household debt

- Business News

Thais urged to check credit yearly and escape debt traps

With debt hanging over many Thai households, financial experts are…

- Business News

Thai business closures rise 8.3% amid economic concerns

Thailand’s business landscape is facing stormy skies as nearly 4,000…

- Thailand News

Thai Finance Ministry to ease debt relief criteria

The Thai Finance Ministry is considering easing debt relief criteria…

- Business News

IMF urges Thailand to give baht-up households a helping hand

The International Monetary Fund (IMF) has warned Thailand to boost…

- Business News

Majority ineligible for Thailand’s debt relief programme

A significant number of borrowers have registered for the You…

- Business News

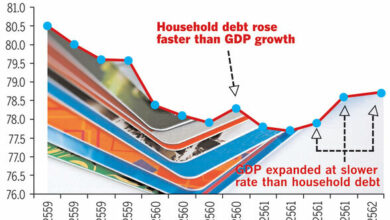

Thailand’s household debt reaches 104% of GDP, raising economic concerns

Thailand’s household debt, encompassing informal loans, has risen to 104%…

- Business News

Thailand tackles high household debt with new relief programme

Household debt continues to pose a significant challenge for policymakers…

- Thailand News

Thailand’s economy rebounds but experts warn of growth risks

Thailand’s economy is showing signs of recovery, yet economists warn…

- Business News

Thailand’s manufacturing index poised for growth after 2024 dip

Thailand’s Manufacturing Production Index (MPI) is set to see a…

- Business News

Thai banks remains cautious despite liquidity surplus

Thailand’s banking sector is experiencing a significant liquidity surplus, according…

- Business News

Thailand’s household debt dips to 89.6% of GDP in Q2

Thailand’s household debt saw a slight decline in the second…

- Thailand News

Thai household debt hits 13.6 trillion baht as bad loans rise

Thai household debt has surged to alarming levels, reaching 13.6…

- Thailand News

Thailand’s household debt growth slows amid stricter loan criteria

Household debt growth in Thailand decelerated in the first quarter…

- Phuket News

2,000 debtors flock to Phuket fair for a chance to clear the air

Over 2,000 debt-ridden individuals yesterday turned out for the 55th…

- Transport News

Ford Thailand urges support for ICE car sector amid EV rise

Ford Thailand is urging the government to extend support to…

- Business News

Thailand tackles household debt crisis, slow economic recovery

The Economic Cabinet directed the Finance Ministry and the Bank…

- Thailand News

New airport planned for Kalasin to boost tourism and exports

Srettha Thavisin, the Prime Minister and Finance Minister, has endorsed…

- Business News

TBA urges integration of informal economy for digital growth

The Thai Bankers’ Association (TBA) has advocated for integrating the…

- Thailand News

Thailand govt cuts informal debts by 670 million baht in two months

The Government of Thailand has slashed the nation’s informal debts…

- Business News

Thai govt to set up asset management firm to tackle household debt

Thailand Prime Minister Srettha Thavisin today announced that an asset…

- Business News

Thai Honda forecast mild ‘declinecycle’ in domestic sales this year

Thai Honda Co, a leading motorcycle manufacturer and distributor, predicts…

- Business News

Thai government seeks interest rate cut as household debt fuels recession

Thailand’s economy is currently grappling with a recession triggered by…

- Business News

Thai government unveils ambitious 500 billion Baht plan for debt resolution

A plan to resolve Thailand’s mounting debt issues, developed by…

- Economy News

Thailand tackles household debt crisis: doubts over effectiveness

To tackle the escalating household debt crisis in Thailand, the…

- Economy News

Debt dilemma: Households in a financial bind as debt soars, Thai PM pledges change

Thailand is in the grips of a financial crisis, with…

- Business News

Thai banks see 0.71% loan growth as SMEs and households struggle

Thailand’s top six banks reported a meagre loan growth of…

- Economy News

Tourism confidence in Thailand plummets amid economic jitters

The tourism confidence index in Thailand has taken a hit,…

- Business News

Thailand’s household debt soars as auto loans and cooperative debts spike

The secretary-general of the National Economic and Social Development Council…

- Business News

Bank of Thailand considers interest rate cuts to address household debt

A senior executive at the Bank of Thailand hinted at the…

- Business News

Household debt tackled by Bank of Thailand with new guidelines

The Bank of Thailand (BoT) is set to introduce new…

- Economy News

Household debt in Thailand soars to 86.9% of GDP, dampening consumer spending

Thailand’s mounting household debt is raising concerns, as it continues…