Stormy skies for Boeing as Coronavirus compounds dire situation

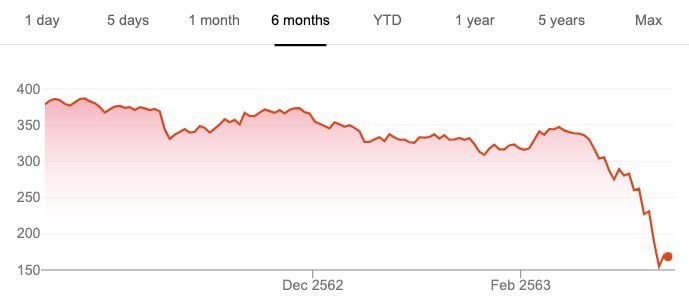

As the world’s Covid-19 cases continue to rise, aircraft manufacture Boeing is watching its stocks slide. From around US$384 a share back in September last year to as low as US$154.84 last week. It’s since bounced back to US$170.20, but a long, long way from its peak. Most of the losses kicked in from mid-February when the extent of the Coronavirus, and its impact on the airline business, became apparent.

Boeing lost US$52 billion on the stock market in just one week. The rout underscores the challenges facing the US aircraft manufacturer in a perfect storm of problems – the rise of the Covid-19 coronavirus and its impact on airlines, and the company’s self-inflicted crisis over the Boeing 73 Max aircraft.

The problems with Boeing will have a profound effect on business sentiment in the US.

Richard Aboulafia, an aviation consultant at Teal Group says the 104 year old company was a safe bet, because it has driven multiple technological revolutions and operates in a safe and growing market.

“But these beliefs are being tested. Boeing is in distress and a lot of that is self-inflicted.”

According to AFP banking sources, the Seattle-based aircraft manufacturer drew on the full US$14 billion credit line it only just secured from banks last month.

Boeing, facing hundreds of lawsuits from families of passengers on the doomed Ethiopian Airlines and Lion Air 737 MAX aircraft which crashed, wants to make sure it has enough reserves to deal with any unexpected problems in the current “uncertain climate”.

It doesn’t get much more uncertain than the current situation.

The two deadly crashes killed a combined total of 346 people.

Boeing told AFP that it estimates that the 737 Max crisis will cost it at least US$18.7 billion, which has caused its debt to explode to US$27 billion as of the end of last year. The manufacturer has neither produced nor delivered any Max aircraft in the past three months. The model has been grounded for a year.

With a return of the 737 Max to the skies uncertain, hundreds of almost-complete aircraft sitting gathering dust, and sales of the 787 slowing, Boeing’s financial situation is teetering. And then there’s the coronavirus.

Around the world airlines are having to drastically alter schedules, put off flight and ground staff, cancel orders for new planes and re-assess their business plans as passengers stay home and borders close.

The coronavirus pandemic now poses the most serious crisis for the airline industry since September 11, 2001. Last week Delta Air Lines decided to postpone deliveries of new aircraft, while United Airlines is only taking on new aircraft if it believes it can pay for them.

American Airlines announced over the weekend that it plans to cut 75% of its international flights through to May 6 and ground nearly all its wide-body fleet.

A week ago, UK airline Flybe collapsed Thursday as a slump in demand for flights because of the novel coronavirus outbreak dealt the final blow to the struggling carrier.

The Boeing 737 Max assembly plant alone employs 12,000 people. When Boeing suspended production of the MAX in January, most economists believed that this decision would affect US growth in the first half. Now its knock-on effects to a beleaguered US business sentiment will have even greater impact.

And whilst it is likely, at some stage, the world will see a major reduction in active coronavirus cases, there is still doubt whether the Boeing 737 Max will ever fly again.

GRAPHIC: Boeing Company shares over the past 6 months – Google

Latest Thailand News

Follow The Thaiger on Google News: