Bitcoin sheds nearly 15% of its ‘value’ in one day

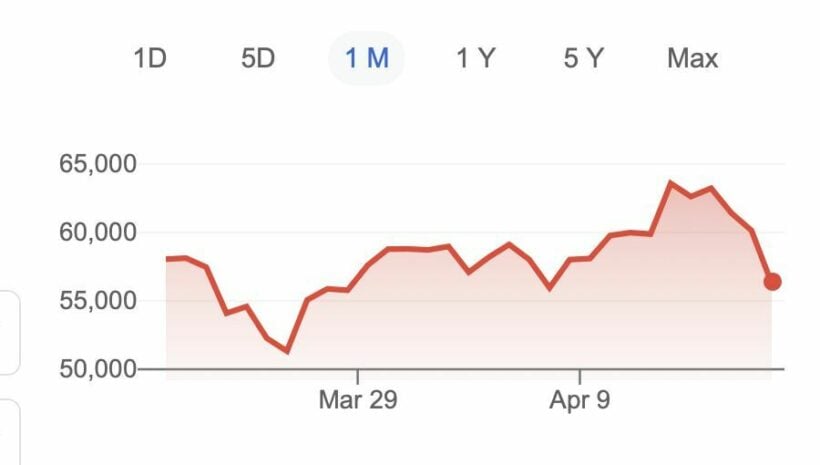

After a meteoric, and probably unsustainable rise and rise over the past 12 months, Bitcoin has suffered a short and sharp mini-crash over the weekend, dropping nearly 15% of its value in less than an hour – a stark warning of the cryptocurrency’s unpredictable volatility.

Bitcoin dropped in ‘value’ from about US$59,000 to US$51,000 before rebounding. Ethereum and Dogecoin also suffered dramatic and sudden losses, before clawing back some of their losses.

This time last year Bitcoin was simmering around US$7,725 after bumping up and down on the spot since 2018. But last year, fuelled by fears of an over-heated US stock market, Covid volatility (whatever that is), government handouts and people-with-too-much-time-on-their-hands, Bitcoin went on a spectacular climb to peak at US$63,588 last Tuesday. But Newton’s first law (the scientist, not me) kicked into action, and with venom.

The price of a single Bitcoin hit a low of US$52,810.06 Saturday after tumbling more than US$7,000 in just one hour, before stabilising.

The drop on Saturday appears to have been triggered by a Twitter rumour that the US Treasury would crack down on money laundering schemes involving cryptocurrencies. Separately, Reuters reported a power blackout in China’s Xinjiang region, where a lot of Bitcoin ‘mining’ happens, was blamed for the steep dive.

That information came from data website CoinMarketCap.

The sudden rise of the cryptocurrencies over the past 12 months has drawn a lot of attention from governments and investors, and RobinHood-esque day trade brigade. Coinbass went public, and therefore ‘mainstream’, last Wednesday.

“All eyes are on Coinbase… as the cryptocurrency exchange prepares for its first day of trading as a public company on Nasdaq under the ticker symbol ‘COIN’.

Coinbase’s market debut is a special event for several reasons. First, it will be Nasdaq’s first major direct listing, an unusual route for companies to go public without the underwriting of an investment bank.” – USA Today

Then Dogecoin had a 500% rally – an ‘asset’ that was created as a joke 8 years ago – on April 16. 500%!!!

The fervent supports of cryptocurrencies, almost a cult, are having their moment and proving, for now, that they can have their day in the financial sun as well. With Coinbase’s successful debut on Wall Street last week, they’ve gone all suit and tie.

Last year’s sharp, and very tempting, rise in Bitcoin values has the wider financial market talking about the bubble in the cryptocurrency market – Bitcoin has more than doubled in value since the start of this year. The market will decide whether that bubble will continue to grow or do what bubbles eventually do.

At the end of 2017 the Bitcoin digital token rose in value to nearly US$20,000 before crashing to almost US$3,000 the following year.

For now, it’s all eyes on the cryptos to see which way they move. The only thing that can be guaranteed is that their valuations will remain volatile and that there will be winners and losers.

Latest Thailand News

Follow The Thaiger on Google News: