US dollar surge hits Asian currencies: Thai baht suffers

Asian currencies experienced a dip today, with the Thai baht and Indonesian rupiah bearing the brunt of the losses. This was mainly due to the rising strength of the US dollar, bolstered by robust economic indicators and the threat of inflation from the Federal Reserve, which have pushed US bond yields to a 16-year peak.

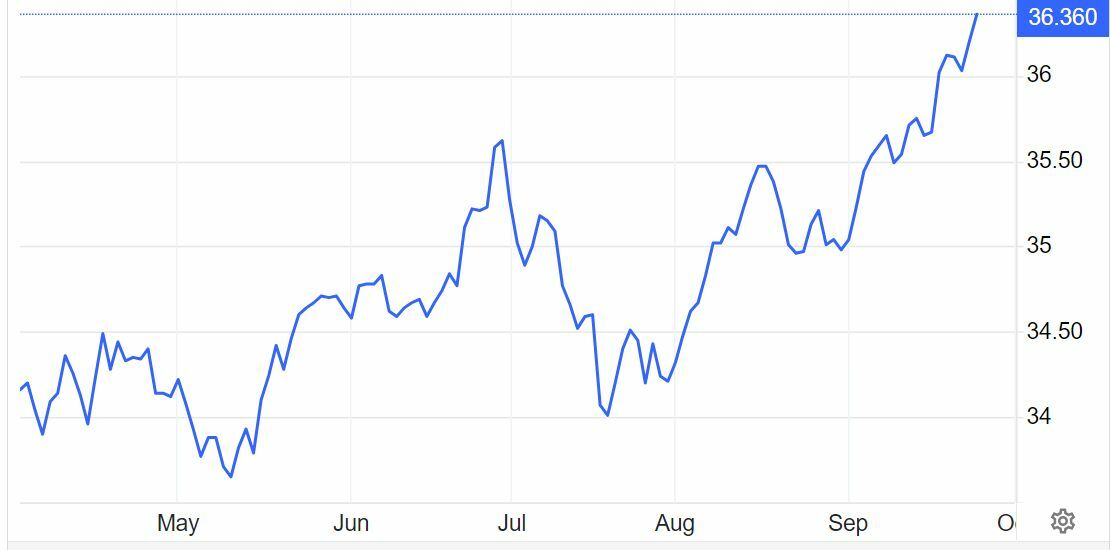

The baht saw a fall of up to 0.8%, trading offshore at 36.34 to the dollar, marking its lowest point since November 10, 2022. The rupiah fell by up to 0.6%, its most significant dip in eight months.

Edi Susianto, a senior official, noted that the central bank of Indonesia has been intervening in the foreign exchange market to maintain balance while staying weary of the rise and fall of Asian currencies.

The 10-year Thai government bond yield rose to 3.26%, a record high since May 2022. Meanwhile, the Indonesian 10-year benchmark yields reached their highest point since March 30, standing at 6.86%.

Investor sentiment towards the baht has been dampened by continuous fund outflows, driven by wider rate differentials and a recent surge in oil prices, which could potentially escalate inflationary pressures in Thailand, a net oil importer.

The Bank of Thailand’s policy decision, set to be announced on Wednesday, is now the centre of attention. Analysts polled by Reuters widely predict that the central bank will maintain its key policy interest rate at 2.25%.

Government expenditure

According to Christopher Wong, a foreign exchange strategist at OCBC, increased government expenditure intended to boost the struggling economy has raised worries about a potential dip in budgetary consequences, further eroding investor confidence.

“The outflows from funds are not limited to Thailand alone; they are impacting a significant portion of the region. This is primarily because of the prevalent narrative that the Federal Reserve will sustain higher interest rates for a prolonged period.”

The report showed that the city-state’s industrial production had decreased for the 11th consecutive month in August, mostly because of a slump in the electronics industry, which caused the Singapore dollar to depreciate by 0.2%.

The US dollar index reached its highest point since November 2022 at 106.1, following hawkish rhetoric from the Fed and the expansion of the budget deficit financed by borrowing, which led to a more than 45 basis point increase in the 10-year US Treasury yield in September, breaching the 4.5% mark for the first time since 2007.

DBS analysts noted the challenges present in the current financial landscape, stating…

“Between the still-strong dollar and Asian central banks generally lagging emerging market peers in other regions in hiking rates, we find the mix extremely challenging for Asian currency rates currently.”

Follow more of The Thaiger’s latest stories on our new Facebook page HERE.

Latest Thailand News

Follow The Thaiger on Google News: