Taxing times: Thai PM backtracks on VAT hike after public outcry

In a dramatic U-turn, Prime Minister Paetongtarn Shinawatra pulled the plug on a proposal to crank up the value-added tax (VAT) following a storm of public outrage. The PM took to X (formerly Twitter) today, December 6, decisively posting: “No VAT adjustment to 15%.”

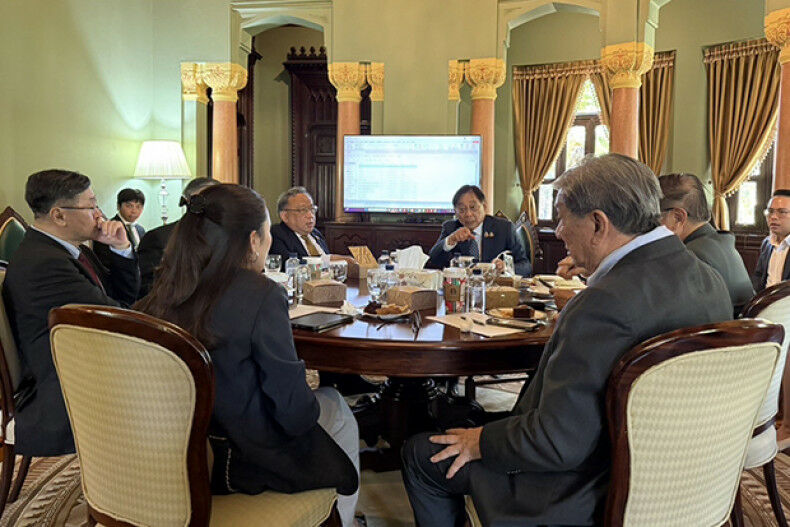

This swift decision emerged from a huddle at Government House with Finance Minister Pichai Chunhavajira and her advisory team. The government found itself under fire after Pichai, who also serves as Deputy Prime Minister, floated the eyebrow-raising idea of spiking VAT from 7% to 15% on Tuesday.

Even the Thai premier seemed at odds with the scheme, conceding the very next day that such a leap would burden the populace. While the 38 prime minister asserted that the Finance Ministry is still mulling over tax reforms to tackle social inequality and boost competitiveness, she didn’t delve into specifics.

Since 1992, VAT has held steady at 7%, despite several governments eyeing an increase to a 10% ceiling. Meanwhile, Pichai expressed backing for slicing corporate income tax from 20% to 15% and easing personal income tax from 35%, all in a bid to compete globally and lure in talent.

Peoples’ Party MP Sirikanya Tansakun wasn’t shocked by the government’s about-face. On her X account, she remarked that clarity on other tax areas, like personal income and capital gains tax, remains murky.

“Mr Pichai should convene a press conference to lay out a clear roadmap for tax reforms benefiting the public.”

Prime Minister Paetongtarn Shinawatra (second left) at a meeting with Finance Minister Pichai Chunhavajira and her economic advisors at Government House on Friday. Picture courtesy of TNAThe VAT hike wasn’t just a sore point for individual critics. The United Thai Nation, a military-affiliated coalition partner, also balked, warning that such a move would inflate the cost of goods and clobber the poor.

Thailand’s tax-to-GDP ratio has been treading water around 17% since 2007, lagging behind the Asia-Pacific average of 19% and the OECD’s 34%, the organisation points out. In 2022, VAT accounted for about a quarter of the country’s total tax revenue, according to OECD figures.

Meanwhile, over in Indonesia, plans are underway to bump VAT from 11% to 12% starting next year, reported Bangkok Post. As Thailand weathers this tax tempest, it’s clear that any proposal that affects the public’s wallet will be met with scrutiny.

What Other Media Are Saying

- Vietnam Plus reports Thailand’s Finance Minister proposing VAT increases alongside income tax reductions to bolster state revenue, competitiveness, and address disparities, while emphasising structural reforms and sustainable fiscal policies.(read more)

Frequently Asked Questions

Here are some common questions asked about this news.

Why is there a push to align Thailand’s tax policies with global trends?

Aligning with global trends, like the OECD’s, could enhance competitiveness and attract international business, benefiting Thailand’s economy.

How might increasing VAT impact Thailand’s wealth distribution?

An increased VAT could potentially narrow the wealth gap by taxing higher consumption levels of wealthier individuals, redistributing revenue to assist low-income groups.

What if Thailand reduces its corporate income tax as suggested?

Reducing corporate taxes might attract more businesses, increasing investment and potentially boosting economic growth and job creation.

How does Thailand’s aging population affect its tax policy considerations?

An aging population necessitates increased savings and efficient tax policies to ensure long-term economic stability and support for retirees.

What economic conditions are necessary for successful tax restructuring in Thailand?

Economic stability and recovery are crucial for tax restructuring, ensuring changes do not adversely impact growth or exacerbate financial burdens.

Latest Thailand News

Follow The Thaiger on Google News: