Debt dilemma: Households in a financial bind as debt soars, Thai PM pledges change

Thailand is in the grips of a financial crisis, with household debt skyrocketing to a staggering 16.07 trillion baht, a 3.6% surge compared to last year.

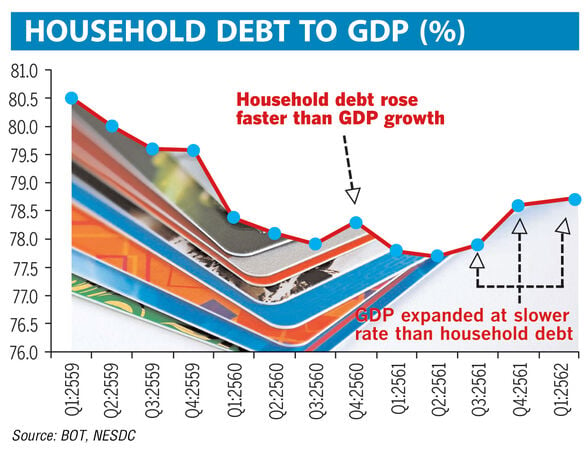

Thai Prime Minister Srettha Thavisin vowed to address the problem of what he calls debt slavery. The National Economic and Social Development Council (NESDC) yesterday dropped a bombshell, revealing that Thailand’s household debt is a whopping 90.6% of the country’s GDP.

A crisis that has gripped the nation and shows no signs of slowing down. This financial menace has remained constant throughout the year, casting a dark shadow over economic recovery.

The 61 year old prime minister isn’t one to back down from a challenge. In a bid to tackle the escalating crisis, the Thai government has launched a comprehensive initiative to address non-formal debts as a national priority.

The Finance Ministry is throwing a lifeline, offering loans of up to 50,000 baht for five years. But that’s not all – the Bank for Agriculture and Agricultural Cooperatives is stepping up, providing special agricultural loans. The government, acting as a mediator, is set to broker deals between debtors and creditors, declared PM Srettha.

“Informal debt can be likened to modern-day slavery, as it has the power to destroy dreams and is a persistent issue.”

The government is gearing up to tackle the unregulated lending issue, commonly known as loan sharks. The police will join forces in this financial crusade to ensure the eradication of this economic scourge.

Amidst high household debt and inflation casting a shadow on domestic consumption, the government’s initiative is seen as a crucial step towards economic recovery. The plan not only aims to adjust debt structures but also offers post-process measures, providing citizens with opportunities to break free from the relentless cycle of debt, reported Thailand Business News.

To inject some immediate relief into the economy, a 10,000-baht digital wallet handout is on the horizon, planned for May next year. It’s a beacon of hope for citizens grappling with the financial aftermath, a promise of relief in the form of digital currency.

Latest Thailand News

Follow The Thaiger on Google News: