Finance: Runts rally amid mixed earnings season

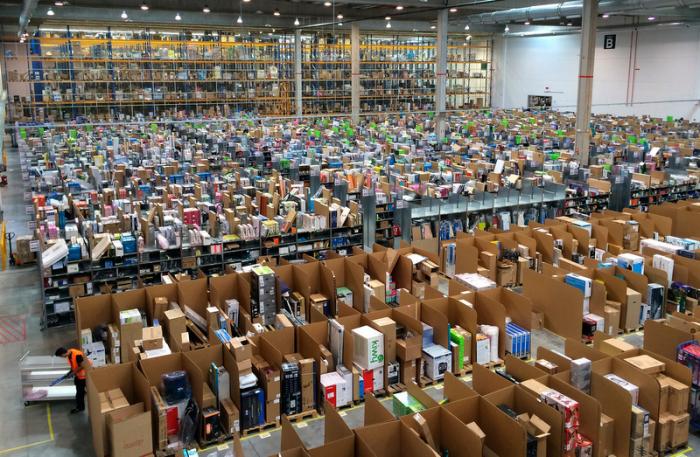

PHUKET: As of the beginning of May, earnings season was in full swing, with the markets sending mixed messages to investors. So far, some big names like Facebook Inc (NASDAQ: FB) and Amazon.com (NASDAQ: AM- ZN), with the latter sometimes being a difficult stock to own given its ups and downs, have put in good earnings reports and have pretty decent technical charts.

On the other hand, Netflix, Inc (NASDAQ: NF- LX) has a chart so choppy that it’s not even close to being ready to own, while Apple Inc (NASDAQ: AAPL) is running into mounting troubles in China.

Somewhat ironically, it’s beaten-down sectors (gold, materials, silver, oil and commodities) and stocks (Exxon Mobil) that have been leading the latest two to three month rally, with nimble risk-tolerant investors capturing some nice gains from bounces by sectors or stocks that have otherwise been in the garbage can.

However, the S&P 500 moved back up above the 2,100 resistance level in mid April, only to begin retreating again over the past few weeks, as the technology sector still lacks leadership stocks with biotech coming under pressure. This explains why the multi-year range the S&P 500 has been stuck in continue to hold.

That range is preventing the S&P 500 from hitting all-time highs, as breaking above the 2,150 level is of primary importance for the index. The failure to take out that resistant level has the index remaining in a choppy range or potentially rolling back over to February lows, or even lower.

Meanwhile, the technical chart for the tech-laden NASDAQ market is more worrisome, as it’s showing three lower highs and two lower lows. This is not what you want to see in a healthy market.

There were also a couple of NASDAQ listed semiconductor stocks that were looking good, only to get whacked again. This makes me a little concerned about the technical chart for the Market Vectors Semiconductor ETF (NYSE-ARCA: SMH), as it’s been showing lower highs and is now pulling back from a late April rally.

This also doesn’t bode well for tech stocks, as semiconductors are their ‘canary in the coal mine.’ A look at the technical chart for the Technology Select Sector SPDR ETF (NYSEA- RCA: XLK) shows the index is in a tightly-bound range, and falling back down towards a support level.

Over in biotech, the SPDR S&P Biotech ETF (NYSE-ARCA: XBI) did break out to a new base rather than a new high only to start falling off again to below a potential support level. Ideally, I want to see the chart breaking above that support zone before I start jumping back into biotech stocks.

Moving on to the global market, we need to see all of them start firing on all cylinders, but we just aren’t seeing that yet. The iShares FTSE/Xinhua China 25 Index ETF (NYSE-ARCA: FXI) representing the China market was actually looking good, with a bottom in January/February followed by a rally that only rolled back over again. A technical chart for the iShares MSCI Emerging Markets Index ETF (NYSE-ARCA: EEM) also looks similar to that of China.

Europe has been a basket case for years, but a few weeks ago, a technical chart for the SPDR STOXX Europe 50 ETF (NYSEARCA: FEU) was looking good with a solid base, bottoming formation and a breakout. Unfortunately, Europe is now retesting a support level, and is still not out of the woods yet – especially with the UK getting ready to vote on Brexit.

Finally, I should mention that when I start to lose one, two, or three stocks (or even sector/market ETFs), it means it’s time to pause and just watch the market, as it’s usually not a good sign for the overall market or a sector (from my past 20 years of experience) to see something suddenly start to get pummeled.

Don Freeman, BSME is president of Freeman Capital Management, a registered investment advisor with the US Securities Exchange Commission (SEC), based in Phuket. He has over 15 years experience working with expat- riates, specializing in portfolio management, US tax preparation, financial planning and UK pension transfers. Call for a free portfolio review. Don can be reached at 089-970 5795 or email: freeman capital@gmail.com

— Don Freeman

Latest Thailand News

Follow The Thaiger on Google News: