Southeast Asian nations ramp up efforts to boost upstream oil industry

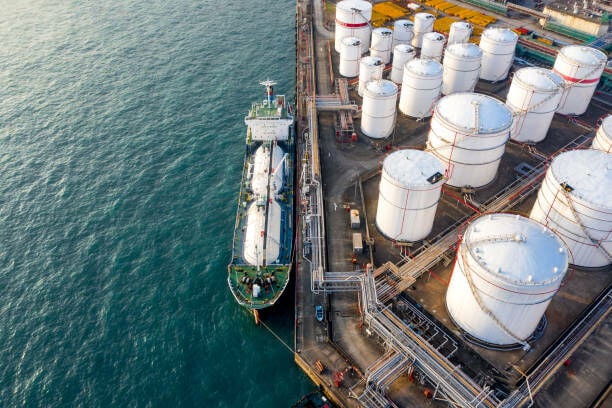

Southeast Asian nations are intensifying their efforts to boost the upstream oil industry, with Malaysia, Indonesia, Vietnam, and Thailand vying for investment from both domestic and international entities, as revealed by a study from BMI, a Fitch Solutions company.

In 2022, Malaysia received foreign investment of 287 million ringgit (US$61.7 billion), equivalent to 47% of the nation’s overall investment, in its oil and gas sector. The country’s state oil company, Petronas, is predicted to announce new production-sharing contracts (PSCs) in 2024, which could lead to an increase in foreign investment.

Prominent international and regional firms like Shell, TotalEnergies, Inpex Corp and Thailand’s PTTEP have already committed to investing in Malaysia’s upstream sector by participating in PSC contracts awarded in 2023.

Indonesia has been successful in attracting significant investment commitments from both domestic and foreign investors, including South Korea’s Posco International, since its launch of petroleum licensing rounds in 2021 and 2022. Investments in the country’s upstream sector saw a 10% increase, from US$12.2 billion (432 billion baht) in 2022 to US$14.8 billion (524 billion baht) in 2023. The development plan for the Tuna offshore gas field, operated by Harbour Energy, which was approved by the Indonesian state energy group SKK Migas in 2023, is one of the largest projects.

Italy’s Eni is poised to become one of the largest investors in Indonesia’s upstream sector following the purchase of the deepwater Bangka and Ganal gas projects from US-based Chevron. Its investments are projected to increase following the discovery of new gas reserves in blocks obtained from Neptune Energy in 2023.

Vietnam is implementing measures to enhance its upstream oil and gas industry’s competitiveness by offering incentives to encourage investment. The country is grappling with a decline in oil and gas reserves while facing increased energy demand and import reliance. Efforts to increase domestic exploration and production activities have been initiated.

Thailand, on the other hand, is experiencing a tepid response from foreign investors in the upstream sector due to diminishing reserves and the absence of new findings. The country is in a weaker position compared to Malaysia and Indonesia, where the upstream industries are recuperating rapidly. Thailand is exploring opportunities in overseas assets in neighbouring countries such as Malaysia, Vietnam, Myanmar and Indonesia.

The Philippines continues to face challenges in attracting upstream investment due to ongoing maritime disputes with China in the South China Sea. However, a consortium comprising Prime Infrastructure Capital, the Philippine National Oil Company (PNOC), and the Udenna Group’s UC38 LLC has recently decided to invest an additional US$600 million (21.2 billion baht) to develop the Malampaya gas field further, reported Bangkok Post.

In contrast, Myanmar is facing significant difficulties in attracting foreign investment owing to a worsening political situation since 2020. Numerous foreign companies, including Shell, TotalEnergies and Woodside Energy, have withdrawn their upstream investments, while Chevron is looking to sell its assets in upstream gas projects.

In related news, geopolitical tensions in the Middle East eased last month, leading to a slight rebound in oil prices. Despite concerns over OPEC production, the market found relief from reduced Saudi Arabian pricing strategies. Read more about Middle East tensions eased.

Latest Thailand News

Follow The Thaiger on Google News: