The real cost for startups in Thailand unveiled

Initiating a startup venture in Thailand offers a compelling opportunity, particularly given the nation’s potential for innovation and expansion. The attraction of establishing a business in Thailand, famously known as the Land of Smiles, is significant, attributed to its comparatively low startup costs relative to other nations. However, what does the financial landscape entail for emerging entrepreneurs?

Upon exploring the Thai startup environment, it becomes evident that the country abounds with prospects, notably within sectors such as agriculture, health care, and technology. This year has witnessed enhanced support through research grants and an anticipated surge in venture capital investments, rendering the ecosystem notably dynamic. Nevertheless, mastering this promising yet intricate market demands a comprehensive comprehension of the actual costs involved.

Accounting for construction expenses necessary for establishing a physical presence to understanding sector-specific operational nuances is crucial. Obtaining a detailed insight into both initial and recurring financial commitments lays the groundwork for success. Whether one aims to pioneer advancements in artificial intelligence or intends to transform the tourism sector, acquiring knowledge of the financial terrain constitutes an essential step towards making well-informed decisions.

Understanding the startup ecosystem in Thailand

Key industries for startups

Thailand is a super exciting place for budding entrepreneurs, with loads of sectors ready to welcome fresh ideas and innovations. First off, the tech scene is buzzing! It’s growing fast and there’s so much room for new ventures in fintech, e-commerce, and software development. Then we’ve got agriculture – it’s a big deal here and ripe for agritech startups looking to amp up productivity and make farming more sustainable. And let’s not forget health and wellness; thanks to Thailand’s top-notch healthcare services and booming medical tourism, there are plenty of opportunities for startups that want to bring new health tech or wellness solutions into the mix. These key areas are not just perfectly aligned with what Thailand does best but also get a boost from an amazing support system that loves seeing entrepreneurial dreams take flight.

Role of the board of investment (BOI) in promoting startups

The Board of Investment (BOI) in Thailand plays a crucial role in fostering the startup ecosystem. It offers numerous incentives and support mechanisms to encourage both domestic and international entrepreneurs to start and grow their businesses in Thailand. These include tax exemptions, import duty concessions, and assistance in obtaining work permits and visas for foreign employees. The BOI also facilitates access to useful resources, funding opportunities, and connections within the industry. By creating a conducive environment for business startups in Thailand, the BOI significantly contributes to the country’s status as a vibrant hub for innovation and entrepreneurship in Southeast Asia.

Initial costs for startup registration

Navigating the financial landscape of establishing a business startup in Thailand involves understanding the initial costs. This segment delves into the primary expenses you’ll encounter during the registration process.

Company registration fees

Registering your company is a fundamental step, requiring a financial outlay that varies by business structure. For a sole proprietorship, expect fees of around 5,000 baht (approximately £120). However, setting up a limited company involves higher costs, ranging from 25,000 baht (£600) upwards. These fees cover the registration process and the acquisition of necessary licenses and permits. Remember, professional legal services may add to these costs, with fees spanning from USD 1,500 (£1,140) to USD 7,000 (£5,300), based on the complexity of your registration.

Minimum capital requirements

The law mandates a share value of no less than 5 baht, dictating a minimum registered capital of 15 baht for a private limited company on paper. Yet, effectively starting your business usually demands a significantly higher capital, tailored to your business’s operational needs. Hiring foreign personnel requires a capital of 2 million baht (£48,000) per employee, although exceptions exist, such as a lowered requirement of 1 million baht (£24,000) if employing a foreigner married to a Thai national. Entrepreneurs should also note that BOI-promoted companies might benefit from unique capital exceptions.

Necessary legal documents

Acquiring the right legal documents is crucial for legal compliance and operational smoothness. This includes personal identification documents for all shareholders, company bylaws, and incorporation documents specific to your business structure and sector. Drafting and legal review of these documents are essential but incur fees, necessitating budget allocation in your startup planning phase.

Choosing the right business address

The business address of your company not only acts as its legal domicile but also influences the perception of your brand. Central business districts in Bangkok provide prestigious addresses, albeit at a premium cost. Alternatively, co-working spaces like True Digital Park provide cost-effective solutions with the added benefit of connectivity within the tech startup ecosystem. Selecting an address balances cost against strategic benefits, influencing client perception, recruitment, and operational efficiency.

By meticulously planning for these initial costs, you’ll set a strong foundation for your business startup in Thailand, aligning your financial outlay with a clear pathway to growth and innovation in the Thai market.

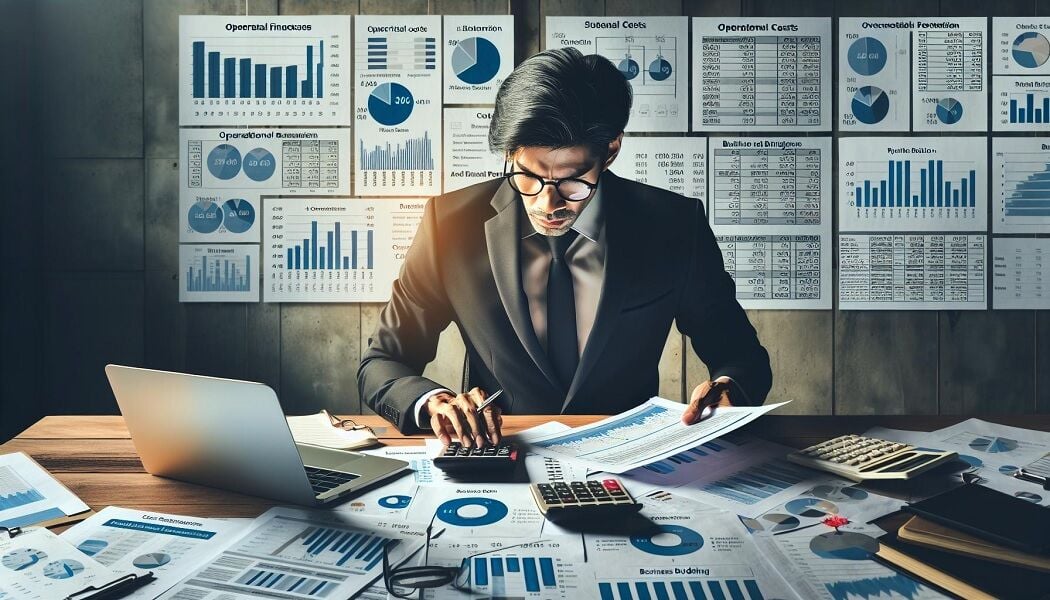

Ongoing operational costs

Upon establishing your business startup in Thailand, it becomes imperative to contemplate the continuous operational expenses you will face. These costs are critical for sustaining seamless operations and guaranteeing the long-term viability of your enterprise. Let’s delve into critical areas including employee management, accounting practices, adherence to legalities, and banking operations that significantly influence your financial planning.

Hiring and employee management

Employees represent the most valuable asset to your organization. The expenses associated with employing staff in Thailand include not merely their wages but also compulsory contributions to social security, which presently stand at 5% of an employee’s wage, subject to a maximum monthly contribution limit of 750 THB per individual. Moreover, offering competitive benefits to attract skilled professionals might increase operational expenses. Investing in training ensures your team contributes effectively to your business goals, but it also adds to the cost.

Accounting and tax filings

Efficient accounting and diligent tax compliance are imperative to evade penalties and guarantee adherence to regulations. Regular monthly bookkeeping and tax submissions, inclusive of Value Added Tax (VAT) where relevant, along with withholding tax, constitute critical procedures. The Corporate Income Tax (CIT) rate in Thailand is established at 20% on net profits, thereby mandating precise financial documentation to minimize tax liabilities. Although delegating these responsibilities to external accounting firms provides specialized knowledge, it also entails an extra ongoing cost.

Mandatory business licenses

Just a heads up, depending on what your business is all about, you might need to snag some licenses to keep everything up and up in Thailand. The price tag for these can swing one way or the other, depending on your industry and how much red tape there is. Keep it in mind as you get things rolling. It is crucial to allocate funds for these licenses to prevent any interruptions in operations. For example, enterprises engaged in importation, exportation, or manufacturing might face considerable licensing costs.

Opening a business bank account

A business bank account transcends the mere function of a repository for funds; it serves as a conduit for the effective management of an organization’s financial operations. In Thailand, the procedure to inaugurate a business banking account entails numerous administrative actions and may incur assorted fees. While the initial setup cost may be modest, consider the transaction fees, maintenance charges, and minimum balance requirements that banks might impose, impacting your operational budget.

By understanding these ongoing operational costs, you position your business startup in Thailand for financial stability and long-term success. Adequate planning and budgeting for these expenses ensure you can focus on growing your business without unexpected financial hurdles.

Navigating the challenges

Managing risks for new businesses

When launching a startup in Thailand, it’s crucial to understand and manage potential risks effectively. Market research, comprehensive business planning, and financial forecasting are your first lines of defence. Anticipate challenges such as market entry barriers, competitive analysis, and regulatory compliance. Adequate insurance coverage, including professional liability and property insurance, offers another layer of protection. Build a resilient supply chain by diversifying suppliers to mitigate risks related to supply disruptions. Remember, a well-considered contingency plan enables quick response to unforeseen situations, preserving your business continuity.

The reality of business closure

The possibility of business closure is a reality every entrepreneur must face. In Thailand, navigating this process requires an understanding of legal and financial obligations. Prioritize clear communication with stakeholders, from employees to suppliers and clients. Managing debts effectively and understanding bankruptcy laws are essential steps to mitigate financial impact. Ensure compliance with Thai regulations on business dissolution to avoid legal complications. Liquidation or selling the business offers a way to cover outstanding debts and potentially benefit from the business’s residual value. Awareness of the exit process enables preparedness for every outcome.

Financial resources and assistance

Venturing into Thailand’s business landscape offers exciting opportunities across various sectors. However, you must be well-informed about the financial commitments involved. From the initial setup, encompassing registration fees and legal documentation, to the ongoing operational costs like employee management and legal compliance, each aspect demands careful planning and budgeting. Additionally, understanding the nuances of risk management, from market research to insurance, can safeguard your startup against unforeseen challenges. Equipping yourself with this knowledge not only prepares you for the financial journey ahead but also positions your business for long-term success in Thailand’s vibrant market. Remember, thorough preparation and strategic financial management are your best allies in navigating the complexities of starting and sustaining a business in Thailand.

In today’s fast-paced business environment, revolutionizing your enterprise with advanced data capture strategies can be a game-changer. Implementing innovative technologies to efficiently gather, analyze, and utilize data not only enhances operational efficiency but also provides invaluable insights, driving informed decision-making and fostering a competitive edge in the market.