Invacio Research Analytics: Pushing the boundaries of artificial intelligence and embracing cryptocurrencies

Newly established in Phuket, Invacio Research Analytics, a group subsidiary of Invacio founded by William J D West and led by Linleeya West (Thai/Swiss educated), are bringing Artificial Intelligence to Thailand and also bridging the gap between established currencies and the emerging world of cryptocurrencies.

Through a sister subsidiary company, Invacio AAP Holdings (Seychelles), under the Invacio umbrella are all set to accept their very own invacio branded cryptocurrency (INV) as a means of payment for their many AI driven services.

Invacio outline below exactly where their INV fits into the world and their future plans.

Many of you will have noticed a growing trend in the world of cryptocurrencies: The once high, almost guaranteed, returns from participating in ICOs are quickly dissipating. With more and more currencies failing to make anywhere near the gains they have done previously upon hitting exchanges. In fact, quite often nowadays, the opposite is true with more currencies crashing in value quite soon after launching. Research has shown that it takes less than 4 months for a vast majority of ICO backed projects to fail and any monies tied up in the currencies lost. It can be truly disturbing to see that happen.

In some respects, the crypto world has brought this, near cataclysmic, turnaround upon itself. So many companies have undertaken ICOs as a means to actually create a product from the ground up. Mostly raising money on the back of an idea and a wishlist of elements that need to be created before true progress and an actual product can be put into the market. But while the coinsale is in progress they hype the coins like crazy to drive an immediate desire to own them.

Presenting them as an actual investment (SEC registered coins are seen as a security owing to the fact they resemble shares in the legal definition) even when they are merely a utility token, to be used once the final product that was outlined in the whitepaper is launched, with no securities elements attached.

Lack of experience or technical knowhow can kill any company’s chances of success in the world of cryptocurrency as any apparent flaw, unforeseen delay or blatant error can cause a coin holding community to turn on the founders and destroy them in a torrent of fear, uncertainty and doubt. Obviously trying to create or develop a product from out of nothing whilst also trying to calm chat rooms full of baying coin holders wanting answers is not going to facilitate a hitch free process by any stretch of the imagination. Thus, the team loses focus, inhouse arguments break out, relationships break down and ultimately, no products make it out and companies die.

So why are we at Invacio different and why should you buy our tokens?

Cryptocurrency in general is massively down in terms of market cap overall with even some of the big name coins down dramatically from their all time highs of late 2017 and early 2018. This general malaise has affected very many startup companies as they were entirely reliant on funds raised being of sufficient value to pay for their planned products to be developed. Again, Invacio is different because the products are ready or near market ready and so all we need to do is create the infrastructure and launch the product derivatives. With progress on 2 new Thai facilities and a developers office in India underway, we are readying to build our initial server centres and start the scaling process with our AI systems.

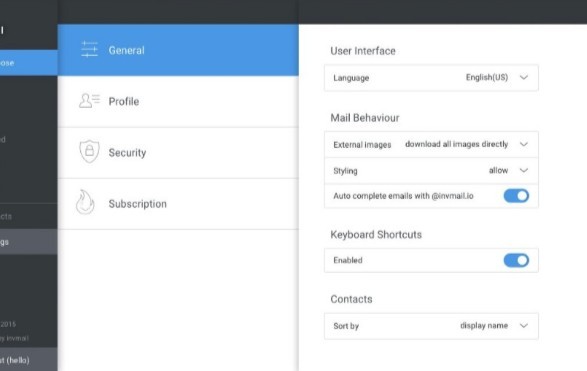

We have already launched our Zero-knowledge secure email system invmail.io and the Android version of our Tamius wallet (Apple iOS should be released very soon too).

There is a roadmap outlining the expected launch dates of our products and we are doing everything we can to prepare our systems and begin launching our AI driven services in line with it. The next products we are planning to launch are Agnes and Network both of these will require holding or spending INV to access.

Beyond the initial uses for INV that we as an organisation will be putting forward for general consumers, we are also reaching out and arranging other ways for INV to be used. Our partnership with CEAM is one such project where INV is the only currency that is being accepted during the private presale process for their asset backed property coin. Currently under MOU as was announced sometime ago, the lawyers are putting the finishing touches to a full Joint Venture agreement but in the meantime private sales for the CEAM project have already begun.

The long term financial viability of Invacio is going to stem from its operations in the private and government sectors, more so than the consumer market. The reason for this is that there are literally thousands of individual modules and hundreds of AI modules within our overall system that can be rolled out as specifically targeted separate products. A few of the modules we can look to exploit separately are: facial recognition, image compression and recognition and market monitoring.

Via our API service, commercial organisations will be able to tailor make their own datasets and have our systems provide the analysis through any number of modules.

As more and more services come online there will be a growing number of reasons for various parties to buy, hold or spend INV to secure our services, this can only drive demand across all markets.

Our journey to this point in our development has been very interesting but as the saying goes: “When the going gets tough…..”.

We do not run away from challenges but embrace them and will continue to strive, push and fight our way through until we can look at our past efforts and smile, knowing that we delivered what we promised.

Please contact Roger Baker via email at Roger@invacio.com for any enquiries or visit invacio.com to learn more about their other divisions.

Latest Thailand News

Follow The Thaiger on Google News: