Phuket Business: The not-so-hidden cost of inflation

PHUKET: If you are an expatriate living in Thailand or considering relocating here, high inflation might be a distant memory from as far back as the late 1970s. However, Thailand has much higher rates of inflation than is seen in most developed countries, and you will need to consider that when you invest and prepare a budget for your Thai living expenses.

When I moved to Phuket in 2008 I did not expect to see such extreme rising prices. In 2008 I could find fresh coconuts at Tesco Lotus for 5 baht, now in 2013, 15 to 20 baht is the lowest I can find. While Phuket can still be less expensive than the US or Europe, prices continue to increase here at a rapid rate.

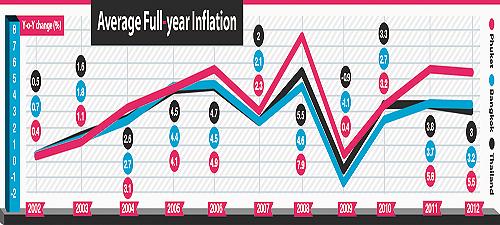

Understanding Thailand’s rate of inflation

The Ministry of Commerce, which calculates Thailand’s inflation rate, found that from 2000 until 2012, the annual rate has averaged 2.66%. However, during that period, inflation in the Kingdom has ranged from an all time high of 9.2% for the month of July 2008, to a record low of -4.4% in July 2009. Those all time highs and lows corresponded with political disturbances within Thailand as well as the impact of the global financial crisis on the country’s economy.

Back in December, inflation in Thailand also hit a 13-month high of 3.63%, in part due to minimum wage hikes along with the implementation of a diesel-tax subsidy to boost consumption after the 2011 floods hit the economy.

The diesel subsidy has since been extended until the end of January, plus there was another round of minimum wage increases at the start of the year. Moreover, such subsidies and wage hikes can vary from province to province – meaning accompanied price hikes leading to inflation would vary around the country.

Be aware of double standards

To further complicate matters for expatriates, Thailand is really two countries, one that is “first world” or well developed (areas like Bangkok, Phuket and Chiang Mai frequented by tourists where the local middle class is concentrated), and one that is much less developed.

The cost of maintaining a middle or upper class lifestyle in “first world” Thailand is not only rising because of large numbers of expatriates and retirees moving to the country, it’s also rising as more and more Thais join the ranks of the middle and upper classes as the economy grows.

That means expats living in Thailand who expect a high standard of living may have to contend with a rising cost of living that is much higher than the official inflation rates.

Finally, large numbers of tourists tend to visit Thailand at certain times of the year – usually after the rainy season ends in late November with their numbers peaking around the holidays and remaining high into the early months of the new year, before the weather gets too hot or wet again.

This annual high season brings about its own inflation as “foreigner” prices for accommodation, food, entertainment or transportation, in major tourism destinations such as Phuket, can rise significantly before falling back down when the high season ends.

Investment strategies for inflation

Given the above inflationary environment, many expatriates living in Thailand may find themselves in a situation where their living expenses are rising at a much higher rate than their net worth or cost of living adjustments to their pensions. Fortunately, there are investment strategies that can help your net worth keep pace with inflation.

For starters – and over the long term – investing in equities will usually be a better strategy for keeping pace with inflation than investing in fixed income investments or certificates of deposit in your home country. Moreover, large cap stocks with global operations that give them exposure to much higher growth rates in emerging markets could help your portfolio’s long-term returns.

Finally, Exchange Traded Funds (ETFs) not only offer investors a good way to invest directly in faster growing emerging markets, they usually come with much lower fees than mutual funds or the offshore investment products that are often marketed to expatriates.

After all, given how high Thailand’s average rate of inflation has been over the past decade, you will want to seek out investments with the lowest possible commissions and annual expenses to help ensure that their returns will keep pace with the rising cost of living in the country. In my opinion Thailand has the world’s best coconuts. Enjoy them while here but expect to pay more in the next few years due to inflation.

Don Freeman is president of Freeman Capital Management, a Registered Investment Advisor with the US Securities Exchange Commission (SEC), based in Phuket, Thailand.

He has over 15 years experience and provides personal financial planning and wealth management to expatriates. Specializing in UK and US pension transfers. Call 089-970-5795 or email: freemancapital@gmail.com.

— Don Freeman

Latest Thailand News

Follow The Thaiger on Google News: