Don’t let emotions cloud financial judgment

PHUKET: There are two emotions that tend to cloud our collective judgments and cause major swings in the financial markets: fear and greed. They lead to the ever-repeating cycle of boom and bust and are not likely to disappear anytime soon, so gaining a good understanding of them – as well as how they can affect an investor’s financial decision making – is an exercise that is well worth the time.

I myself have been the victim of these emotions when it comes to making investment decisions, and when I was an active NYSE trader on a proprietary trading desk back in the United States, these emotions ruled the place on a daily basis. If we could see how fear and greed affect our decisions, it would become much easier to see how they also affect the masses and thus, the long-term monetary cycle.

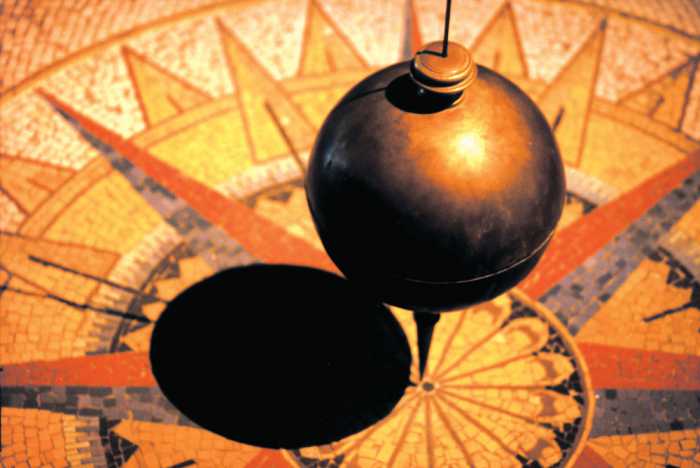

While it is true that there is a pendulum that swings between the two extremes, in the middle is a safe place where the market tends to recover and trend up slowly for three to five years, before greed reaches a high level and the trend shifts toward fear. Are we at that stage yet where greed rules in the global stock markets? I think we are, and this leads to one of my favorite of all Wall Street adages.

Be fearful when others are greedy, and be greedy when others are fearful. This strategy pays off in the long run. Considering the market is trading at high valuations with weak underlying fundamentals, the last two years of market action seem to represent classic greed. People are making money very quickly with absolute disregard to why. The fact that it is only printed money behind the bid in the market doesn’t matter when greed is being fed with ever-increasing record highs on major indexes. What about the fact that economic activity does not appear to correlate with those record highs? Well, that is lost on the greedy and soon-to-be fearful.

So what should investors do to protect their portfolios? They should get ready to be greedy as soon as the fear sets in and the market is brought back down to reality. This is a very easy trade to make. They simply cash in a large portion of their stock holdings and sit on cash with a price-earnings ratio target on the market as a whole.

For an American, they should use the Russel 2000, since it is a much broader measure of the stock market than the S&P 500 and is also currently much more overvalued. Set a trigger at a price-earnings ratio of 10 on this index. When it gets hit, it will be safe to go back into the market, despite what the talking heads on TV will be saying at that moment.

Remember, it is generally a better investment strategy to do the opposite of what the prevailing financial media suggests. Before a crash, they are always the most confident, and near the bottom they are all spouting doom and gloom despite the fact that stocks are on sale at amazing discounted prices. Why do we shop for shares differently than we do for shoes or anything else? Fear and greed, that’s why. Learn to recognize them at play and your investment decisions are likely to become immensely better.

David Mayes MBA lives in Phuket and provides wealth management services to expatriates around the globe, focusing on UK pension transfers. Faramond UK is regulated by the FCA and provides advice on taxation and pensions. He can be reached at david.m@faramond.com or 085-335 8573.

— David Mayes

Latest Thailand News

Follow The Thaiger on Google News: