Finance: What is a contrarian investor to do these days?

PHUKET: If you read my columns regularly, you know that I like to try to approach investing from a contrarian viewpoint. This basically means going against the crowd and the current trend, or essentially buying things when they are beaten and battered down and selling when everyone else loves them and thinks the run will last forever. So what does this mean in today’s market?

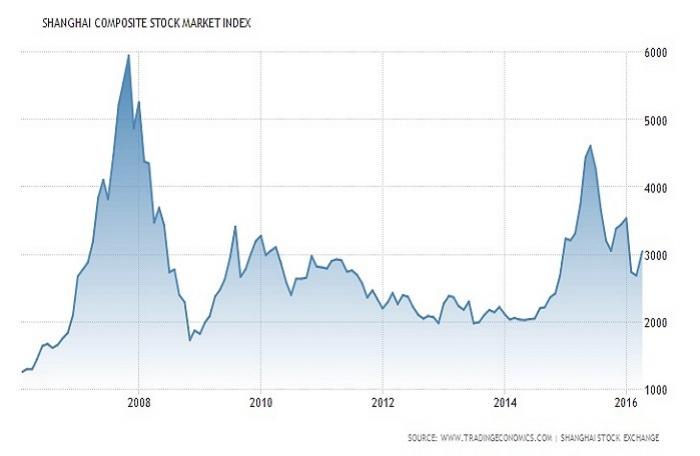

A lot of people are asking if China is a good bet; as a whole, it could stand a whole lot more battering before it could really be considered a value buy, without much risk to the downside remaining. If you look at the index as a whole in the chart above, you can see we are pretty much in the middle of the range for the last decade. The middle of the range is generally not a great place to enter a market, although it is far better than buying near the top.

Individual stocks can be good value buys if you have the risk tolerance for making individual plays, which is not for most of you out there. However, a friend of mine recently put me on to HSBC shares in Hong Kong – these represent good value, trading at a Price to Earnings (P/E) ratio of about 9, and paying out a gross dividend yield of about 8.5 per cent at the moment.

Some other banks, such as Goldman Sachs, are also at decent valuations. They are trading at around 8.5 times earnings, but in their case they only pay a meager dividend of 1.65 per cent. However, unless you expect the illuminati to fall, both of these stocks are most likely going to be sticking around for the long term.

Steel has taken a beating recently and pundits are calling the recent rally a dead cat bounce. However some stocks,such as US Steel (ticker symbol X), are trading at such lows that it is tough to imagine them not being significantly higher in the next bull market. At the moment, there is no P/E ratio – as they are losing money. So, this play would not be for someone faint of heart, as they also pay a dividend of only about one per cent.

Obviously another contrarian play one could make off of the low steel price would be to build on any empty land you have, since steel is one of the most important cost factors in the overall price of building. Of course not everyone has a bunch of empty building plots sitting around, but if you do, now might be a good time think about converting it into an income-generating property. You obviously need to factor in conditions in the local market; a big cause of the steel drop is that many markets have gotten way ahead of themselves in new construction. This is not always the best time to build, if you are worried about short term returns.

Generally speaking I don’t think we are in the environment yet where contrarian plays are found in abundance, but if you have money that you really want to get working, there are things you can do if you can handle the risk. For those of you with low risk tolerance, I would still conserve your cash for a proper crash. It will be coming – in the long run, patience always pays off. Rushing for a return now may significantly lower your overall returns in the future.

David Mayes MBA resides in Phuket and provides wealth management services to expatriates around the globe, focusing on UK pension transfers. He can be reached at david.m@faramond.com or 085-335 8573. Faramond UK is regulated by the FCA and provides advice on pensions and taxation.

— David Mayes

Latest Thailand News

Follow The Thaiger on Google News: