The rise of the mixed use retail development

As our lifeststyles continue to change and morph along with technological and social evolution, so too our living spaces and the locations we choose to live. Behavioural changes among urbanites have led to the rise of mixed-use projects in Southeast Asian countries, according to property experts.

Christian Olofsson, shopping centre & mixed-use director of IKEA/Southeast Asia, told The Nation that the competitive environment in the retail industry precipitated the new format of incorporating non-traditional elements into a retail complex. Development of mixed-use retail properties is growing with the inclusion of residential units, entertainment revenues and healthcare facilities in a single site.

Catering to the needs of today’s consumers and staying relevant is the goal of the re-think among major players, Olofsson said. The new strategy could bring higher return on investment if the developer optimises the opportunity and is able to better meet the needs of modern consumers than are single-use developers.

The concept is less risky as it comes with a greater variety of revenue sources. It can also help average out the land costs by integrating a mix of components with different types of incomes.

Given the positives, IKEA decided to develop a mixed-use project – Mega City – next to Mega Bangna, Olofsson said.

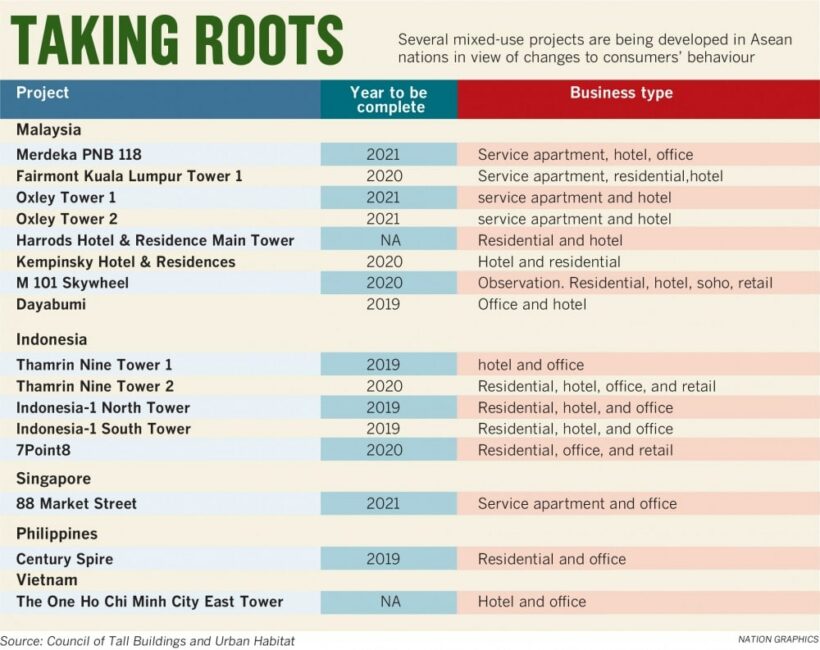

According to a report by the Council of Tall Buildings and Urban Habitat, 451 tall building are listed as under construction globally until 2025, of which a third are mixed-use projects combining hotels, residential units, offices, service apartments and retail outlets. In Southeast Asia, excluding Thailand, 16 mixed-use projects are currently under construction – eight in Malaysia, five locate in Indonesia, and one each in Singapore, Vietnam and the Philippines.

The Council on Tall Buildings and Urban Habitat is the world’s leading institute on the inception, design, construction and operation of tall buildings and future cities around the globe. Founded in 1969 and headquartered at Chicago’s historic Monroe Building, the council is a non-profit organisation with its Asia headquarters at Tongji University in Shanghai, a research office at Iuav University in Venice and an academic office at the Illinois Institute of Technology in Chicago. It facilitates exchanges of the latest technologies for tall buildings through publications, research, events, working groups, web platforms, and an extensive network of international representatives.

James Pitchon, head of Research and Consulting at CBRE Thailand, said it is not possible to develop a single-use project on a large site, citing the likelihood of oversupply in the local market, be it an office or residential project. Developers of large sites need a range of diversified incomes, he added.

Consumers like the convenience of having a range of facilities in one place that are easily accessible in a climate control environment. Having easy-to-reach retail outlets and a hotel in the same complex appeal to office tenants, especially for the convenience of foreign clients and visitors.

Thais are also open to the idea of staying in a condo next to where they work and play, provided it comes with privacy and exclusivity along with the convenience, Pitchon said.

A JLL research said that the growth of mixed-use projects in ASEAN (the Association of Southeast Asian Nations) began to take off amid infrastructure development and changes to consumer behaviours in the region. The association marked its 50th anniversary last year and the region is gearing up for greater growth and investment.

Already powerhouses in the wider region, Southeast Asia’s economies are projected to grow at an annual average of 5 per cent until 2020. The real estate industry stands to benefit as demographics and market size draw further investments, given the manufacturing and logistics advantages. The upgrade in ASEAN infrastructure, especially the advancement of high-speed rail networks, will attract development of mixed-use projects connected to the train stations, as is the case in Japan and Hong Kong, the research said.

Find more than 30,000 properties for sale in Thailand at property.thethaiger.com

SOURCE: The Nation

Latest Thailand News

Follow The Thaiger on Google News: