By the book: The market is ripe for the picking

PHUKET: “The time to buy is when there’s blood in the streets.” – Baron Rothschild.

“You pay a very high price… for a cheery consensus.” – Warren Buffett.

While there certainly isn’t blood in the streets here in Phuket, the property market remains slow with a consensus to wait on the sidelines. A faltering global economy, the weakness of the European currencies and politics have all contributed to the softness of the market here.

Phuket’s rental market has suffered too and is weaker than in recent times. There are fewer Russians seeking rentals, more hotel rooms and low oil prices, meaning that fewer people from the oil industry are seeking rental properties.

However, should we really be feeling so pessimistic about the future?

The answer is no, Phuket’s future is very bright. All economies have their peaks and troughs and Phuket will surely rebound soon. The expanded airport due to open this month, strong and increasing arrivals, improving infrastructure and leisure facilities, and continued high season rental demand are just some of the reasons for a positive outlook and expected rebound.

When any market has a correction, opportunities will arise and Phuket’s property market is no different. In the resale market, we are now seeing sellers reducing prices, in some cases quite heavily. There are buyers and investors around who are picking up these bargain deals. Property at these lower prices will produce higher than average rental returns but they won’t be around forever.

For instance, a 130sqm, foreign freehold 2-bed condo with a partial sea view in Rawai was recently sold for a heavily discounted price of 4.5 million baht. Using conservative rental rates and even at only 60 per cent occupancy, net returns are projected to be nearly 6 per cent per annum (see image 2, rental rates range from just 1,500 to 3,000 baht per night).

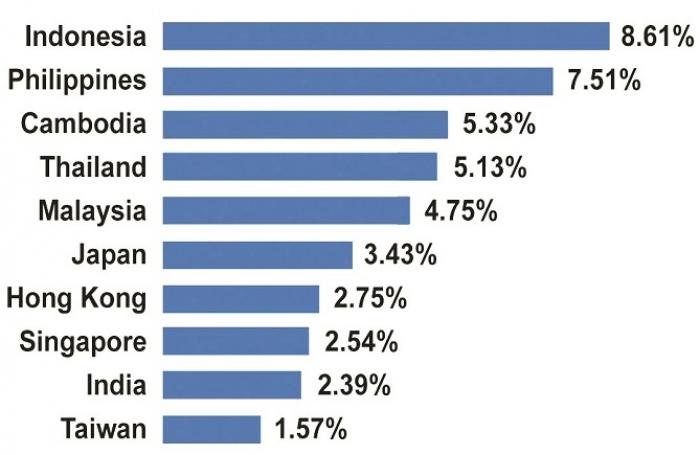

The rental rates in the chart (see image 1) can be compared with the average rental yields throughout the Southeast Asian region. The chart shows the average gross yields for Thailand are 5.13 per cent, versus Singapore and Hong Kong where yields are less than 3 per cent. The properties are 120sqm apartments located in premier city centers.

The findings by Global Property Guide Research match those of our in-house research into the average rental returns from properties in Phuket (see image 3).

The downturn in current market conditions has created opportunities for buyers/investors to achieve above average income returns on property purchases. Property is an important part of an investment portfolio and can generate a steady income return through rental revenues and capital gains upon eventual sale, and it seems that now is the time to be buying into Phuket. Why wait to pay a higher price once the cheery consensus is that the market has recovered?

For more information about this article, contact Kevin Hodges, Siam Real Estate – Tel: 076-324042; Email: kevin@siamrealestate.com; Web: siamrealestate.com.

— Kevin Hodges

Latest Thailand News

Follow The Thaiger on Google News: