Potential Trump return haunts global finance leaders at IMF meeting

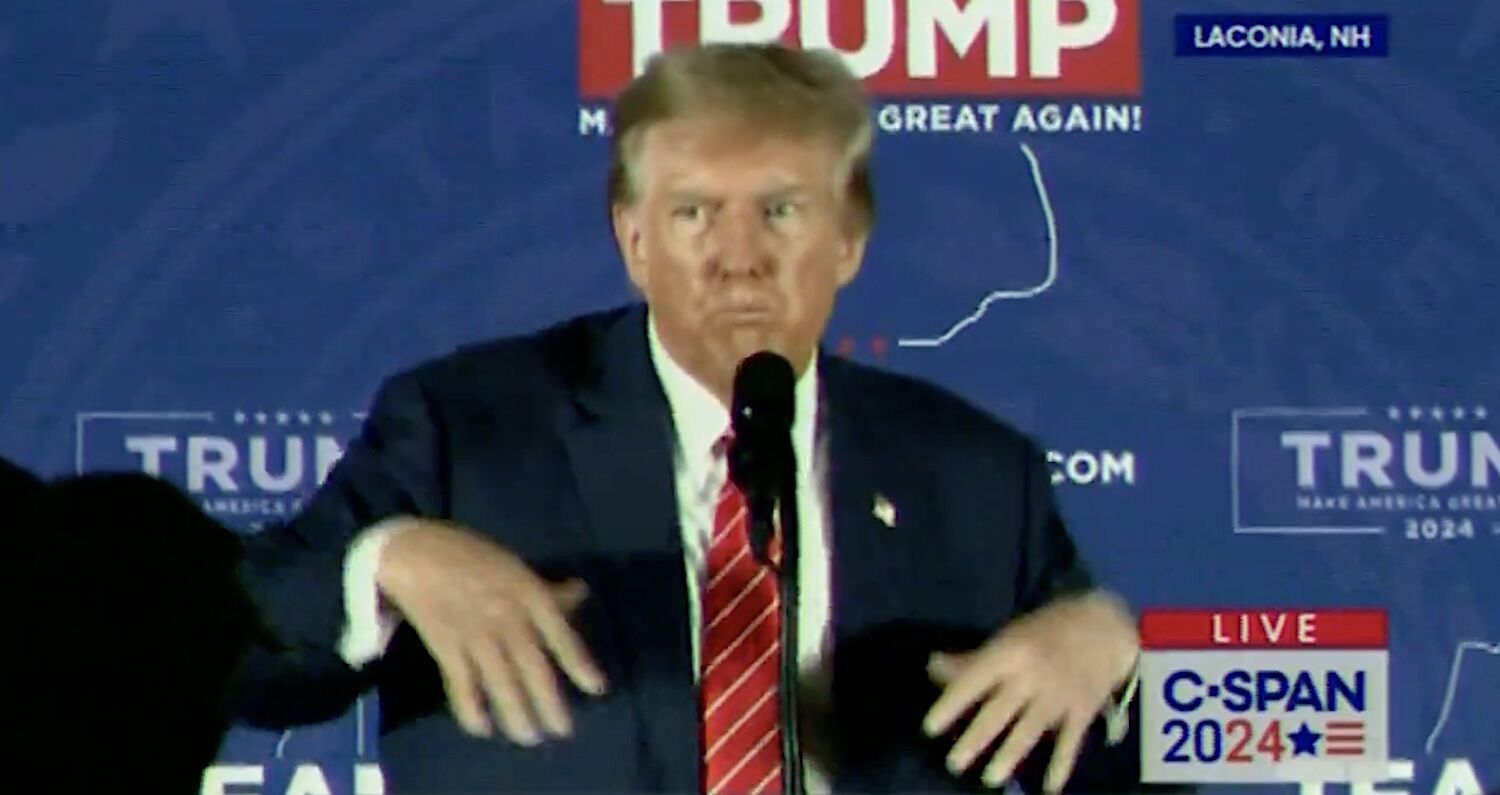

Amidst the typical chatter of low growth, high debt, and conflicts flaring up, the real buzz at the annual IMF and World Bank meetings was the possible political comeback of Donald Trump. This was the hot topic for finance leaders in Washington last week, overshadowing the usual suspects on the agenda.

According to some sources, Trump’s alleged leap in the polls rattled Vice President Kamala Harris’s early lead and had officials, central bankers, and civil society groups abuzz. The elephant in the room? Trump’s potential shake-up of the financial world—think tariff hikes, trillions more in debt, and a pivot back to fossil fuels, dismissing climate initiatives.

Kazuo Ueda, the Bank of Japan’s Governor, captured the mood.

“Everyone seemed to worry about the high uncertainty on who would become the next president, and what policies would be taken under the new president.”

Trump’s grand plan? A whopping 10% tariff on imports across the board and a staggering 60% on goods from China. A move certain to stir up global supply chains and provoke retaliatory tariffs, likely sending costs soaring worldwide, said German Finance Minister Christian Lindner.

“In a US-EU trade war, there would only be losers.”

Social Security

Trump’s campaign also dangles tax breaks, including keeping 2017’s tax cuts and scrapping taxes on tips, overtime pay, and Social Security benefits. Analysts warn this could pump an extra US$7.5 trillion onto the US debt in the next decade, stacking on top of the already projected US$22 trillion growth by 2034.

Conversely, a Harris victory would likely mean more of the same multilateral cooperation seen under Joe Biden’s presidency, focusing on climate, corporate taxes, and development bank reforms. Although Harris’s plans might inch the debt upwards, it would be nowhere near Trump’s lavish proposals.

Biden’s tariffs on steel, aluminium, and Chinese imports in select sectors like electric vehicles have stayed firm, which Harris backs, criticising Trump’s blanket tariff plans as a potential US$4,000 tax on American families.

Markets are already feeling the tremors of a potential Trump triumph, with Trump trades seeing a surge in assets like stocks, Bitcoin, and the Mexican peso as his poll numbers rise.

The dollar is on a tear, enjoying its best month in over two-and-a-half years, gaining 3.6% against major currencies. Analyst Steve Englander from Standard Chartered says 60% of this uptick comes from Trump’s optimistic betting market outlook.

Roberto Campos Neto, Brazil’s central bank chief, noted that Trump’s market influence is already stirring inflationary ripples in long-term US interest rate futures, heightening concerns since both Trump and Harris’s fiscal plans seem inflation-prone.

Growth future

The IMF proclaimed the success of the global assault on inflation, highlighting minimal job losses, as the US economy might overshadow weaknesses in China and Europe. IMF boss Kristalina Georgieva urged a swift reduction of the Covid-era debt mountain to avoid a stagnant growth future and growing dissatisfaction worldwide.

When quizzed on Trump’s potential impact on IMF strategies, Georgieva emphasised current economic challenges.

“The sentiment of the membership is that elections are for the American people. Our focus is to identify challenges and figure out how the IMF can address them constructively.”

Despite fresh optimism from the Federal Reserve’s rate cut aimed at boosting emerging markets, fears remain that increased US deficits under Trump could spell trouble, said Turkish Finance Minister Mehmet Simsek.

“A larger deficit means growing debt, which means higher long-term rates, leading to a strong dollar. High US rates and a strong dollar aren’t good news for emerging markets.”

Lingering worries about a possible global trade war threaten to halt inflation relief efforts. Lesetja Kganyago, South Africa’s central bank governor, cautioned against retaliatory tariffs that could disrupt the disinflation process and weigh heavily on central banks.

Saudi Finance Minister Mohammed Al-Jadaan, presiding over the IMF’s steering committee, underscored the necessity of dialogue with both Republican and Democratic administrations, including during Trump’s tenure, said Al-Jadaan.

“We need to ensure that we continue that dialogue.”

Al-Jadaan added it was an opinion widely echoed during the meetings.

“Every challenge is an opportunity to reorganise ourselves and learn to deal with it,” concluded Angola’s finance minister, Vera Daves de Sousa, keen to embrace whatever comes next.

What Other Media Are Saying

- DevDiscourse highlights how global finance leaders at IMF and World Bank meetings address potential implications of Donald Trump’s possible return to the presidency, focusing on economic stability and policy shifts. (read more)

- Bloomberg reports that world financial leaders in Washington discuss debt, inflation, and rates, but are preoccupied with Donald Trump’s potential return to the White House ahead of the election. (read more)

Frequently Asked Questions

Here are some common questions asked about this news.

Why are global finance leaders concerned about a potential Trump presidency?

They fear Trump’s policies may disrupt global trade and increase debt, potentially leading to economic instability.

How could Trump’s proposed tariffs impact everyday consumers?

Broad tariffs could raise consumer costs significantly, acting like a tax on American families.

What are the potential long-term effects of increased US debt under a Trump administration?

Growing debt could lead to higher long-term interest rates and a stronger dollar, negatively impacting emerging markets.

How might a Trump victory affect global inflation trends?

Inflation could rise due to increased tariffs and higher long-term interest rates, complicating the global disinflation process.

What role does multilateral cooperation play in the current global economic climate?

Multilateral cooperation helps address global challenges like climate change and debt relief, contrasting sharply with Trump’s more isolationist policies.

Latest Thailand News

Follow The Thaiger on Google News: