Line Man Wongnai and Line Thailand tap into booming Thai e-payment market

Tech giants Line Man Wongnai and Line Thailand recently revealed plans to expand their businesses by capitalising on the rising e-payment market within their business ecosystem. They officially announced last month their successful joint acquisition of shares in Rabbit Line Pay Co (RLP) from previous shareholders, RabbitPay System Co and Advanced mPAY Co. This crucial transaction has allowed Line Man Wongnai to emerge as the majority shareholder of RLP.

With Thailand’s e-payment volume seeing a significant increase in 2022, rising to 28 billion transactions from 20 billion transactions in the previous year, the companies are looking to harness this growth. The value of e-payments also jumped from 39 billion baht in January 2022 to 46.6 billion baht (US$1.3 billion) by December of the same year, according to the Bank of Thailand.

Yod Chinsupakul, the chief executive of Line Man Wongnai, revealed he sees growth in e-payment opportunities in Thailand.

“To acquire shares from the existing shareholders in RLP will be a major milestone for our growth.”

Following the acquisition, the existing executive roles at RLP will see a reshuffle, with Yod Chinsupakul and In Young Chung, Line Man Wongnai’s chief finance officer, stepping in as the new chief executive and chief financial officer of RLP, respectively.

The acquisition aims to align RLP payment services more closely with the Line ecosystem, including Line Man, Line Shopping, Line App, and Wongnai’s merchant network. The change in ownership is expected to spur innovation and enhance user experience within Line Man Wongnai’s services and the broader Line ecosystem.

Yod Chinsupakul expressed his vision for Line Man Wongnai.

“We want to use our strength of over 10 million Line Man and Wongnai users, over 500,000 merchants, and over 100,000 riders to create a coherent transaction experience for all stakeholders. With the addition.”

He further added that the company is open to organic growth, acquisitions, and partnerships, and is paving the way for an initial public offering (IPO) by 2025.

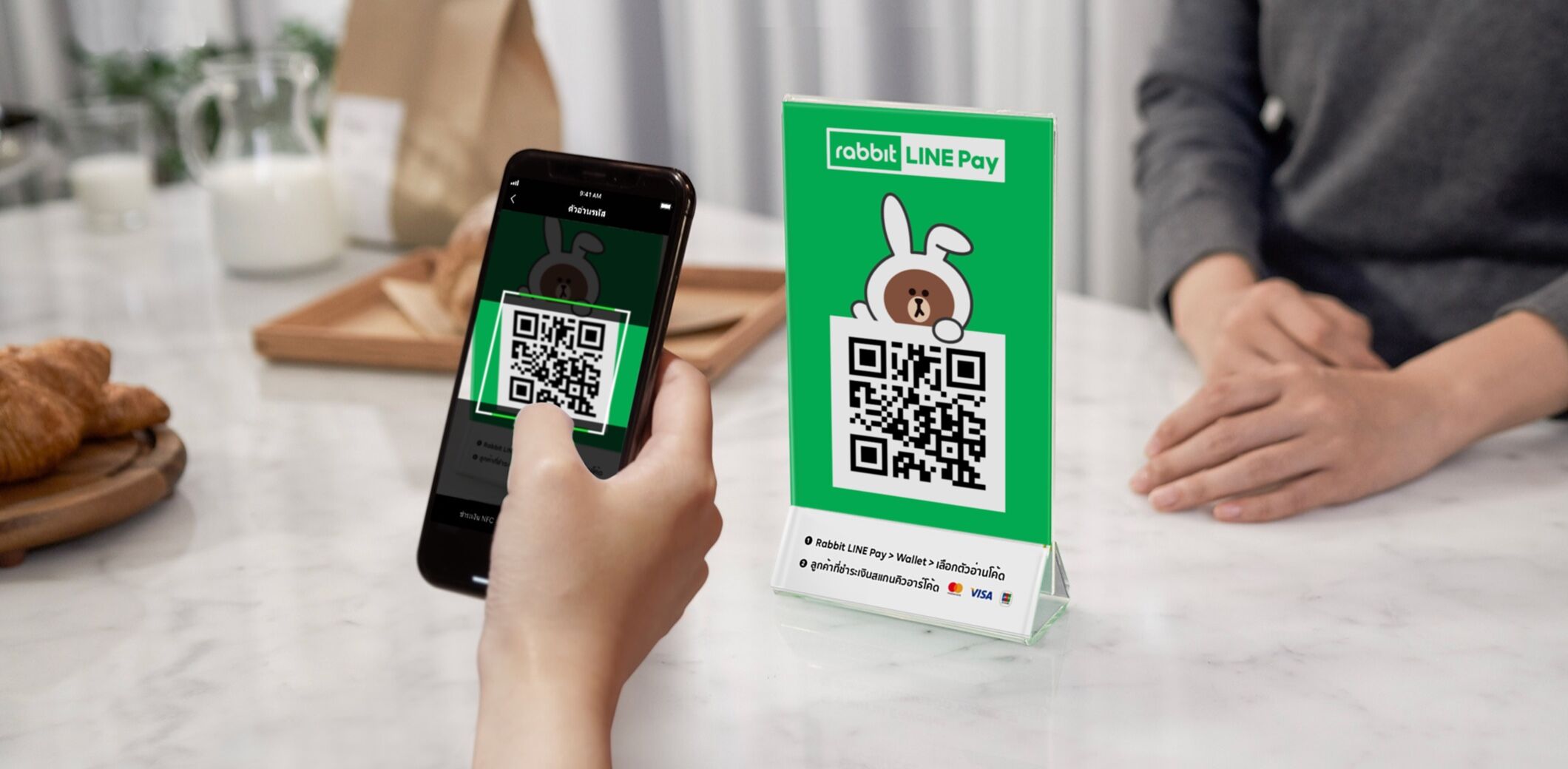

RLP, with its long-standing presence among Thai e-payment users, offers a wide array of online and offline payment channels, including a secure digital wallet, and quick payment options for purchases, money transfers, or top-ups. It currently serves 10 million users.

In Young Chung, Line Man Wongnai’s chief finance officer, revealed that the acquisition would allow Line Man Wongnai to optimise financial transaction costs by up to 50%. He also mentioned that the rapid growth of e-payments post-Covid-19 has given this business a high potential, leading to Line’s decision to acquire shares and control synergy in its ecosystem.

The chief executive of Line Thailand, Phichet Rerkpreecha, stated that the new structure will enable more synergy in the Line ecosystem in Thailand with 54 million users, mainly Line Shopping and other services.

After the acquisition, three main shareholders of the RLP will be INE MAN Wongnai, LINE Thailand, and the former shareholder, LINE Pay.

In related news, the Sawasdee by AoT app is continuing to grow, with new features stretching outside the scope of airports. Click HERE to read more.

Follow more of The Thaiger’s latest stories on our new Facebook page: CLICK HERE.

Latest Thailand News

Follow The Thaiger on Google News: