Phuket Business: Recalling the cycle of market emotions

PHUKET: My first investment was in a stock fund in 1990 when I was an engineering student at university. I was told to just buy and hold and put money in blindly and it will grow.

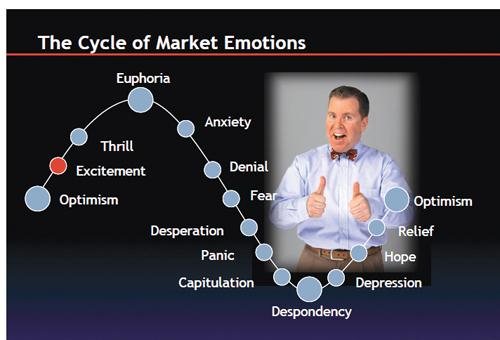

They were somewhat right but I wanted to know more and began a quest to find a way to pinpoint what is known as the cycle of market emotions curve.

The point of maximum financial opportunity is at the bottom of the curve (despondency and depression). This is the ideal time to buy, but your emotional state (and mine) will be feeling overwhelmed. The market does bottom and turn into a bull market. It is not different this time. It is important to understand this cycle of market emotions.

One of the greatest investors of all time, Sir John Templeton, said: “Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

So the news is turning more positive because we are in the maturing optimism stage. This is determined by looking at many components of investor psychology, global monetary policy and technical analysis.

A bear market (20+ points or more decline) is highly unlikely until we reach the ‘thrill’ and ‘euphoria’ stages. This time will come but is likely 12-30 months out depending on how fast investors warm up to buying stocks and what the Federal Reserve does.

Right now, growth stocks are the place to be investing in. This optimistic stage rewards investors who take risk and buy stocks with strong earnings and sales.

One point I want to make is the news in the early stages of a bull market (say in 2009) is often horrible doom and gloom. But bad news is actually good news and the stock market rallies.

Now we are entering a period of optimistic news. So when economic numbers come out and show strong job growth or home sales are up, we will see the market move higher. In this stage I would expect to see stocks release a strong quarter of earnings or sales.

Recently we’re seeing the global markets firing on all cylinders and economic news will continue to turn positive, while jobs and the housing market improve. Enjoy this period of growth. This is such an important stage. If you have laggards that aren’t participating, they need to be sold to focus your assets in stocks and funds hitting new highs and leading the market.

Don Freeman is president of Freeman Capital Management, a Registered Investment Advisor with the US Securities Exchange Commission (SEC), based in Phuket, Thailand.

He has over 15 years experience and provides personal financial planning and wealth management to expatriates. Specializing in UK and US pension transfers. Call 089-970-5795 or email: freemancapital@gmail.com.

— Don Freeman

Latest Thailand News

Follow The Thaiger on Google News: