Thai banks cut lending rates to ease Covid-19 fallout

Today the Bank of Thailand, in a joint effort with the Financial Institutions Development Fund, eased debt repayment requirements, in bid to help people affected by the Covid-19 virus who are unable to pay monthly minimums.

Kasikornbank (KBank) and Siam Commercial Bank (SCB) are also planning to reduce their prime lending rates by 40 basis points. The KBank co-president Predee Daochai says that the KBanks’ new prime lending rates which take effect tomorrow consisting of:

- The minimum lending rate (MLR) will be reduced to 5.60% from 6%

- The minimum overdraft rate (MOR) to 6.22% from 6.62%

- The minimum retail rate (MRR) to 6.10% from 6.50%

“The bank’s deposits rates will remain unchanged and the rate cuts are part of KBank’s debt relief measures for customers during the Covid-19 pandemic.”

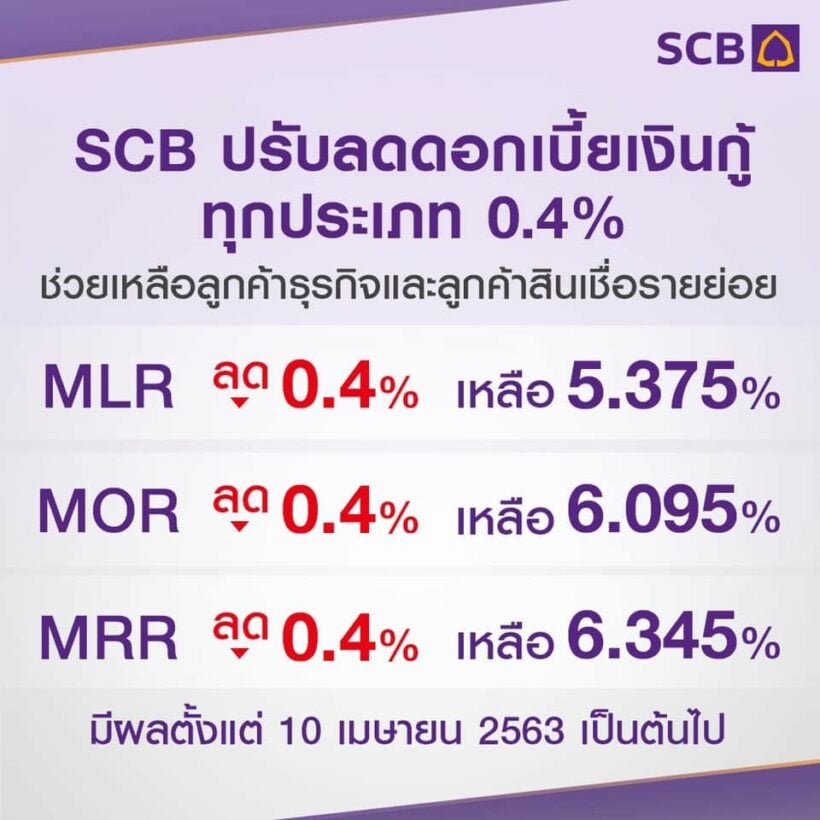

The head of SCB Bank Arthid Nanthawitthaya announced new leading rates…

- MLR will be reduced to 5.375% from 5.775%,

- MOR to 6.095% from 6.495%

- MRR to 6.345% from 6.745%,

The latest rate reduction aims to lighten the financial burden of the bank’s retail and corporate customers amid the economic downturn stemming from the coronavirus crisis.

SOURCE: Bangkok Post

Latest Thailand News

Follow The Thaiger on Google News: