Financial outlook for the year ahead

PHUKET: Looking back at 2014, the Standard & Poor’s 500 (S&P 500) posted a solid year. The S&P +11.4%, Dow +7.5% and Russell 2000 +3.5%. The “buy the dip” mentality began to take hold as any small correction saw buyers step in and purchase equities.

2014 SUMMARY

• Soaring Treasury bond prices

• Collapse in global commodity prices (oil)

• MH17 airline crash, Russia and Ukraine conflict

• The largest Ebola outbreak in history

• Utilities the best-performing United States sector, and energy was the worst sector

Small cap stocks certainly lagged large caps, but at the end of 2014 small cap growth stocks began to break out to new highs. International stocks lagged behind US equities as can be seen by the EFA Exchange Traded Fund (ETF), which tracks the international market and returned -6%. The US Oil ETF fell 42% and the popular SPDR Gold Trust declined 2.2% for the full year.

MY OUTLOOK

• US economic growth will likely continue to improve in a very low interest and low inflation rate

environment.

• Labor markets are improving, strengthening of the US dollar and lower oil prices will boost the

recovery.

• Quantitative easing is ending and the US monetary and banking system (post 2008) is returning to a more normal healthy condition.

• I am bullish long-term for the US economy and stock market, but short-term

I continue to see volatility and corrections likely as the market has had a nice move up since November 2012 without much of a pullback.

I currently see the economic recovery continuing as we have not reached a point where the Federal Reserve has over tightened the money supply. Therefore, the bull market will likely continue without a threat of a bear market or recession as we saw in 2000 or 2008. It will be important in the next three to five years to focus on individual stocks and leading ETF sectors. Over the past 14 years, while the US stock market digested the gains from 1982 to year 2000, we have had a technology bubble, housing bubble, gold bubble, banking crisis and now the latest oil bubble which has come back to normal levels (oil under $50).

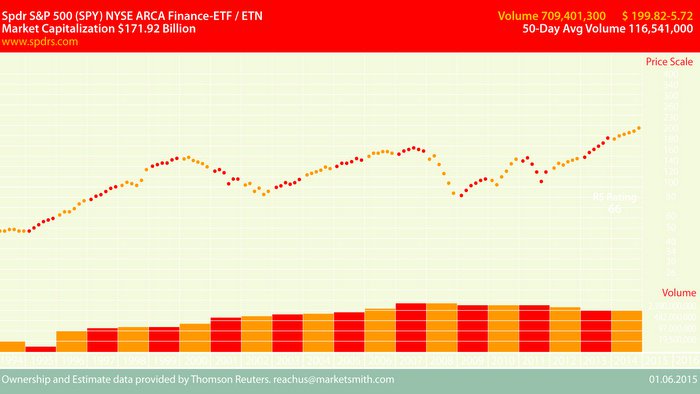

Cash has built up as a result of all this fear (wall of worry) and will eventually be redeployed back into equities and long-term investments. The upward trend of the stock market remains positive (see chart above) despite all the fear built up over the past 12 years.

My positive outlook could change at any point, however, depending on the actions of the Federal Reserve, the economic numbers and earnings, and sales reports.

Don Freeman is president of Freeman Capital Management, a Registered Investment Advisor with the US Securities Exchange Commission (SEC), based in Phuket, Thailand. He has over 15 years experience and provides personal financial planning and wealth management to expatriates. Specializing in UK and US pension transfers. Call 089-970-5795 or email: freemancapital@gmail.com.

— Don Freeman

Latest Thailand News

Follow The Thaiger on Google News: