Is the dream over? China walks back Belt & Road ambitions

China has splashed more than a trillion dollars on a wild campaign to expand its influence across the developing world through its Belt and Road program.

As Beijing begins to count the cost of the troubled initiative, more and more countries are struggling to repay their debts to China. Tens of billions of dollars of loans have been misused and countless projects are stalled, if they ever got started.

According to some economists, China’s “debt-trap diplomacy” has fuelled crises in places like Sri Lanka and Zambia. After nearly a decade of giving generous loans to eager foreigners, the mainland will now evaluate new projects more rigorously.

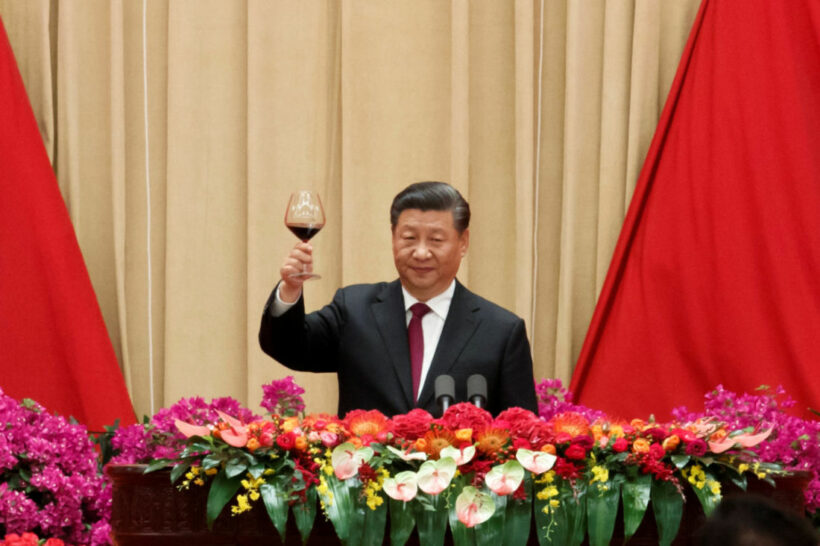

President Xi Jinping once called the initiative the “project of the century,” but by a November meeting with senior officials, Xi spoke of increasing complexity and risk control. Chinese banks have slashed lending to low-income countries. Nearly 60% of China’s overseas loans are held by countries in financial distress. To escape from the mess China has begun working with longstanding enemies like the Paris Club, perhaps forcing Chinese banks to accept losses – something they hate, preferring to extend troubled loans indefinitely.

Weifeng Zhong of the Mercatus Center at George Mason University said…

“That strategy risks prolonging countries’ debt woes rather than fixing them. China is [now] attempting a course correction.”

The program dates back a little over a decade when China saw an opportunity to earn better returns on cash holdings through investment overseas. On taking power in 2012, Xi expanded promoted the plan, to expand China’s influence and build markets for Chinese goods.

After a stock-market collapse in 2015, China used the initiative to export products in oversupply at home, like steel and textiles, often requiring borrowers to source from Chinese suppliers. While the US finances nearly all its overseas development projects with aid, China acts more like a banker. China handed out about US$1 trillion in loans and other funds to almost 150 countries like Ecuador and Angola, becoming the world’s largest official creditor.

By 2017, Chinese banking executives were asked to finance projects with little prospect of returns. Lenders insisted on designating certain projects as “policy-instructed,” so they would not be held accountable for defaults.

More prudent lending could make Chinese money less appealing to some countries, making it tougher to win over governments. Chinese officials are exploring other ways to make the Belt and Road more sustainable, such as forming public-private partnerships to reduce risks and shifting toward more lending at below-market interest rates.

Brad Setser, a senior fellow and sovereign-debt expert at the think tank Council on Foreign Relations, said…

“China may need to find a new way, such as moving away from lending in favour of giving grants and other aid.”

SOURCE The Bangkok Post

Latest Thailand News

Follow The Thaiger on Google News: