Essential steps to financial mastery in the digital age

Embarking on a journey to excel in the finance sector presents an exhilarating opportunity, replete with abundant prospects and some challenges. Whether one is transitioning from academia or contemplating a career shift, understanding the essential steps towards success in the realm of finance is paramount. A combination of comprehensive education, practical experience, and strategic planning positions individuals for a rewarding career that not only offers commendable remuneration but also allows them to emerge as experts in financial management.

Initially, it is imperative to discuss the foundational development process. This procedure commences with the fulfilment of secondary education, emphasizing disciplines such as accountancy and economics, before progressing to specialized higher education credentials like a B.Com (Bachelor of Commerce), BBA (Bachelor of Business Administration), or an MBA (Master of Business Administration) in Finance. Every phase is carefully designed to augment one’s proficiency and knowledge in finance, thereby equipping them for achievement in this complex domain.

But hey, it’s not all about collecting degrees. Getting some real-world experience is equally important. Internships are like treasures hidden along the path; they help you learn how things work from the inside, give you precious insights, and connect you with folks who can help speed up your journey towards becoming a financial mastermind. As we dive into this article together, I’ll walk you through 10 crucial steps designed specifically for budding financial experts – guiding you confidently and skillfully towards reaching the top of the financial ladder.

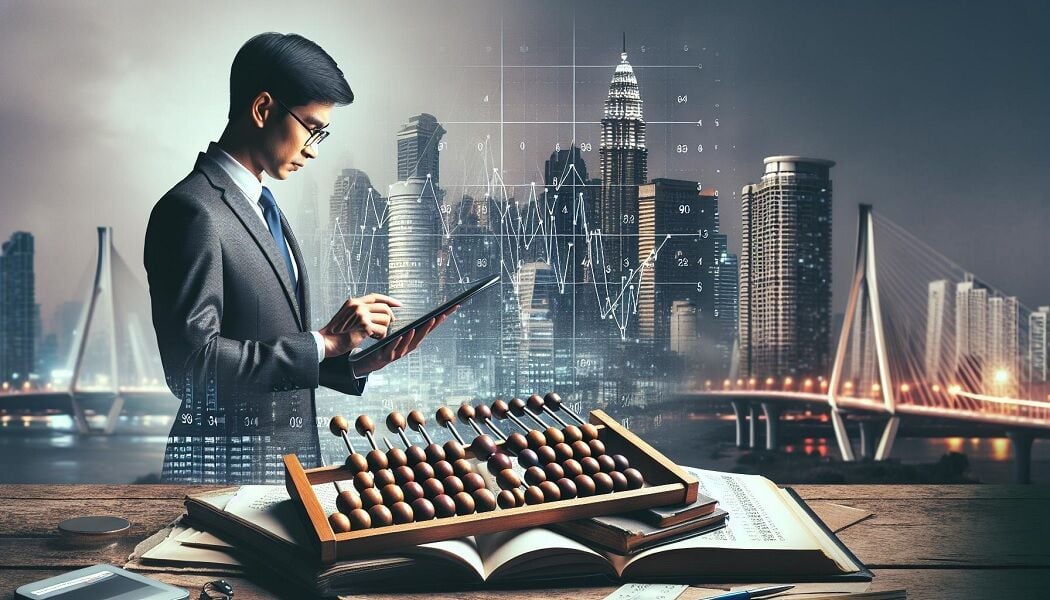

Understanding the essentials of financial mastery

The role of education and certifications

Kicking off your adventure into becoming a finance wizard is honestly pretty thrilling, and it all starts with getting cosy with the basics. Imagine diving into topics like accountancy and economics while you’re still in high school – it’s like laying down the foundation for future awesomeness. And here’s an exciting bit: progressing to degrees such as a Bachelor of Commerce (BCom), Bachelor of Business Administration (BBA), or even a Master of Business Administration (MBA) in Finance can seriously boost your skills. These programs aren’t just about getting savvy with numbers; they open up a whole new world on how businesses operate, which is super handy if you’ve got dreams of sparkling in the finance realm.

Now, let’s talk about adding some sparkle to your resume with certifications – it’s like collecting badges of honour! Getting yourself involved in programs from top-notch places like the Canadian Securities Institute, or nabbing certifications such as Certified Management Accountant (CMA), can set you apart from the crowd. It shows you’ve got the dedication and deep know-how that makes folks sit up and take notice. Plus, these shiny credentials are something employers love to see when they’re on the hunt for someone who can handle big financial responsibilities with ease.

Importance of a solid financial foundation

Establishing a robust financial foundation is essential for progress in one’s financial career. This requires acquiring an in-depth comprehension of financial principles, mechanisms of the market, and strategies for investment from an early stage. The use of resources such as trading simulators can enhance practical skills and awareness of the market, thus equipping individuals for effective decision-making in real-world financial contexts.

A solid foundation also means applying your academic knowledge through internships and real-world experiences. Internships offer a gateway to understanding business operations and financial management within a professional setting. They allow you to apply theoretical knowledge to practical scenarios, facilitating a deeper understanding of financial dynamics. This hands-on experience is invaluable, enabling you to navigate complex financial landscapes confidently.

Plus, crafting a strong financial base means keeping up with all the fresh trends and happenings in the finance world. Getting to know about global markets, updates in regulations, and the cool new financial tech out there is key. This kind of know-how means you’re always ready to tweak your plans and make smart choices, just like a finance pro would do.

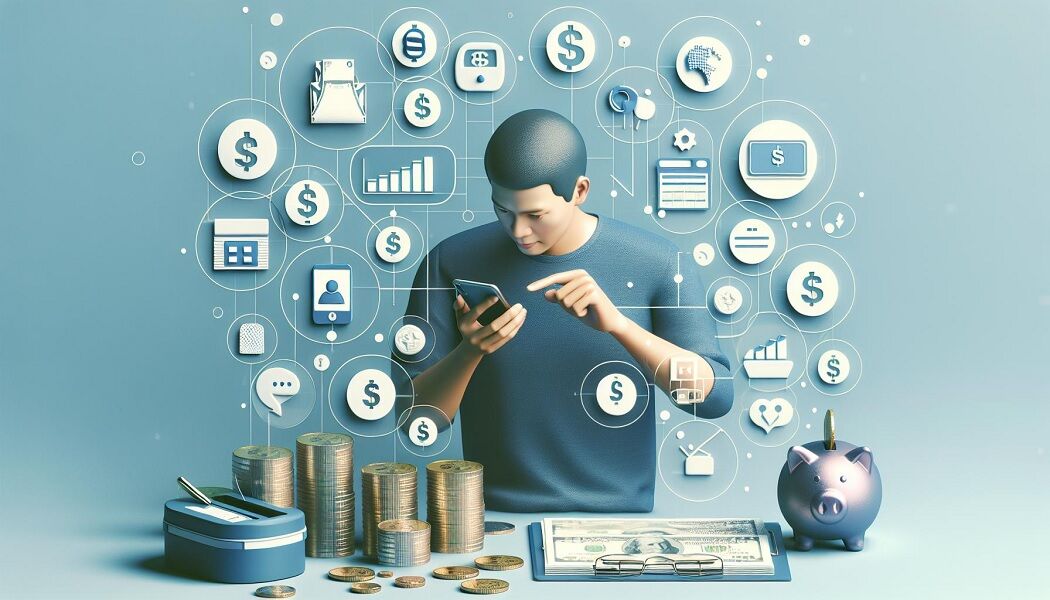

Personal financial management techniques

Creating and managing a budget

To advance in financial matters, adhering to a budget is essential. This involves monitoring income and expenditures, thereby identifying unnecessary expenses. Categorizing spending into distinct groups facilitates the establishment of feasible limits, ensuring one does not overextend financially. Periodic review of one’s budget allows for adjustments in response to changes in income or expenses, minimizing unforeseen challenges and aiding in the achievement of savings objectives more efficiently. Utilizing a budgeting application can simplify this process by providing clarity and ease of management. Ultimately, diligent budget management is crucial for enhancing and sustaining financial well-being.

Saving and investing wisely

Saving up is super important, but guess what? Learning how to smartly invest those savings can kick your financial goals into high gear. First things first, let’s get that emergency fund sorted. Aim to stash away enough to cover three to six months of living costs for those just-in-case moments. Once you’ve got that cushion, it’s time to think bigger: retirement dreams or maybe a new home. Here’s where the fun begins – mixing it up with your investments helps balance things out and could boost your returns. From cool low-cost index funds, stocks, and bonds, to even diving into real estate, there’s a whole world of options based on how much risk you’re comfortable with and the rewards you’re after. Keeping an eye on market trends will help you tweak your strategy as you go along.

Enhancing your professional finance skills

Building strong mathematical and analytical abilities

Mastering mathematics and analytical skills significantly enhances one’s proficiency in finance. It equips individuals with a distinct advantage, enabling them to comprehend complex financial concepts and navigate the global finance landscape with ease. Delving into subjects such as algebra and statistics arms professionals with the necessary tools to analyze financial data effectively. This encompasses identifying trends, assessing the viability of investments, and making informed decisions regarding financial allocations. To maintain and refine these skills, consistent practice and the application of mathematical knowledge to real-world financial scenarios are imperative. Engaging in financial simulations and case studies serves as an excellent method for improving decision-making capabilities based on quantitative analysis.

Mastering financial modelling and data analysis

If you’re diving into the finance world and want to stand out, getting a grip on financial modelling and data analysis is like finding your superpower. These skills let you whip up predictive models that are super handy when it comes to planning, figuring out investments, and predicting future finances. It’s kind of like having a crystal ball but backed by solid data! You’ll want to become best buddies with software like Excel and maybe even get cosy with programming languages such as Python – they’re key players in making all this magic happen. When you dive into financial modelling, it’s all about playing out different financial what-ifs and seeing how market changes might play with your forecasts. Imagine being able to plot out various scenarios before they happen – pretty cool, right? And the best part? By sinking your teeth into courses focused on these topics and then actually applying what you’ve learned to real-life projects, you’re not just learning; you’re doing. This hands-on experience is golden for advising on financial strategies or catching those market trends before they catch everyone else off guard.

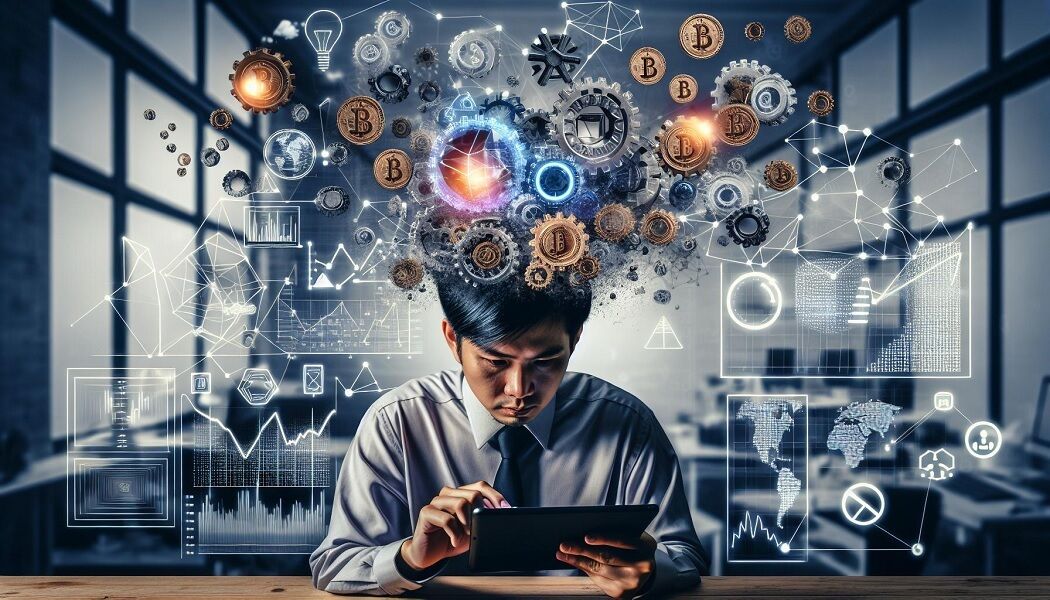

The role of technology in finance

Staying ahead with FinTech innovations

In your journey through the 10 steps to becoming a financial master, embracing FinTech innovations is crucial. The integration of technology into finance has transformed the landscape, making digital skills indispensable for finance professionals. With the FinTech industry booming—evidenced by a record-breaking deal worth $279 billion in 2022—understanding and leveraging these technological advances will set you apart.

FinTech applications offer advanced analytical tools, blockchain technology, and mobile banking solutions, enhancing the efficiency of financial services. By staying ahead with FinTech innovations, you position yourself to harness the power of digital transformation, streamline financial processes, and deliver superior financial strategies. It’s not just about keeping pace with technology but leveraging it to foresee market changes, manage risks, and capitalise on opportunities.

Leveraging financial software and tools

Mastering financial software and trading simulators is a pivotal step in becoming a financial master. Tools like Excel for financial modelling, Python for data analysis, and trading platforms equip you with the capabilities to conduct complex analyses, create predictive models, and simulate investment strategies. This proficiency allows for a more accurate assessment and forecasting of financial outcomes.

Moreover, using trading simulators, like those found on Investopedia, can enrich your understanding of market dynamics without any financial risk. These platforms enable you to construct mock portfolios, applying theoretical knowledge in a practical context. They provide a sandbox environment where you can experiment with various strategies, understand market reactions, and refine your investment decisions.

By leveraging financial software and tools, you not only enhance your technical skills but also improve your strategic decision-making abilities. This combination of technology and finance skills propels you towards achieving mastery in finance, equipping you to offer insightful advice, manage financial risks effectively, and lead with confidence in the digital age.

Advancing your career

Gaining relevant experience in the field

Starting your journey towards financial mastery, it’s crucial to gain relevant experience in the industry. Most employers require at least five years of industry experience for roles such as financial managers. Begin by seeking internships right after graduating from your bachelor’s programme. These internships, whether part of your academic course or pursued independently, expose you to real-world financial operations, bolstering your resume. Furthermore, consider entry-level positions that align with your career goals, such as an analyst position, which can provide a solid foundation in financial principles and practices. Experience in these roles teaches you how to apply theoretical knowledge in practical scenarios, making it indispensable for advancement in your finance career.

Networking and professional development

Building a strong professional network is a key step in advancing your finance career. Attend industry conferences, seminars, and training events as these are excellent opportunities to meet like-minded professionals and industry veterans who can provide valuable insights and potential job leads. Joining finance-related online communities and forums can also enhance your network and knowledge base. Additionally, professional development plays a significant role in your career progression. Attend workshops and pursue further qualifications or certifications relevant to your field, such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) designations. These certifications not only deepen your finance expertise but also signal to employers your commitment to the field and readiness for more complex roles. Engaging in continuous learning and networking effectively positions you as a competitive candidate for advancement in the fast-evolving finance sector.

In addressing educational inequality in Thailand, a multifaceted approach is crucial. Strategies must include enhancing access to quality education across all socioeconomic backgrounds, investing in teacher training, and integrating technology in classrooms to bridge the learning gap, ensuring every child has the opportunity to succeed.