BOT to mount rescue of crumbling baht

The Bank of Thailand (BOT) is attempting to steer the baht and the economy through some tricky times. As the government is apparently out of ideas to jump-start the economy due to high debt, the responsibility has fallen to the central bank.

The central bank’s recent move to raise the key policy rate by 0.25 percentage points to 1% has, however, set some analysts wondering if the BOT had done enough to stem the rapid depreciation of the baht, caused by the widening gap between benchmark rates in Thailand and the United States. The Federal Reserve Bank has aggressively raised the funds’ rate to a range of 3-3.25%.

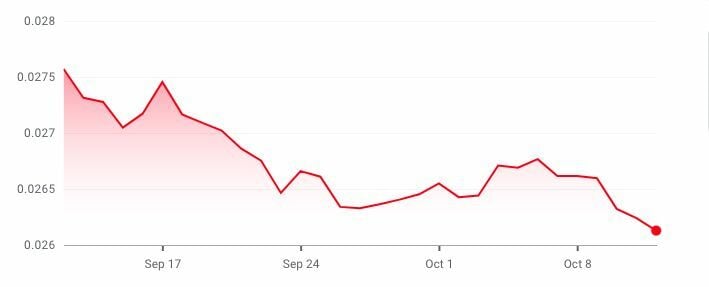

Like the global equity market, the Thai stock market has been highly volatile recently, and the baht fell to below 37 to the dollar, a key psychological barrier, raising fears that it could weaken to 40 per dollar. Analysts warned that the BOT should give priority to the weakening baht rather than solely focusing on inflation. Moving too slowly could lead to higher costs later.

BOT governor Sethaput Suthiwartnarueput said he was exhausted trying to explain the central bank’s gradual and measured approach, aimed at containing inflation without disrupting economic recovery. He said…

“It is the issue of the dollar strengthening that is affecting the value of the baht and other currencies around the world. It is the price of the dollar.”

The dollar has appreciated about 18% this year, while the baht has weakened by 12, in the middle of the group of currencies that had weakened compared with the Japanese yen, which has dropped by 20%.

With observers worried that the baht’s depreciation will push up inflation, Sethaput argued that so far, the far weaker baht has not resulted in inflation. Headline inflation peaked in the third quarter and it will start to decline, while core inflation (excluding fresh food and energy) will peak in the fourth quarter.

The latest figures may vindicate the central bank’s claims. Headline inflation in September rose 6.4%year on year, compared with a 7.9% rise in August, partly due to a drop in oil prices, while core inflation was 3.1% compared with 3.2% in August.

The prices of goods and services in September remained high, while floods contributed to rising inflation. Oil and gas prices are still key factors that determine when inflation will subside. Energy prices are highly volatile with crude oil prices recently rising over US$90 a barrel.

Latest Thailand News

Follow The Thaiger on Google News: