Thailand drafts law for new financial hub with competitive incentives

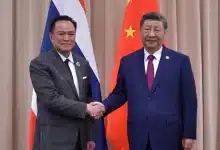

The Finance Ministry has completed drafting legislation for a financial hub and plans to present it to the Cabinet by early February. Deputy Finance Minister Paopoom Rojanasakul stated that this legislation offers more privileges and authority than the Eastern Economic Corridor laws.

The government is committed to advancing this draft law. Once Cabinet approval is obtained, it will be submitted to Parliament for a first reading by the end of March.

The draft, consisting of 96 sections, establishes a One Stop Authority (OSA) committee to handle tasks such as issuing and revoking licences and granting tax and non-tax incentives for businesses investing in a financial hub in Thailand.

This legislation exempts the application of seven existing laws related to finance and insurance, covering areas such as financial institution business, payment systems, securities, and futures trading. Tax incentives, including corporate and personal income tax benefits, will be detailed in subordinate legislation and aim to attract investors more effectively than other global financial centres.

Non-tax benefits will encompass special privileges related to visas, immigration, and regulatory reforms to facilitate business operations. Paopoom noted that the ministry has addressed limitations faced by financial hubs in Hong Kong, Singapore, and Dubai.

Thailand’s comprehensive financial landscape, which includes a wide range of economic participants, is a significant advantage in becoming a financial hub. The nation plans to elevate its credit guarantee system to the National Credit Guarantee Agency to support small and medium-sized enterprises with direct guarantees at low fees. Low labour costs are an additional advantage.

Financial hub

Thailand could also connect with Cambodia, Laos, Myanmar, and Vietnam, while partnering with Hong Kong’s financial centre to gain easier market access. Thai businesses such as financial institutions will be able to apply for licences on equal terms with foreign entities, with services provided to non-residents and exceptions for certain domestic transactions.

The financial hub aims to attract entities in sectors such as commercial banking, payment services, securities, futures trading, digital assets, insurance, reinsurance brokerage, and other related businesses as specified by the OSA. Investments must occur in designated zones with a specific proportion of Thai workers employed.

Services are primarily for non-resident individuals, with exceptions such as reinsurance with Thai insurance companies, capital market services with Thai operators for international investments, interbank transactions with Thai institutions, and connecting payment systems with Thai service providers. Foreign exchange transactions require compliance with exchange control laws and measures to prevent baht speculation.

Target businesses will receive competitive tax and non-tax benefits determined by the OSA, including exemptions from foreign business laws and immigration benefits for foreign nationals. They will also have the right to own condominium units for business and residential purposes, reported Bangkok Post.

An OSA office will be established as a government agency to promote Thailand as a financial hub and attract financial businesses. The OSA committee, led by the finance minister, will set policies, define licence types and scope, and oversee operations. All activities must adhere to international standards for anti-money laundering and combatting terrorism financing.

Latest Thailand News

Follow The Thaiger on Google News: