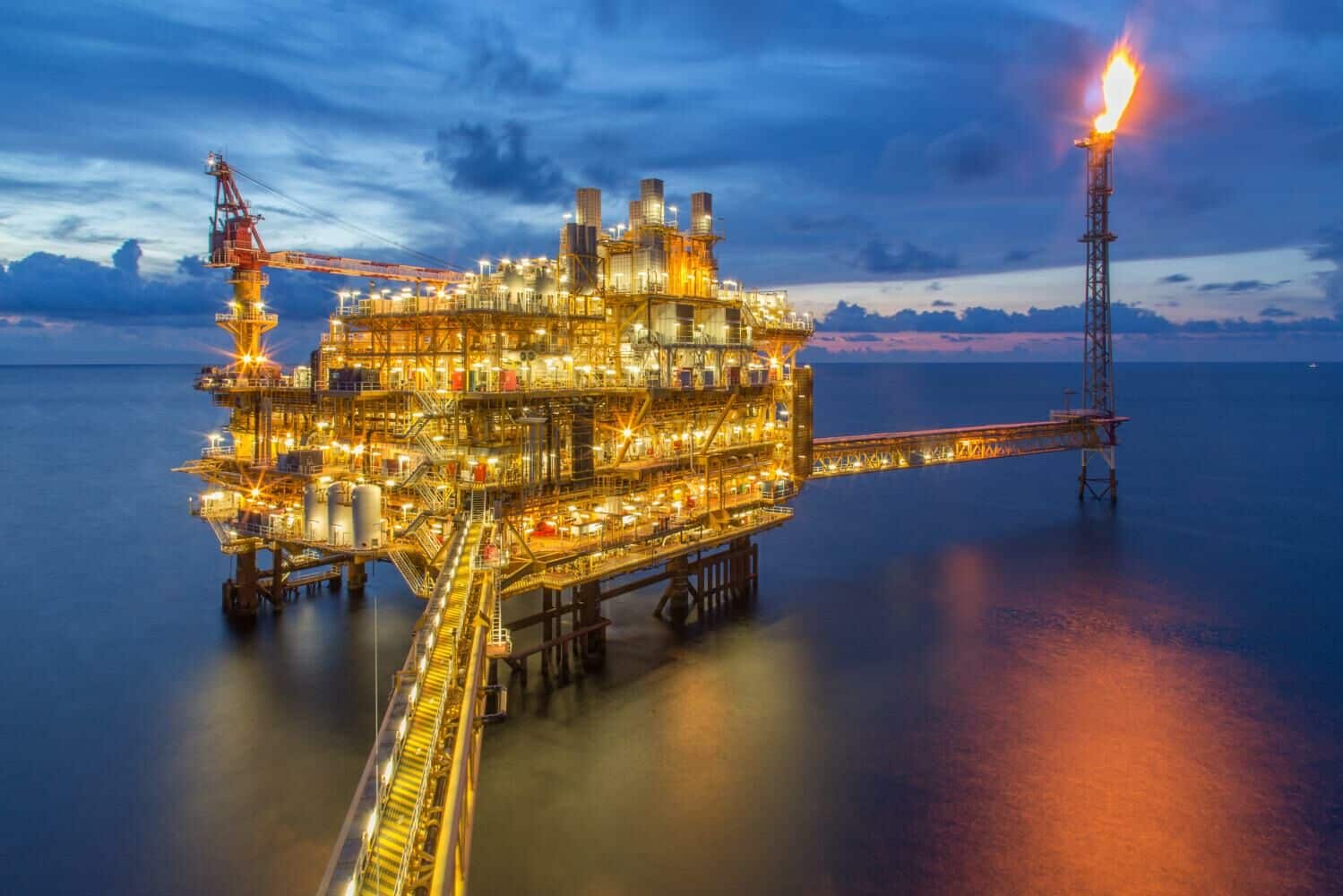

PTT Plc shifts gears: Oil giant explores new horizons

PTT Plc, Thailand’s oil and gas giant, is re-evaluating its tactics in the logistics sector, contemplating a shift away from its traditional petroleum roots.

The national conglomerate is investigating fresh investment avenues in non-oil sectors, aiming to revamp its business footprint in the rapidly advancing world of logistics.

Leading the charge is Chaya Chandavasu, PTT Senior Executive Vice-President for Corporate Strategy, who highlights the need for a rigorous analysis of the competitiveness of PTT’s non-oil enterprises before making any decisive moves.

At the heart of this initiative is Global Multimodal Logistics (GML), a subsidiary born in 2022 with a mission to offer cutting-edge domestic and international logistics services, managed under the umbrella of Siam Management Holding Co., another one of PTT’s offshoots.

The inception of GML was a strategic manoeuvre to align with Thailand’s 13th National Economic and Social Development Plan for 2023 to 2027. This plan places a strong emphasis on modernising logistics and infrastructure, and PTT is keen on riding this wave.

GML’s repertoire spans rail and land transport, air logistics, cold storage management, and logistics lease management. The mission? To ramp up competitiveness while slashing logistics costs, in a cutthroat industry.

Expanding logistics

Despite these new ventures, PTT isn’t abandoning its love affair with oil and gas. Chaya affirmed that PTT remains committed to logistics investments linked to oil, gas, and petrochemical products.

The conglomerate is knee-deep in the third phase of expanding logistics facilities at two crucial deep-sea ports. The mammoth Laem Chabang in Chon Buri and the vital Map Ta Phut in Rayong are being primed to bolster oil transport capabilities and serve as essential depots for liquefied natural gas.

With an eye-watering investment of 114 billion baht, the Laem Chabang facility is on track to kick into gear by 2027, with the 55.4 billion baht Map Ta Phut facility set to follow suit the same year, Chaya said, underscoring PTT’s shift towards streamlining its portfolio for maximum impact.

“We will only focus on businesses we specialise in and those that can compete with rivals.”

But it’s not just logistics that PTT is shaking up. The company recently hit the brakes on its electric vehicle (EV) ambitions.

In a surprising turn of events, PTT has decided to divest its shares in Horizon Plus, a joint venture established to spearhead domestic EV manufacturing. This move, driven by escalating market competition, has been sanctioned by Horizon Plus shareholders, effectively cutting ties and ensuring it will no longer remain a PTT subsidiary.

With these dynamic shifts, PTT Plc stands at a crossroads between tradition and transformation. As Thailand’s economic landscape evolves, PTT’s strategic recalibrations in both logistics and EVs showcase its adaptability and ambition to stay ahead in a fiercely competitive world.

Whether it’s fuelling the future or forging new paths in logistics, all eyes are on PTT to see where the road leads next.

Latest Thailand News

Follow The Thaiger on Google News: