tax

- Thailand News

Three arrested in Bangkok for 28 million baht tax evasion

Three company directors were arrested for tax evasion by issuing…

- Thailand News

Double tax deductions to boost northern Thailand tourism

The Ministry of Finance is planning to introduce measures under…

- Business News

Tax exemption for corporate insurance payouts amid flood recovery

The Cabinet has sanctioned a tax exemption for corporate income…

- Thailand News

Thailand to explore new tax system for ageing population

Thailand must urgently adjust its tax structure and increase tax…

- Business News

Thailand to introduce carbon tax to curb emissions this year

Thailand is set to implement a carbon tax this year, Deputy…

- Business News

Thailand urged to reform high tax rates to match global standards

Thailand’s tax system requires comprehensive integration, as its current personal…

- Politics News

Thaksin’s taxing plan to tackle poverty in Thailand

Thaksin Shinawatra is making more waves to shake up Thailand’s…

- Thailand News

Nonthaburi noodle vendor investigated for gold purchase taxes

A noodle vendor in Nonthaburi announced plans to purchase an…

- Business News

PM Srettha orders Temu to comply with Thai tax laws

Prime Minister Srettha Thavisin directed the Revenue Department and the…

- Business News

Tax relief planned for businesses after minimum wage hike

The Finance Ministry is poised to introduce measures to support…

- Business News

Jet fuel tax relief losing altitude, says deputy finance minister

The Finance Ministry appears unlikely to extend the jet fuel…

- Business News

Thai hotels seek tax breaks for renovations and EV charger installs

Operators of Thai hotels are advocating for tax deductions or…

- Business News

Local governments digging deep into land tax challenges

Local governments face a significant challenge in evaluating underutilised land…

- Business News

New tax deductions approved to boost secondary city tourism

The Cabinet yesterday approved measures aimed at boosting tourism in…

- Business News

Thailand to tax residents’ foreign income irrespective of remittance

The Revenue Department of Thailand will amend a law to…

- Business News

Thailand to introduce carbon tax by 2025, oil tax burden unchanged

The Excise Department plans to introduce a carbon tax by…

- Thailand News

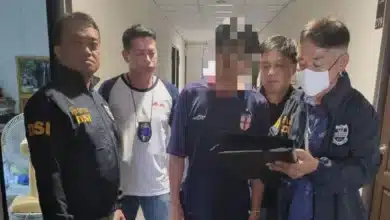

DSI shifts gears, catches Thai man for swerving luxury car taxes

Department of Special Investigation (DSI) officers arrested a Thai man…

- Thailand News

Land and building tax revenue to hit 43 billion baht this year

The Finance Ministry anticipates the land and building tax collection…

- Thailand News

Taxing times: Newsreader’s fiery retort sparks social media blaze

A TV newsreader’s fiery response to a lawyer’s announcement about…

- Business News

Thai hotels urge reform of unfair land and building tax rates

Hotels are calling for a revision of the property tax…

- Business News

MNEs taxed to curb profit sharing, 12 billion baht revenue expected

The Revenue Department anticipates the implementation of draft legislation aimed…

- Business News

Thailand’s solar panel tax cut scheme to save households on bills

A new tax reduction scheme aimed at encouraging households to…

- Retire in Thailand

Why investment is crucial before retiring

When you are at the edge of those golden years…

- Business News

Thailand’s revenue department ups tax amid economic slowdown

The Revenue Department faces a challenging year in meeting its…

- Business News

Government revenue falls short due to dip in oil taxes

There’s been a shortfall in the government’s revenue collection for…

- Thailand News

Bali’s new tourist tax: Will it save paradise or sow chaos?

In the latest move to combat over-tourism and preserve its…

- Thailand News

Accountant arrested in Thailand for 130 million baht tax fraud

Thai authorities recently apprehended a 46 year old accountant involved…

- Thailand News

Thailand revenue dept rectifies glitch in My Tax Account system

A glitch in the My Tax Account system of Thailand’s…

- Thailand News

Ex-municipal tax chief caught after 15 years for embezzling funds

The Anti-Corruption Division (ACD) successfully apprehended a former municipal tax…

- Business News

Easy e-receipt scheme may not boost Thai tourism says hotel association

The recently introduced Easy E-Receipt scheme, aimed at boosting tourism…

- Ask an Agent

Your go-to guide to property taxes in Thailand

Buying property in Thailand is an exciting venture, whether for…

- Thailand News

Unexpected traffic fines surprise vehicle owners at tax renewal in Prachuap Khiri Khan

At the Department of Land Transport (DLT) in Prachuap Khiri…