Phuket Finance: A time tested formula

PHUKET: A question I am often asked by clients, who do a bit of stock trading on their own portfolios, is how to determine the appropriate position size. Indeed, there have been studies that show that this aspect can be just as important as the actual security selection in the long run. The reason this is so important is that in short-term trading, as in many games of chance like roulette or blackjack, wins and losses tend to come in streaks. Back in the 1950s, a formula came out of research at Bell Laboratories that is still the backbone of the position sizing strategies for much of the investment world, and has even been slightly modified and applied to long term investing by such gurus as Bill Gross and Warren Buffet.

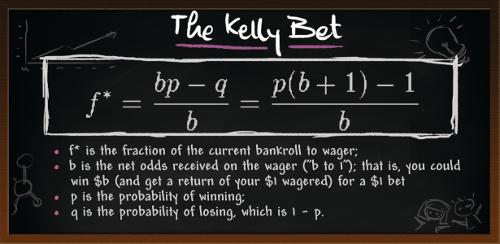

The formula I am referring to is called the Kelly Criterion. While I will include here for any fellow math nerds out there, you do not need to be one to incorporate the basic idea into your stock trading. You can use the basic idea to make it slightly more systematic than “I think I’ll buy 1,000 shares because it is a nice round number”, although there are some advantages to trading in round lots and not going into position sizes that are not divisible by 100 shares. Anyway, the formula is as follows:

For simple bets with two outcomes, one involving losing the entire amount bet (i.e the loss realized at your stop loss point), and the other involving winning the bet amount multiplied by the payoff odds (this could be a price target or your historical average winning %). The Kelly bet (see graphic) explaned is:

f* is the fraction of the current bankroll to wager;

b is the net odds received on the wager (“b to 1”); that is, you could win $b (and get a return of your $1 wagered) for a $1 bet;

p is the probability of winning;

q is the probability of losing, which is 1 – p.

In laymen’s terms, what this will yield is a proportion of your trading bankroll to risk on any one idea or trade, and this will be sensitive to the probability of a loss or a win. If you are a frequent trader, your own prior probability should be available from tracking your own success rate. Keep in mind that if you balance risk and reward, you can have a statistical edge even if you are only right 40% of the time. You simply need to make sure your losses are smaller than your gains by using stops and being disciplined enough to follow them.

The reason the formula works well is because as you experience a string of losses, each subsequent trade places less capital at risk, whereas during a winning streak, it edges up. The main thing to remember is that if you take your investment capital and allocate something like 10% as risk capital, you would only use that 10% as the bankroll in the above formula, not your entire life savings.

David Mayes MBA lives in Phuket and provides wealth management services to expatriates around the globe, focusing on UK pension transfers. Faramond UK is regulated by the FCA and provides advice on taxation and pensions. He can be reached at david.m@faramond.com or 085-335-8573.

— David Mayes

Latest Thailand News

Follow The Thaiger on Google News: