day.

5. Blockchain technology in trade finance

Despite some misconceptions about its decline, blockchain is actually expanding beyond its cryptocurrency origins. This innovative technology offers improved transparency, reduced fraud risks, and streamlined documentation processes. The decentralised and secure nature of blockchain brings efficiency to cross-border transactions by breaking down traditional barriers in trade finance.

Smart contracts, powered by blockchain, are automating agreements and accelerating transaction times without the need for intermediaries. As businesses and financial institutions increasingly adopt blockchain, the potential for more efficient and cost-effective global trade is becoming a reality.

6. Technological innovation as a key player

Technological innovation will continue to be a crucial pillar that shapes the Forex and CFD markets. Traders striving to stay ahead in this dynamic environment must wholeheartedly adopt cutting-edge technology solutions.

With advanced functionalities designed to streamline operations, platforms such as IG Trading Platform provide traders with a user-friendly interface and powerful trading tools to execute trades seamlessly. These platforms not only enhance operational efficiency but also elevate your overall trading experience.

Looking ahead, key trends indicate a shift towards more decentralised and automated trading systems. This shift, coupled with the increasing use of artificial intelligence and machine learning algorithms, is set to redefine how traders navigate the complexities of the financial markets. Embracing these technological advancements will be essential for staying agile and competitive in this dynamic era of finance.

If you’re in search of an excellent trading platform where you can trade on the move, IG is the answer you’re looking for. With their award-winning trading app, you have flexible access to more than 17,000 global markets.

Sponsored by IG. CFDs are complex, high risk and losses can be substantial. 70% of retail client accounts lose money when trading CFDs with this investment provider.

Latest Thailand News

Follow The Thaiger on Google News: